The Broader Markets

The S&P 500 closed the shortened holiday week at new highs, up about 1.1%, about inline with the 1.1% the options market was pricing. With that, the VIX closed at 17.30, its lowest level in a year.

SPY options are again pricing in about a 1.1% move in either direction for the upcoming week. That corresponds to about $396.50 to the downside and $405.50 on the upside. Here’s this week’s expected move chart (as of last Thursday’s close) via Options AI:

The expected move from QQQ options is about 1.7% for the week and IWM about 2.2%.

In the News

Tesla (TSLA) reported first quarter vehicle production numbers on Friday while equity markets were closed. Options are pricing in a roughly 6% move for the upcoming week, and about a 12% move for the month of April. The company is due to report earnings the last week of April. With the stock near $660, this week’s expected move corresponds to about $620 for a bearish consensus and near $700 for bullish:

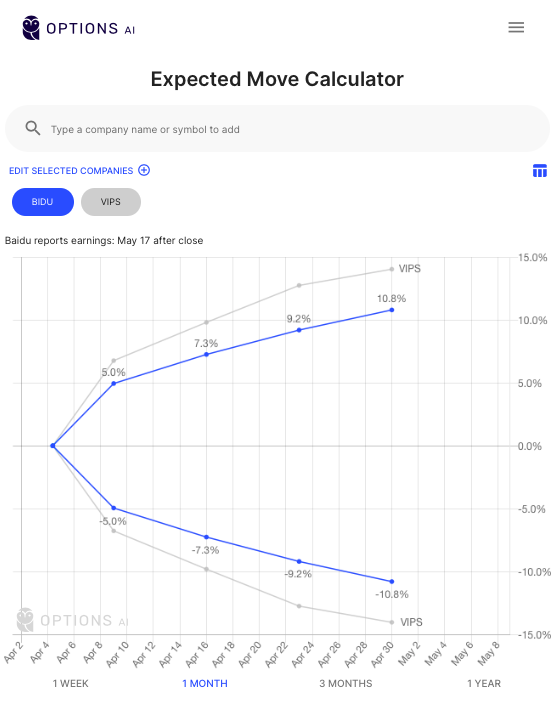

The Archegos story had an effect on both its holdings at the center of the liquidation as well as the financial institutions affected. Below is a comparison of the one month expected moves for two of the stocks at the center of the story, Baidu (about 11%) and VipShop (about 14%). Comparisons like this can be accessed via the free Options AI expected move calculator:

Expected Moves for Companies Reporting Earnings

Earnings season picks up in earnest the second week of April, beginning with some of the large financial institutions like JP Morgan and Wells Fargo. The latter part of the month features some of the largest tech names including Netflix, Apple, Tesla, Amazon and Facebook.

The Options AI Earnings calendar is a free resource to keep up to date on upcoming earnings as well as how options are currently pricing those potential moves. Here’s an example of companies reporting April 20th, with both Netflix and Snap included (unconfirmed):

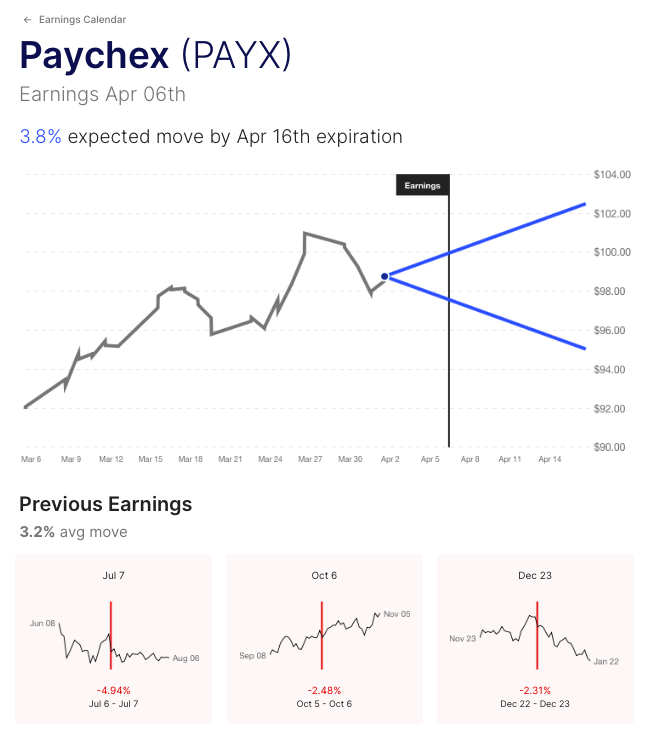

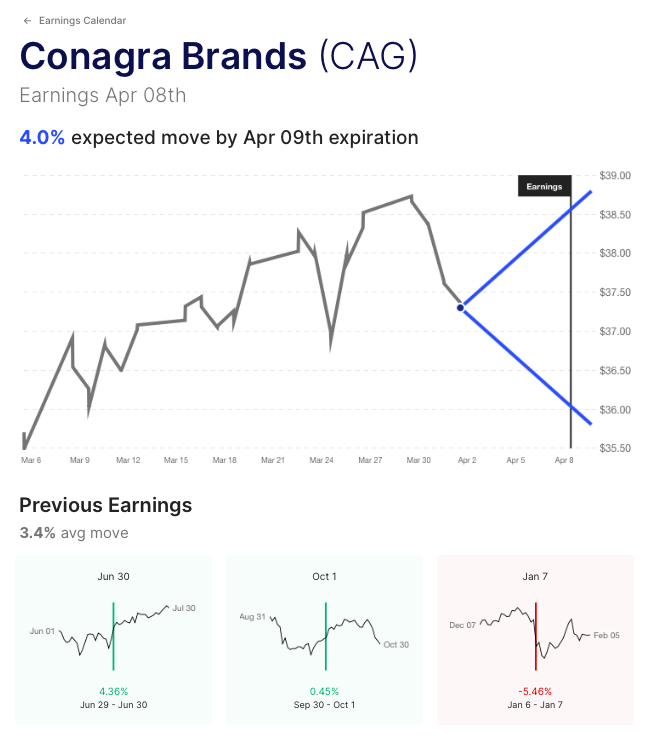

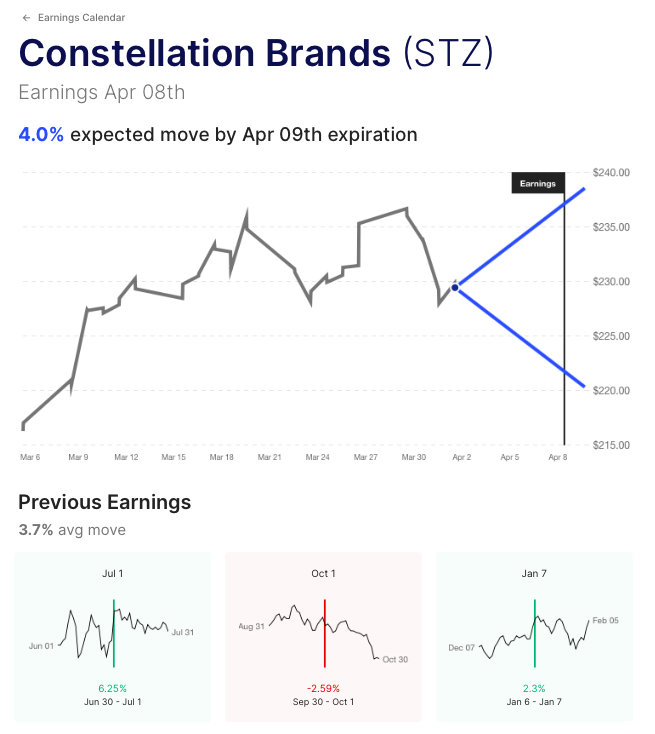

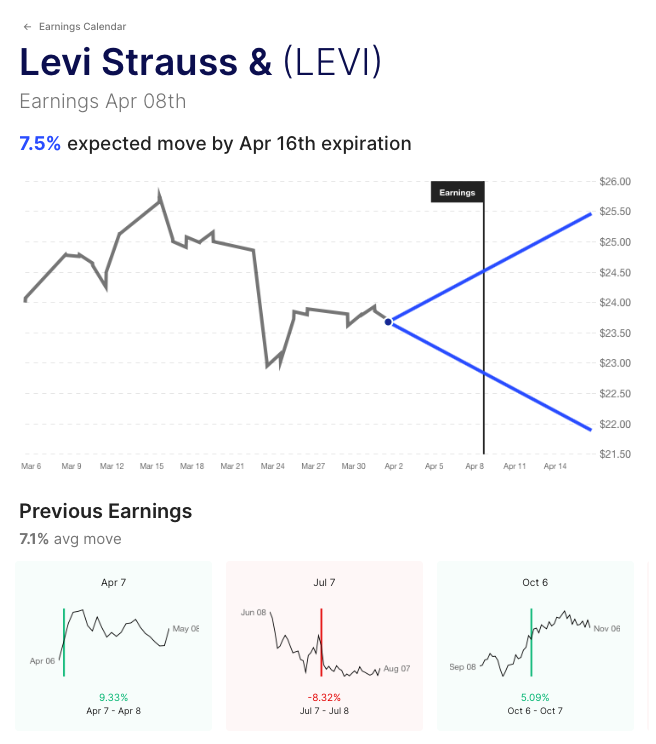

This week’s earnings calendar is light. Here’s are the expected moves for some of the companies reporting this week, including Paychex, Conagra, Constellation and Levi’s. Each entry shows prior earnings moves for comparison. A larger searchable list can be found on the Options AI Earnings Calendar. Links for each stock go to their individual pages showing expected moves and recent earnings moves for comparison. Those without weekly options are indicated with their expected move for monthly expiry (April 16th):

PAYX / Expected Move by April 16th: 4% / Recent moves: -2%, -2.5%, -5%

CAG / Expected Move This Week: 4% / Recent moves: -5%, 0%, +4%

STZ / Expected Move This Week: 4% / Recent moves: +2%, -3%, +6%

LEVI / Expected Move by April 16th: 7.5% / Recent moves: +5%, -8%, +9%

Options AI puts the expected move at the heart of its chart-based platform and Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading.

[…] post What You Need to Know in Options this Week. Tesla, VipShop, Baidu, Netflix, Snap and more. appeared first on Options AI: […]

[…] post What You Need to Know in Options this Week. Tesla, VipShop, Baidu, Netflix, Snap and more. appeared first on Options AI: […]