Market View Last Week – SPY was higher by about 1.5% in a wildly volatile week. Stocks saw a large two-day relief rally to begin the week as treasury yields...

The Latest

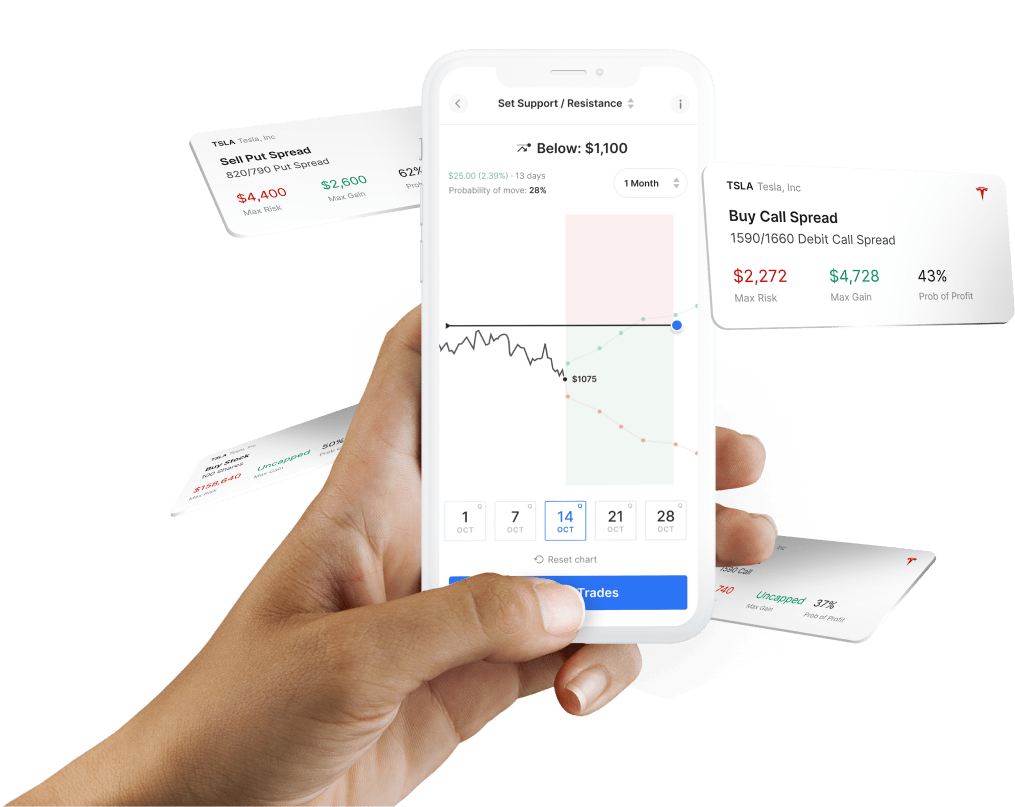

Why Options AI Does Spreads MULTI-LEG OPTION SPREADS CAN BE A SMART WAY TO LOWER COSTS AND HELP IMPROVE PROBABILITY OF PROFIT WHEN LOOKING TO ADD THE POWER OF OPTIONS TO...

Spreads as Zones on a Chart YOU DON’T NEED TO BE FLUENT IN GREEK TO ENJOY THE BENEFITS OF OPTION SPREADS At Options AI, we see multi-leg options not as a bunch of...

LEVEL 1 TO LEVEL 3 OPTIONS IN ONE QUICK STEP At Options AI, we are passionate about simplifying advanced trading. This includes how we approach more complex strategies...

Debit Call Spread BULLISH DIRECTIONAL STRATEGY, ALSO KNOWN AS A BULL CALL SPREAD A Debit (Bull) Call Spread is a two-leg options trade where we buy a Call option and...

Bull Put Spread BULLISH INCOME STRATEGY, ALSO KNOWN AS A BULL PUT SPREAD A Credit (Bull) Put Spread is a two-leg options trade where we sell a Put option and...

Stay in the loop

Be the first to hear product announcements and get daily market content from The Orbit.