The Broader Markets

The major indices rallied to new highs. Options were pricing in about a 2% move last week and the SPY climbed by nearly 3%. With that, option volatility, as measured by the VIX settled near 20 to close the week.

At the close on Friday, SPY options were pricing in about a 1.5% move in either direction for the upcoming week. That corresponds to about $388 to the downside and $400 on the upside. Here’s this week’s expected move chart via Options AI:

In the News

Tesla (TSLA) was higher on the week by nearly $100. With the stock now just below $700, Tesla (TSLA) options are pricing in an expected move of about 7% for this week, down slightly from last week. Options are pricing in a roughly 15% move for the next month (to April 16th), also slightly less than last week. In other words, following last week’s rally, Tesla options are pricing in less of an expected move now than they were a week ago. We revisited Tesla options this past week and looked at how spreads could potentially lessen costs while defining risk when trading the stock. (you can read more about that here).

Here’s the updated expected move chart via Options AI:

Meme, short squeeze and SPAC stocks were once again some of the largest percentage movers this past week We recently wrote about the uniqueness of option implied volatility and skew in stocks that are experiencing large price movements, using GameStop as an example (you can read that here). Speaking of GameStop, after a wild week of moves and the stock now near $270, options are now pricing a weekly move of about a 30% move in either direction – corresponding to roughly $185 on the downside and $350 to the upside:

Expected Moves for Companies Reporting Earnings Next Week

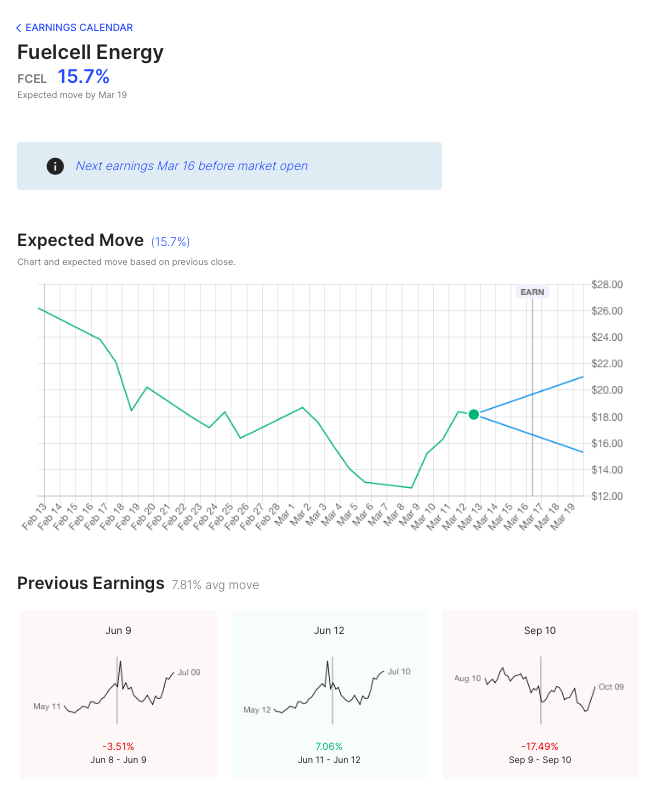

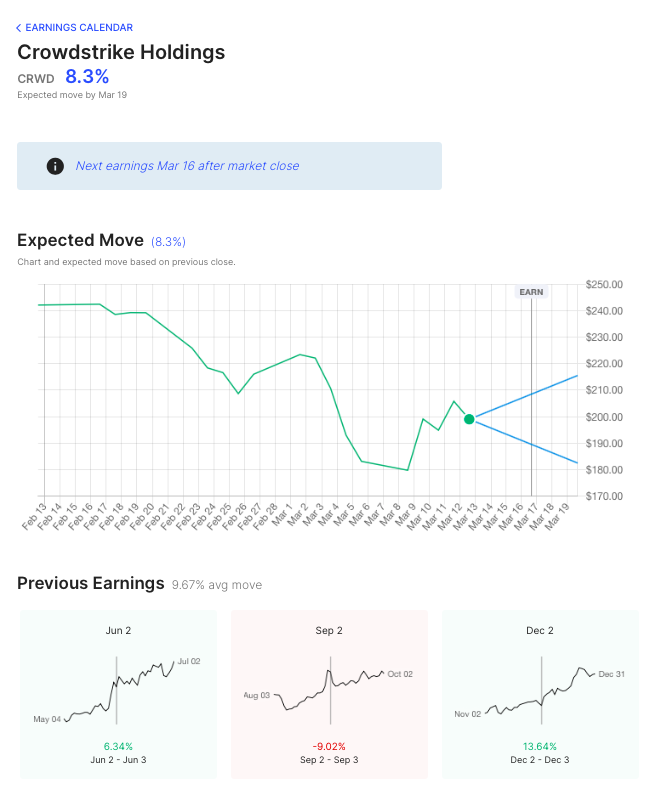

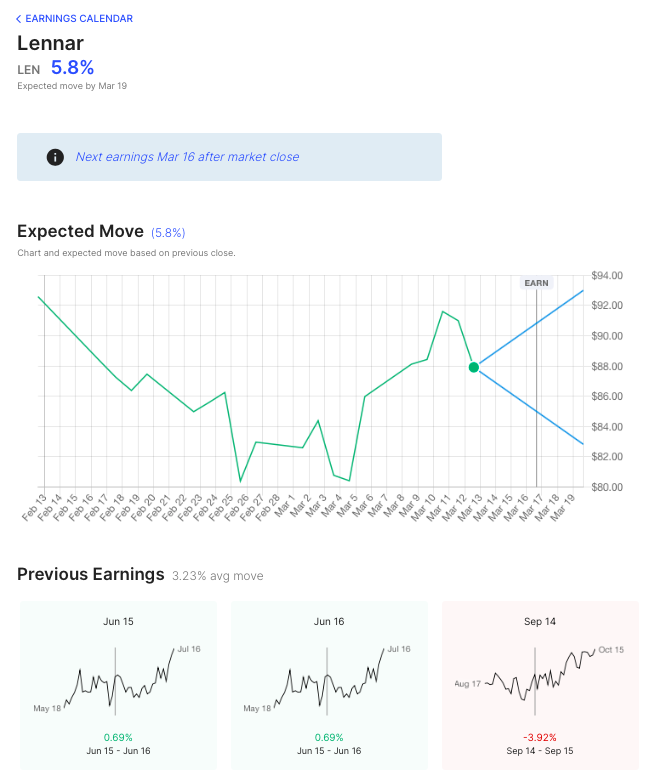

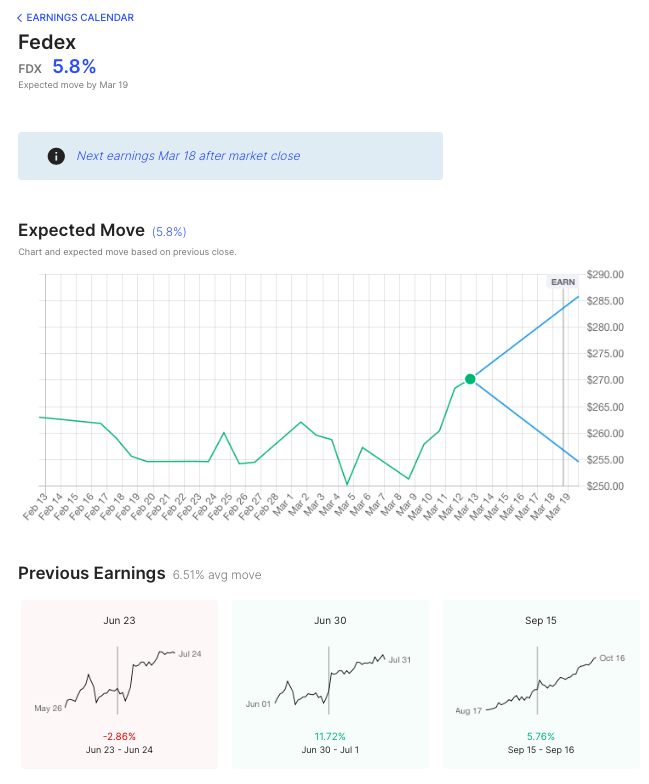

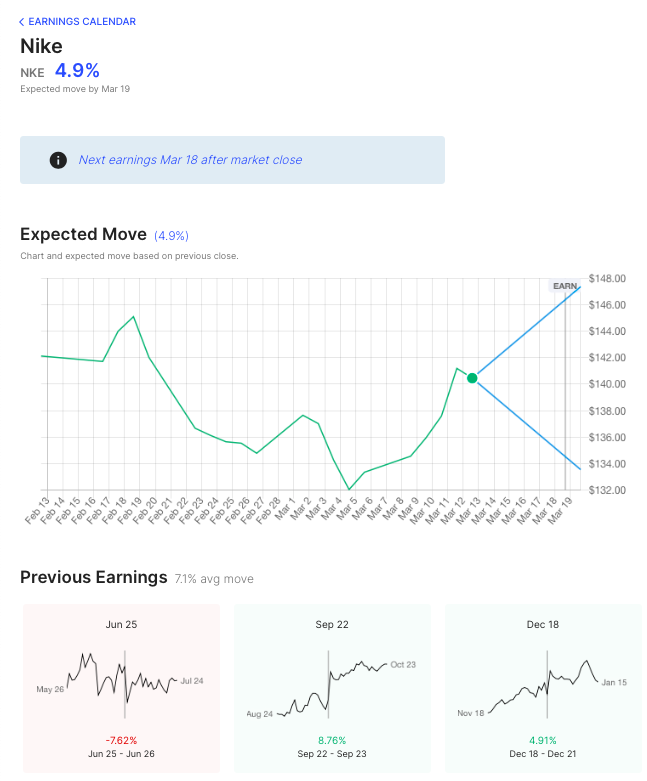

Expected moves for some of the companies reporting earnings this week, including CrowdStrike, Nike and FedEx can be seen below. Each entry shows prior earnings moves for comparison. A larger searchable list can be found on the Options AI Earnings Calendar. Links for each stock go to charts for this week in comparison to recent earnings moves:

FCEL / Expected Move This Week: 16% / Recent moves: -17%, +7%, -4%

CRWD / Expected Move This Week: 8% / Recent moves: +14%, -9%, +6%

LEN / Expected Move This Week: 6% / Recent moves: -4%, +1%, +1%

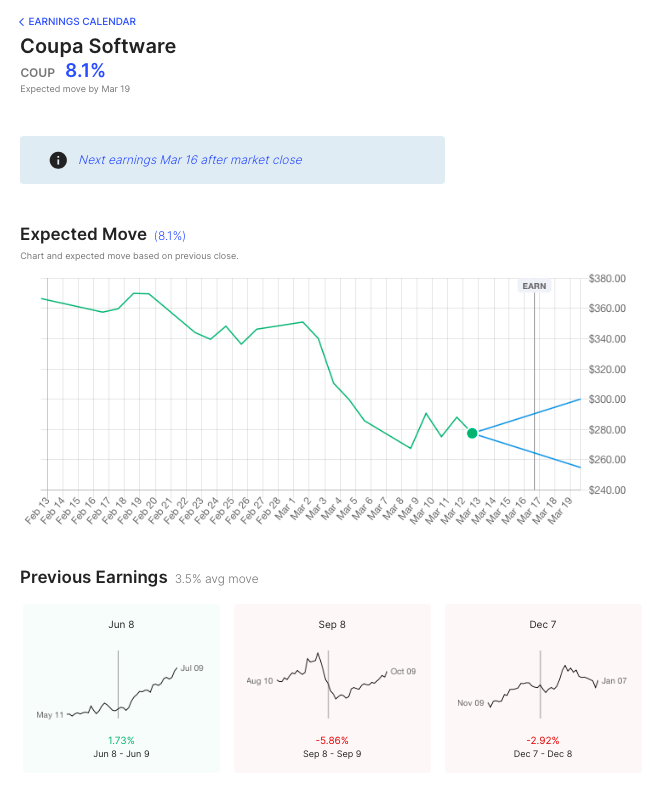

COUP / Expected Move This Week: 8% / Recent moves: -3%, -6%, +2%

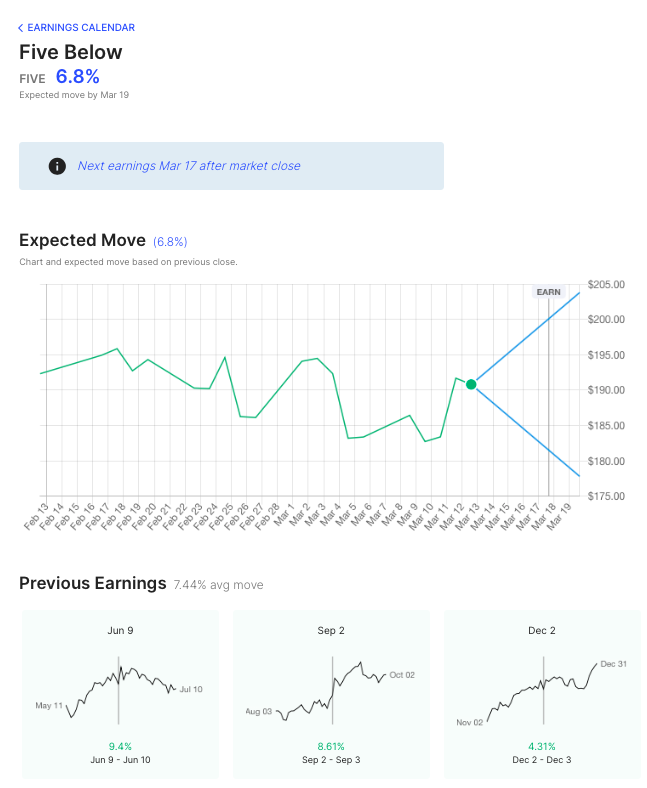

FIVE / Expected Move This Week: 7% / Recent moves: +4%, +9%, +9%

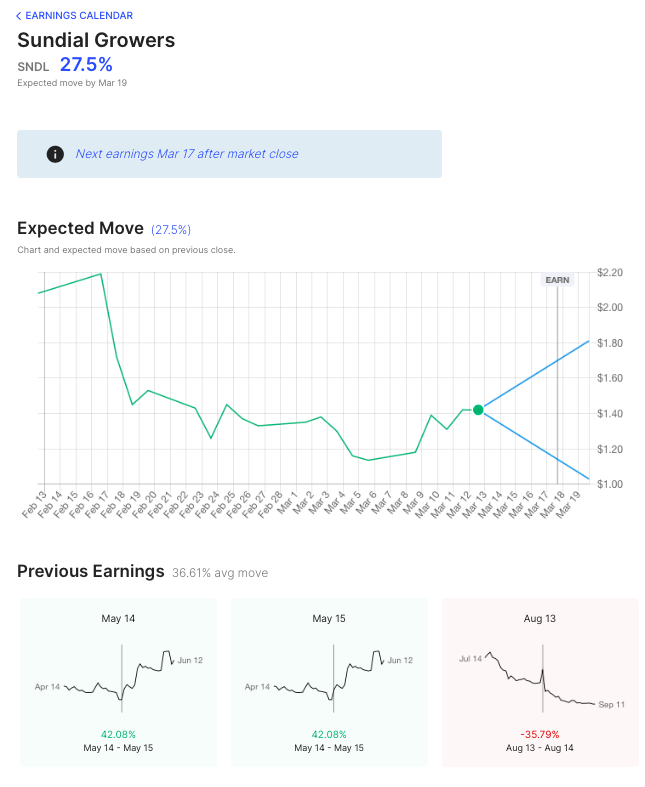

SNDL / Expected Move This Week: 28% / Recent moves: -36%, +42%

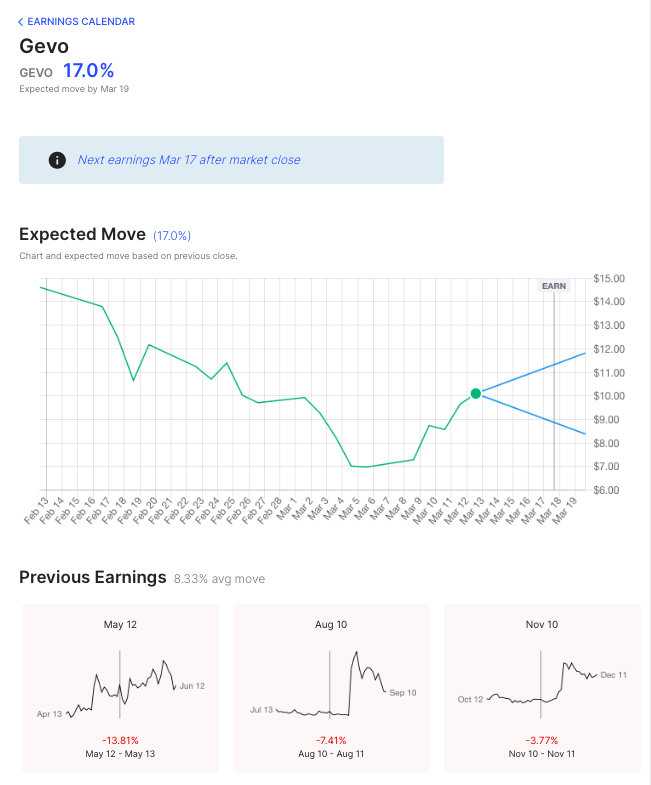

GEVO / Expected Move This Week: 17% / Recent moves: -4%, -7%, -14%

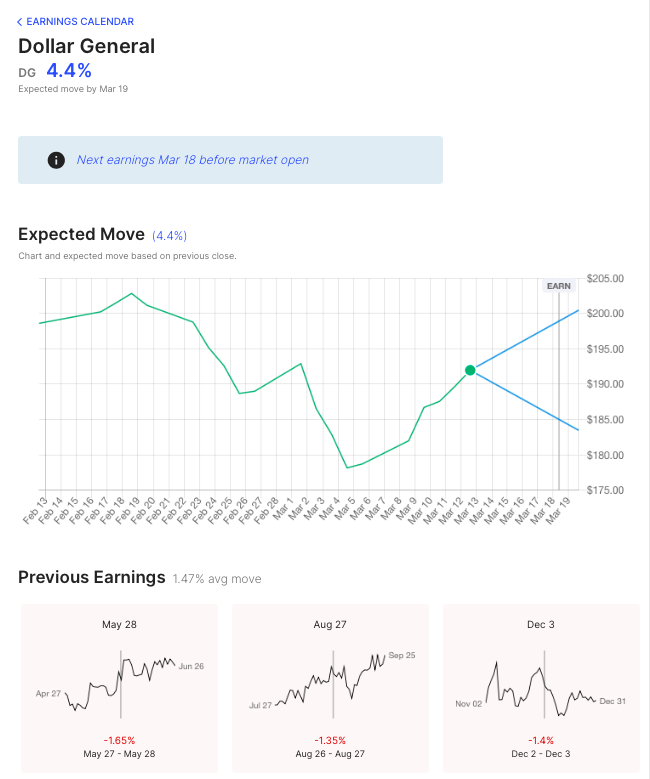

DG / Expected Move This Week: 4.5% / Recent moves: -1%, -1%, -2%

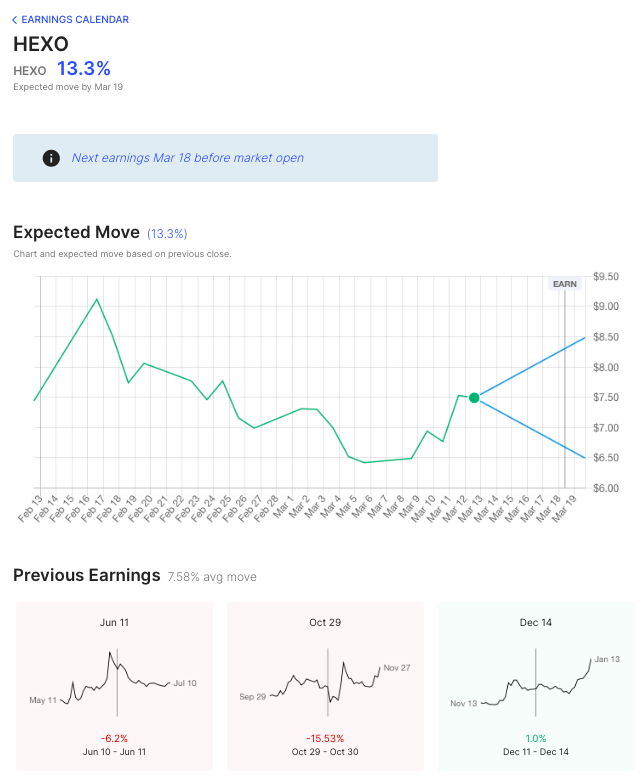

HEXO / Expected Move This Week: 13% / Recent moves: +1%, -16%, -6%

FDX / Expected Move This Week: 6% / Recent moves: +6%, +12%, -3%

NKE / Expected Move This Week: 5% / Recent moves: +5%, +9%, -8%

Options AI puts the expected move at the heart of its chart-based platform and Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading.