What Covered Calls are good for (and where they can go wrong).

One of the most common option trades is a covered call. A covered call is when an investor owns stock and sells an (out of the money) call against that stock. The result is a lower cost basis in the stock and the potential to collect the premium from the call sale. Ideally, the investor also sees gains in the stock. Here’s an example:

An investor owns 100 shares of Apple (AAPL) they bought for $130. They sell 1 May 21st $140 call at $1.80. That lowers their overall cost basis in the stock to $128.20 ($130.00 – $1.80).

If the stock is at or below $140 on May 21st the investor would collect the entire $1.80. So, an ideal situation is for the stock to go higher, but not higher than $140.

This strategy can lower the cost basis in the stock and it could be repeated for several expirations. However, if the stock moves higher – above the level of the call strike – the investor could be called away in the stock.

If the intention is not to sell (be called away in) the stock, the investor would need to buy the call back (cover the short call), likely at a loss. The cost to cover that call is uncapped. An example:

The investor sells the 140 call at $1.80. The stock goes to $150. With the short call so far in the money, it is likely that the investor will be called away at $140. Assuming the intention is to remain long the stock, then the investor would need to buy to cover the call – likely at a cost of over $10.

Because the upside risk of a short call is not defined, a covered call is one strategy that might best suit an investor who is willing to be called away in the stock. If the investor’s intent is to remain long, covering that short call at a loss may be costly on potential stock gains and erode any premium collected up to that point.

Income Generation alternatives via Iron Condors

As an alternative, a credit Iron Condor is a strategy that looks to collect income by selling both an out of the money credit call spread and an out of the money credit put spread. Traders use credit Iron Condors for several purposes, often outside of stock ownership. The first is simply as a neutral or range trade, looking to receive a credit if a stock stays within a range. A second use is to short volatility, especially farther out in time. Here we’ll discuss a third use, as potential income generation for a long stock position. One that does not necessarily cap potential gains in the stock. Here’s an example, using the expected move via Options AI:

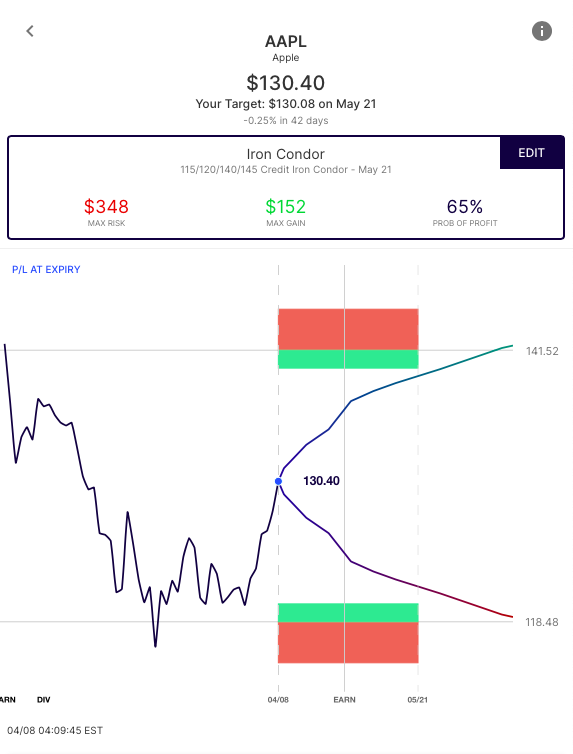

An investor owns 100 shares of Apple, bought for $130. They sell the Apple May 21st 115/120/140/145 Iron Condor at 1.50. This could lower their overall cost basis to $128.50 (at expiration).

If the stock is between 120 and 140 on May 21st the investor would collect the entire $1.50 as added income to stock gains, or as a small buffer vs. losses.

Here is a visualization of that credit Iron Condor position, via Options AI:

The credit Iron Condor simultaneously sells the 140/145 credit call spread and the 120/115 credit put spread. Net/net, the trade collects 1.50, very close to the 1.80 of the covered call above. However, if the stock goes above 145, the losses from the Condor are capped (at 3.50) whereas the covered call has no cap. Potential gains in the stock resume above that level.

If the stock is below 115 or above 145, the investor would lose 3.50 vs gains or losses in the stock.

You can see the various profit/loss scenarios of the condor itself on the Options AI chart below. The Condor itself becomes a max loss with the stock above $145, however, that loss is capped, and the long stock would resume gains as it moved above that level:

Remember, this should be balanced with an understanding of other risks specific to spreads (such as assignment and execution risk).

Or course, the Condor has risk in both directions. If the stock is below $115 on May 21st $3.50 is lost, adding to the losses in the stock. That differs from the covered call where the $1.80 credit is still collected.

Summary

A covered call is often thought of as a bullish strategy. And it is, up to a point. But the investor is capping potential gains in the stock. If the investor is simply looking to add income while holding onto a stock longer term, an Iron Condor can also be considered, as well as credit call spreads.

Options AI uses an expected move chart to help inform strike selection in more advanced trades like an Iron Condor, credit spreads and debit spreads. It generates trades by mapping strikes to your price target. The credit Iron Condor example was done in just a few clicks, in this example using the expected move from the options market to help guide strike selection:

The covered call was also set at the expected move and offered a good comparison for these purposes as both the credit Iron Condor and the short call collected similar premium.

Please note, any stocks and/or trading strategies referenced are for informational and educational purposes only and should in no way be construed as recommendations. The strategies depicted represent just a few of the many potential ways that options might be used to express any particular view. All prices are approximate at the time of writing. Option spreads involve additional risks that should be fully understood prior to investing.

Options AI offers a few free tools including an expected move calculator and an earnings calendar with expected moves.

*Note: technically one could be called away in the stock (or put the stock) if the Condor is left to expiry and the stock closes in the middle of either the call spread or the put spread. Those situations can be avoided by closing the options before expiry to keep their defined risk profile.

[…] On Friday we highlighted and compared 2 brief premium techniques, the covered call, andIron Condor You can read that comparison here […]

[…] On Friday we highlighted and compared two short premium strategies, the covered call, and Iron Condor. You can read that comparison here. […]

[…] On Friday we highlighted and compared two short premium strategies, the covered call, and Iron Condor. You can read that comparison here. […]