Hi! On today’s Orbit we look at that crazy spike in VIX this morning as well as short duration SPX vol which has now been cut in half on the market...

Markets Live: The Orbit

Options University

Video Summary (3 minutes) When a spread is initially bought or sold, it has an initial risk, reward, and probability of profit. As time passes...

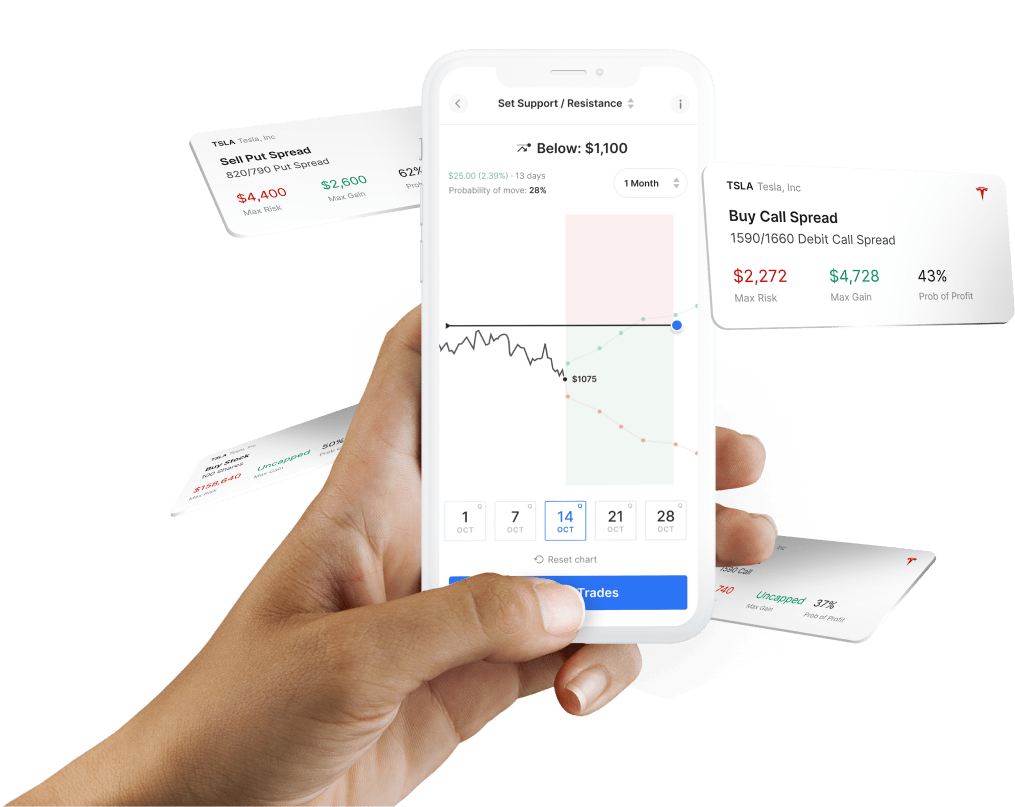

WHY OPTIONS AI?

Innovative tech, expert customer support, and no per contract fees.

Whether your goals are income from options or finding lower cost ways to trade, Options AI has you covered.

Best Brokerage for Options Trading

Options

- $5 flat commission

- $0 per contract fees any size, any # of legs

Stock & ETFs

- $0 commission

No hidden fees, complete fee schedule here

*Applicable exchange, clearing and regulatory fees still apply.

The Options AI Platform plus

Brokerage Account*

Seamlessly execute and manage your stock and options strategies straight from the Options AI visual trading platform.

Options

- $5 flat commission

- $0 per contract fees

Stock & ETFs

- $0 commission

Not Ready for a New Brokerage?

No Problem.

Enjoy all the trading tools and real-time data for one low monthly subscription.* Sign up in minutes and immediately start your 10 day free trial. No catch. You’ll get:

Chart Trades

Drag & Drop profit zones to instantly generate options for income, leverage or protection.

Trade Scanner

Scan unusual options activity and compare strategies across multiple stocks.

Earnings Moves

Find upcoming earnings opportunities with real-time expected moves.

Advanced Options

Fast-track to spreads with unique daily content and education.

The Latest

Hi! On today’s Orbit we look at that crazy spike in VIX this morning as well as short duration SPX vol which has now been cut in half on the market bounce. We also...

Hi! On today’s Income from Options Weekly we have higher vol options to start the week, both as a hangover from last week’s sell-off but also with a ton of earnings (AMD...

Hi! On today’s Income from Options Weekly we look at the initial strength to start the week and the reaction in option premiums following last week’s rise in VIX. We...

Hi! On today’s Income from Options Weekly we look at today’s initial SPX SPY move higher that nearly made the expected move for the entire week and look at strike levels...

Hi! On today’s Orbit we do a quick check on 0dte SPX credit spreads and then a deeper dive in SMCI where we look at a few short duration bull spreads examples in...

Hello! On today’s Income from Options Weekly we discuss the low IV in SPX to begin the week and how that could shift into the end of the week with the CPI and bank...

Stay in the loop

Be the first to hear product announcements and get daily market content from The Orbit.