Market View

Last Week – SPY was higher by about 1.5% in a wildly volatile week. Stocks saw a large two-day relief rally to begin the week as treasury yields declined, and hopes rose that the Fed was beginning to see evidence that would allow them to slow their aggressive rate hikes. Those hopes were dashed on Friday as the NFP report came in hot. Those numbers are notoriously backward-looking and even if it was the last hot payrolls report, markets seem to decide, that the Fed has cover for continued aggressive rate hikes for the foreseeable future.

The move on the week was inside what options were pricing but the swings in either direction during the week were way outside.

This Week – SPY options are again pricing about a 2.9% move for the upcoming week. The VIX ended last week around 31 and implied vol remains near its highs of the year.

Expected Moves for This Week (via Options AI)

- SPY 2.9% (+/- $11)

- QQQ 3.5% (+/- $11)

- IWM 3.4% (+/- $6)

- DIA 2.5% (+/- $7)

Economic Calendar

- Wednesday – FOMC Minutes

- Thursday – CPI

- Friday – Retail Sales, Consumer Sentiment

Earnings Season in High Vol

This week marks the beginning of earnings season, with a lot of eyes on the large banks that report towards the end of the week. Earnings season in a high vol environment means that options need to price both the earnings event itself but also the potential for large market moves into and out of the event.

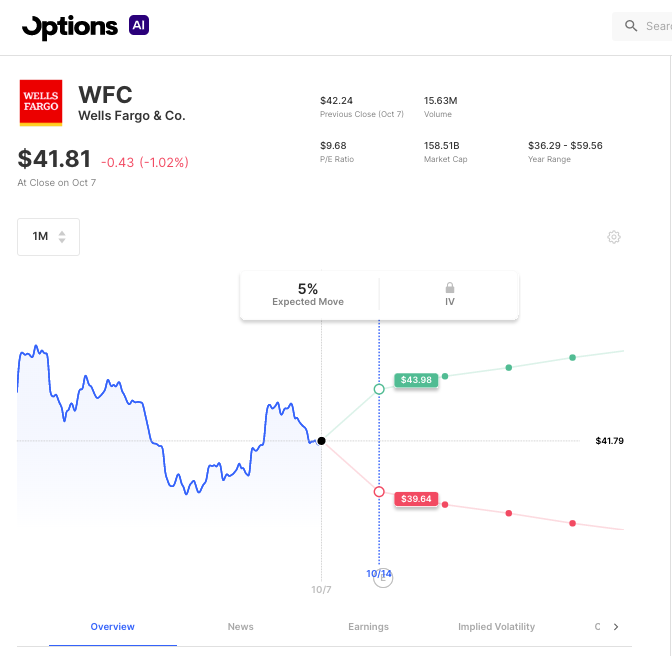

That means trading the event itself needs to be fairly precise, with strategies placed just before and taken off just after in order to isolate the event itself. Here’s an example, with Wells Fargo (WFC) options pricing in a 5.2% expected move for the week (Options AI free tool link).

To put that into some very recent perspective. WFC closed last week up nearly 4% and at one point during the week was higher by nearly 8%. The other banks reporting this week are also pricing around 5% moves, more on that below:

Earnings this Week

Links below go to the Options AI earnings calendar where you can see the other companies each day and click through to see charts (free to use). Recent earnings moves (actual) start with the most recent:

- Pepsico PEP / Expected Move: 2.7% / Recent moves: -1%, 0%, -2% (projected EPS: $1.84)

- Taiwan Semi TSM / Expected Move: 4.4% / Recent moves: +3%, -3%, +5% (projected EPS: $1.69)

- Blackrock BLK / Expected Move: 4.6% / Recent moves: +2%, 0%, -2% (projected EPS: $7.64)

- Delta Air DAL / Expected Move: 6.1% / Recent moves: -4%, +6%, +2% (projected EPS: $1.55)

- Dominos DPZ / Expected Move: 6.1% / Recent moves: -1%, -5%, 0% (projected EPS: $2.98)

- JP Morgan JPM / Expected Move: 4.6% / Recent moves: -3%, -3%, -6% (projected EPS: $2.92)

- Wells Fargo WFC / Expected Move: 5.2% / Recent moves: +6%, -5%, +4% (projected EPS: $1.10)

- Morgan Stanley MS / Expected Move: 5.0% / Recent moves: 0%, +1%, +2% (projected EPS: $1.52)

- Citi C / Expected Move: 5.3% / Recent moves: +13%, +2%, -1% (projected EPS: $1.56)

- United Health UNH / Expected Move: 3.9% / Recent moves: +5%, 0%, 0% (projected EPS: $5.43)

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.