BULLISH INCOME STRATEGY, ALSO KNOWN AS A BULL PUT SPREAD The Credit Put Spread is typically seen as an income generating options strategy used by somewhat bullish...

The Latest

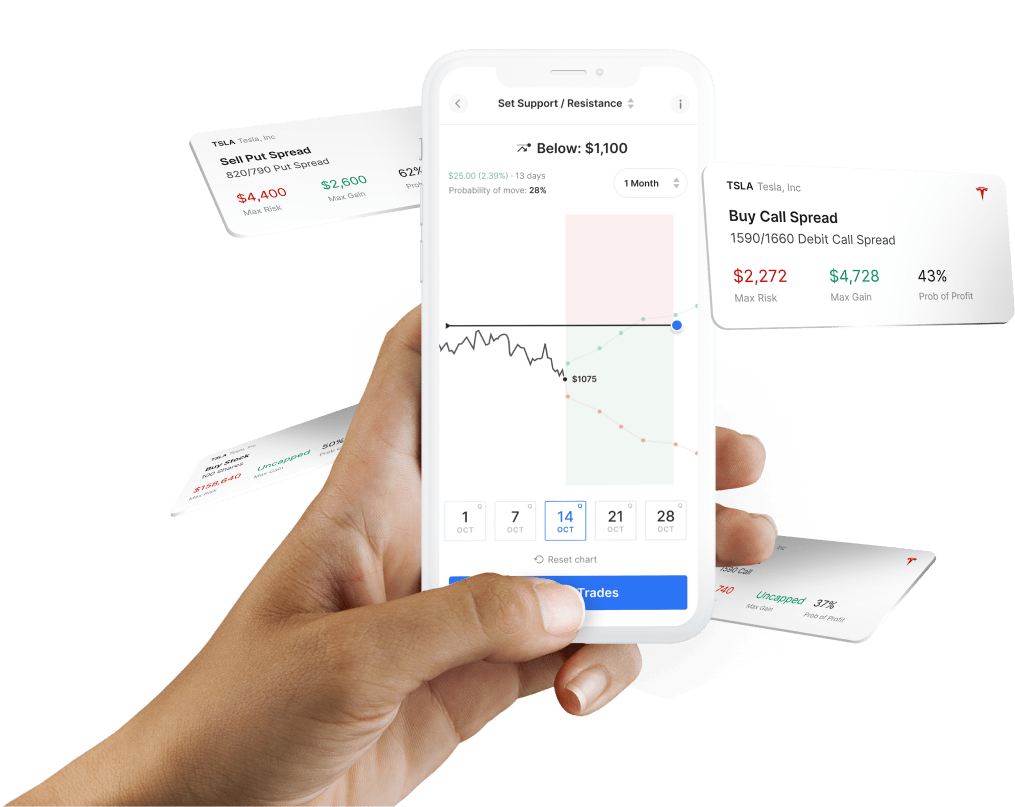

Credit Call Spread BEARISH INCOME STRATEGY ALSO KNOWN AS A BEAR CALL SPREAD We have seen how the setup of a Debit (Bull) Call Spread is conceptually very similar to a...

Credit Call Spread INCOME STRATEGY The Credit Call Spread is typically seen as an income generating options strategy used by somewhat bearish investors who have no...

AN OPTION FOR INCOME IN PLACE OF A LIMIT ORDER TO SELL STOCK Assuming that you own at least 100 shares of an underlying stock, opening a short Call position at a strike...

Debit Put Spread BULLISH DIRECTIONAL STRATEGY, ALSO KNOWN AS BEAR PUT SPREAD A Debit (Bear) Put Spread is a two-leg options trade where we buy a Put option and...

Iron Condor NEUTRAL (OR RANGE-BASED) INCOME STRATEGY An Iron Condor is a four-leg options trade where we sell a Credit Call Spread and simultaneously sell a Credit Put...

Stay in the loop

Be the first to hear product announcements and get daily market content from The Orbit.