LEVEL 1 TO LEVEL 3 OPTIONS IN ONE QUICK STEP

At Options AI, we are passionate about simplifying advanced trading. This includes how we approach more complex strategies.

To fast-track our options education, we’ll actually start with a basic level 1 strategy familiar to most options traders and show how from there it can be one quick step to understanding spreads.

Back to Basics: the Covered Call

The Covered Call (or Buy-Write) is often regarded as one of the most basic and relatively low-risk option strategies. And yet it involves selling rather than buying options.

To setup a Covered Call, we sell a Call option, typically against a corresponding long position in the underlying stock, at Strike price above where the stock is currently trading.

If the stock price remains below our Strike at expiration, then we keep the total premium received from selling the Call. We apply this income to the overall rate of return on the stock (or see it as having boosted our yield). But if the stock moves up and through our breakeven (Strike Price + Premium received) then our upside potential in the stock is capped and we run the risk of being called-away. Since we know that selling options typically comes with a Probability of Profit greater than 50%, we are willing to accept these trade-offs with the goal of generating net income (profits) over time.

With the fundamentals of the Covered Call in mind, let’s now apply two simple modifications to create Spread strategies.

From Covered Call to Debit Call Spread

To be very clear from the outset, the Debit (Bull) Call Spread is not an alternative to a Covered Call. The former is a directionally bullish strategy while the latter is a more passive income generating strategy. Yet for purposes of de-mystifying spreads, the comparison can be very useful.

Put simply, by replacing the long stock leg of a Covered Call with a long Call position (at a strike below our short call), we have immediately transitioned from level 1 options to level 3 spreads – without taking on a fundamentally different market risk profile.

The Covered Call allows us to participate in upside in the underlying stock, but caps our potential gains at the short (or Covered Call) strike level. The Debit Call Spread allows us to participate in stock price gains from our breakeven level (long strike price + premium paid) up to our short strike level. And, if the underlying stock price goes up and through our short Call strike, our long Call covers us in a similar way to how our long stock position covers us with a Covered Call.

Again, the purpose of this comparison is not to imply that these are interchangeable strategies or to suggest that spreads do not have unique risks (such as liquidity). It is simply designed to demystify the notion that spreads require a big leap in options knowledge and understanding.

Credit Call Spread

We have seen how the setup of a Debit (Bull) Call Spread is conceptually very similar to a Covered Call. We are simply buying a Call option instead of buying underlying Stock. And, if we are comfortable with a Covered Call, we are already comfortable with the idea of selling, or being short, options.

So, for our first in-depth strategy review we stay with the theme of the Covered Call strategy as a starting point and look at how we can make another straightforward modification, this time to setup a Credit Call Spread.

A Credit (Bear) Call Spread is a two-leg options trade where we sell a Call option and simultaneously buy a higher strike Call. The strategy has defined risk and defined reward.

It is commonly used as an income generating strategy by generally bearish investors seeking a probability of profit greater than 50% in return for accepting a higher risk to reward ratio.

It might also be used as an alternative to a Short (Naked or Covered) Call by investors who are willing to accept somewhat less premium (income) in return for creating a defined risk position with protection against a sharp move higher in the underlying stock.

Watch the 1 minute overview

Credit Call Spread (vs Covered Call)

To look more closely at the Credit Call Spread, we will take the somewhat unconventional approach of starting with a Covered Call for comparison. Here we’ll take a hypothetical example using VZ.

The Covered Call (or Buy-Write) is perhaps the most basic and popular example of an income generating options strategy. It is a strategy that requires only level 1 options approval and yet it is a two-leg strategy that involves selling (or shorting) an option. As such, we see the comparison as a very useful path to understanding option spreads and in helping to demystify the path from basic level 1 to advanced level 3 options trading.

To clarify, we are not suggesting that a Credit Call Spread is always a direct alternative to a Covered Call (although there are times when it can be that we discuss [here]) or that option spreads do not present additional risks (such as liquidity). The Credit Call Spread is often utilized as an income generating strategy where the investor has no underlying stock position and has no intention to be short a stock. The Covered Call on the other hand is often used by investors seeking additional stock yield or to reduce the basis of a long stock position.

The Setup

Back to basics: Covered Call

In this example, we start by establishing a level at which we believe VZ will find resistance in an upward move. To inform this decision, we decide to look at the expected move for our timeframe – a move of around 2.5% up or down from the current stock price.

We decide to simultaneously buy 100 shares of VZ for $41.08 and sell the 42 Call at $0.50 to create our Covered Call position.

The $50 in income we receive from our Call sale represents the maximum potential gain from our options position. If the stock remains below our strike at expiration, we keep the premium received and might apply this income to our overall portfolio rate of return (or see it as having boosted the yield of the underlying stock position). If the stock moves up and through the 42 strike at expiration, we incur the risk of being assigned (forced to sell) the stock at this level and therefore might consider buying to close our short Call. If the stock moves up and through our breakeven level of 42.50, then we will might either [a] allow the stock to be assigned to define our risk; [b] roll the Call up and out to a later date; or [c] buy to close our short Call at the current market price (undefined risk).

The key take-away here is that by re-capping on the basics of a Covered Call, we have already touched upon most of the fundamental concepts involved in option spreads.

Staying with our example above, let’s replace the long stock leg of our Covered Call with a long Call position. Instead of simultaneously buying 100 shares of stock and selling a 42 Call, we look at simultaneously buying a higher strike Call against our short 42 Call.

To setup an income generating Credit Call Spread we buy a higher strike Call. Why? As we saw with our review of a Covered Call, our risk when we are short a Call is for the underlying stock to move up and through our strike. With a Covered Call our long stock position protects us to the upside and limits potential losses. With a Credit Put Spread, a long Call defines our risk by providing protection above this higher strike. If we were to simultaneously buy a lower strike Call we would instead be creating a Debit Call Spread, an altogether different strategy (one utilized by directionally bullish investors).

In this example, we find that we can simultaneously buy a 44 Call for $0.10 against the sale of our original 42 Call at $0.50. Opening this 42/44 Credit Call Spread for a net credit of $0.40 ($0.50 minus $0.10) means that we have defined our risk to a relatively narrow spread of $2 (long strike minus short strike) while also forfeiting only $0.10 of the income we would have collected had we simply opened a short 42 Call.

Finding the right risk to reward ratio through strike and spread width selection is an important aspect of trading any multi-leg strategy. In this particular example we have highlighted how, by widening the spread (in this case to a two strike width), we can minimize the impact on net premium received. This may be a particular focus if using a Credit Call Spread as an alternative to a Covered Call.

However, when using the Credit Call Spread as a stand-alone income generating strategy, we may prefer to maintain a tighter spread (for example a one strike width). This may have the effect of improving our risk to reward ratio and allow us to instead adjust our potential income by increasing the number of contracts traded. Whatever your goals, Options AI makes finding the right balance of risk, reward, and probability of profit straightforward, with the ability to modify profit zones and breakeven levels straight from a chart.

Visual Setup

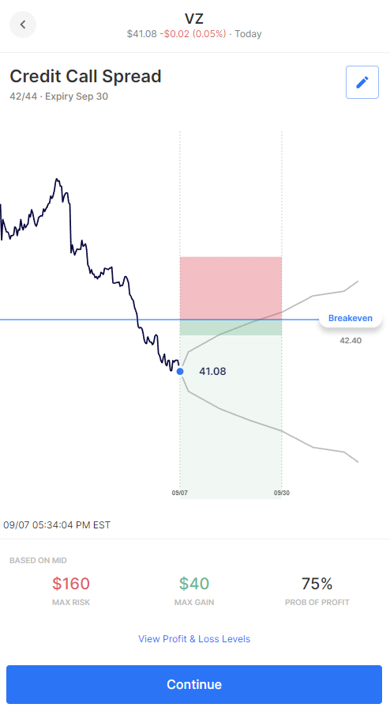

This visual setup using the Options AI platform shows that, in comparison to a naked Short Call (which we know has an uncapped zone of potential loss above our breakeven), the Credit Call Spread has a defined loss (red) zone. In this example, our Max Risk of 1 contract size is $160 (width of our spread less premium received). The trade-off being that our maximum potential profit has been reduced from $50 to $40 and our breakeven level has therefore been lowered from 42.50 to 42.40 (short strike plus premium received).

Perhaps the most noticeable metric (which is typical for both the Short Call and Credit Call Spread) is the relatively high probability of profit. We will look at this in more detail in the summary below.

Summary

In this Credit Call Spread example we have a defined Max Risk of $160. That’s the most that we can lose if the stock closes above our long 44 Call strike at expiration. We will see gains if the stock stays below the breakeven of 42.40 and a Max Gain of $40 if the stock stays below our short 42 strike at expiration.

What may become apparent from the visual and associated metrics is why the Credit Call Spread is a favored strategy of bearish investors who prefer higher probability income strategies over lower probability directional strategies (such as buying a Put or Debit Put Spread).

As a net seller of options, we can profit from something not happening rather than needing to be right on direction and magnitude of move. In the case of the Credit Call Spread we create a breakeven above where the stock is currently trading. So, while we are generally bearish we don’t need an outsized move downwards to realize a gain, but simply for the stock to remain below this level at expiration.

Check out our options trading courses to learn concepts like spreads, covered calls, iron condors and more.