The Broader Markets

The S&P 500 was lower last week by about 1.2%, slightly less than the 1.5% move that was priced by the options market. The small move lower did not affect overall implied volatility, as the VIX stayed near 20 to close the week.

SPY options are pricing in about a 1.4% move in either direction for the upcoming week. That corresponds to about $383 to the downside and $395 on the upside. Here’s this week’s expected move chart via Options AI:

In the News

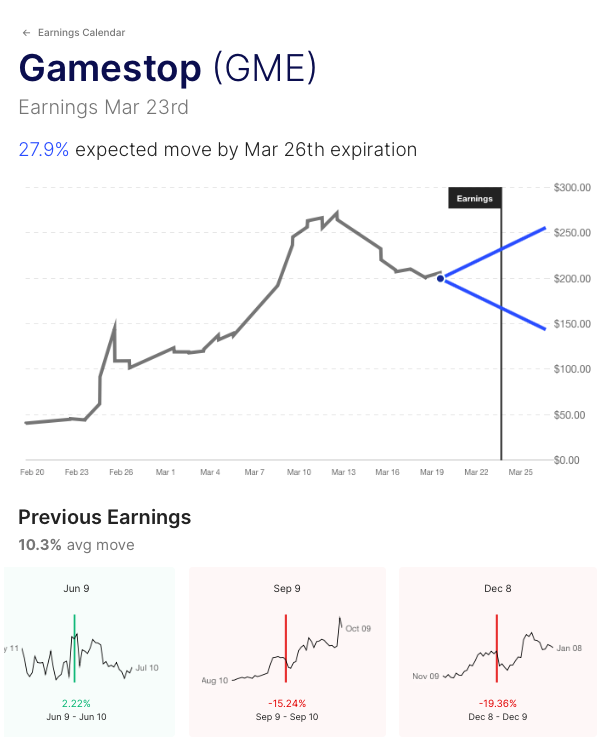

GameStop (GME) closed the week near $200. The company reports earnings on Tuesday after the close. Options are pricing in about a 28% move for this week, corresponding to about $255 on the upside and $140 on the downside:

We recently wrote about the uniqueness of option implied volatility and skew in stocks that are experiencing large price movements like GameStop and (you can read that here).

Tesla (TSLA) was about 6% lower on the week versus the 7% move being priced in the options market. For the upcoming week options are pricing in about . With the stock now $650, Tesla (TSLA) options are pricing in an expected move of about 6.5% for this week, down slightly from last week. That corresponds to almost $695 on the upside and $610 on the downside.

We recently wrote about Tesla as an example of how spreads can potentially lessen costs while defining risk. (you can read more about that here).

Here’s the updated expected move chart via Options AI:

Expected Moves for Companies Reporting Earnings Next Week

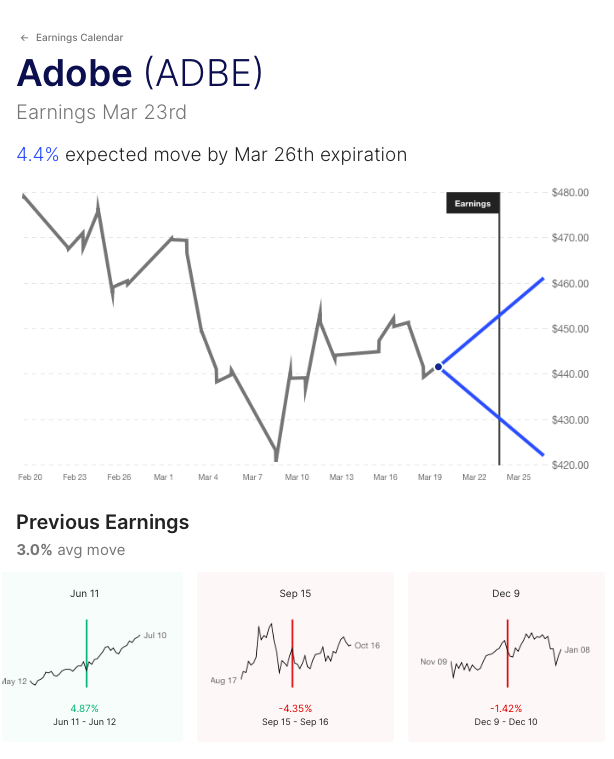

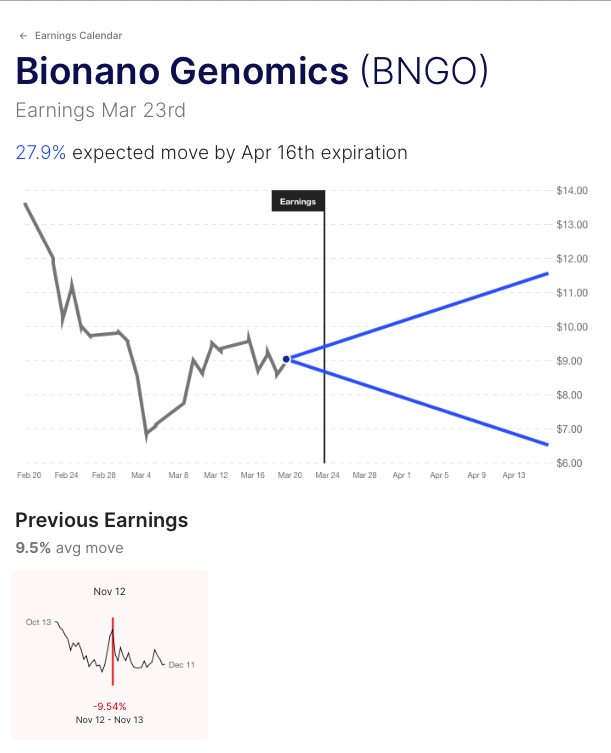

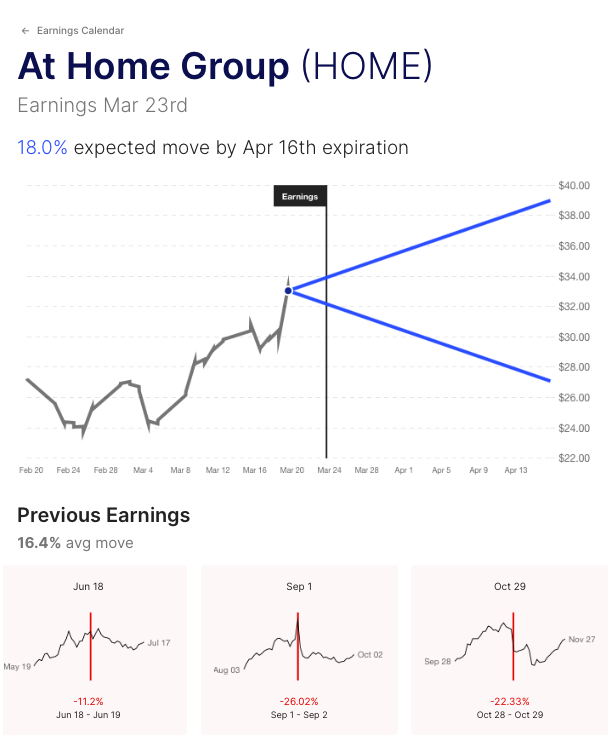

Expected moves for some of the companies reporting earnings this week, including GameStop, Adobe and At Home can be seen below. Each entry shows prior earnings moves for comparison. A larger searchable list can be found on the Options AI Earnings Calendar. Links for each stock go to charts for this week in comparison to recent earnings moves. The stocks that do not have weekly options are labeled with expected moves for April 16th expiration.

HUYA / Expected Move This Week: 11% / Recent moves: +3%, 0%, -11%

GME / Expected Move This Week: 28% / Recent moves: -20%, -15%, +2%

ADBE / Expected Move This Week: 4.5% / Recent moves: -1%, -4%, +5%

BNGO / Expected Move by April 16th: 28% / Recent moves: -10%

HOME / Expected Move by April 16th: 18%

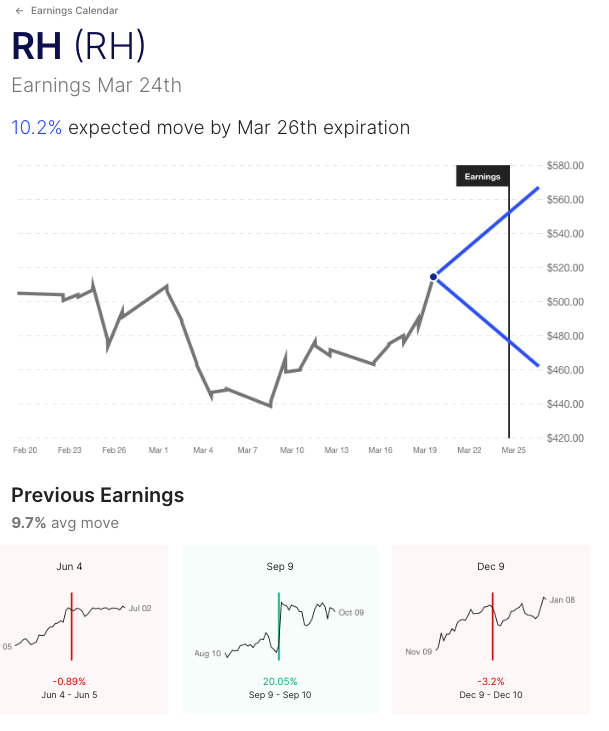

RH / Expected Move This Week: 10% / Recent moves: -3%, +20%, -1%

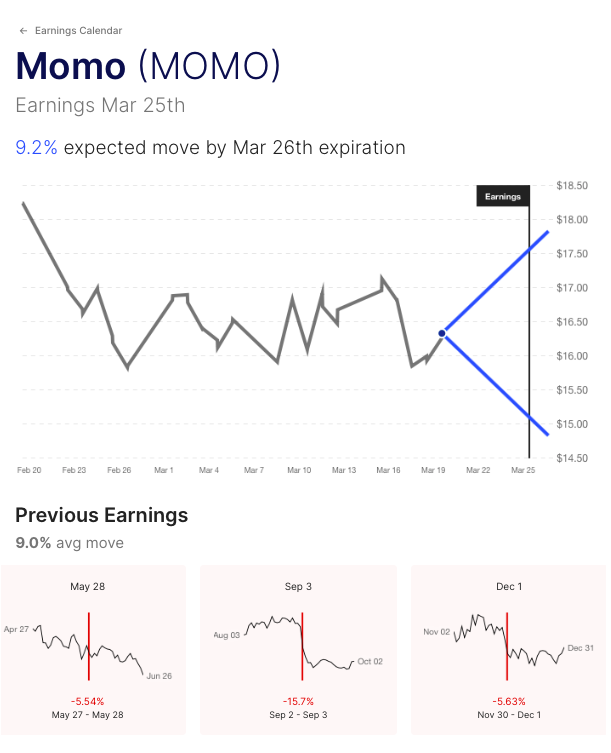

MOMO / Expected Move This Week: 9% / Recent moves: -6%, -16%, -6%

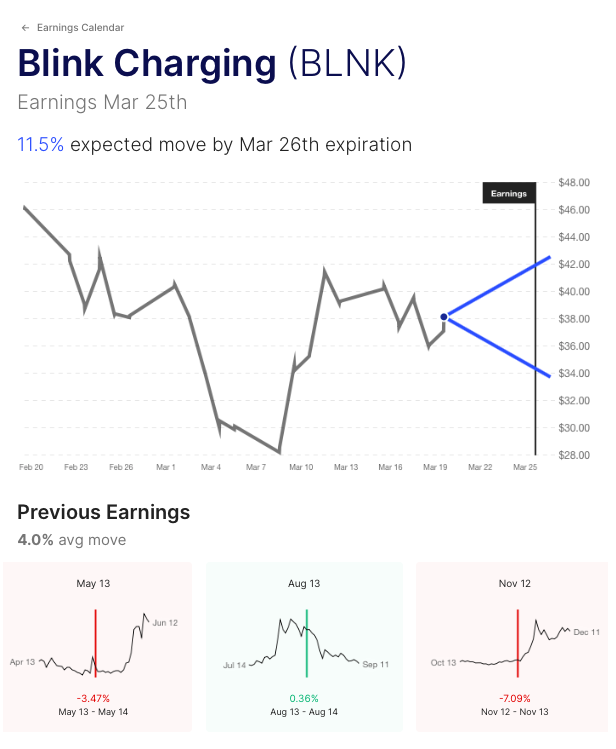

BLNK / Expected Move This Week: 12% / Recent moves: -7%, 0%, -4%

Options AI puts the expected move at the heart of its chart-based platform and Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading.

[…] post What You Need to Know in Options this Week. SPY, GameStop, Tesla, Adobe, Blink, At Home, Bionano and… appeared first on Options AI: […]

[…] post What You Need to Know in Options this Week. SPY, GameStop, Tesla, Adobe, Blink, At Home, Bionano and… appeared first on Options AI: […]