The Broader Markets

The S&P 500 closed the week at new highs, up about 1.6% on the week versus the 1.4% the options market was pricing. With that, the VIX closed at 19, its lowest level in a year. The Nasdaq closed the week slightly lower.

SPY options are pricing in about a 1.1% move in either direction for the upcoming (holiday shortened) 4 day week. That corresponds to about $391 to the downside and $400 on the upside. Here’s this week’s expected move chart via Options AI:

In the News

GameStop (GME) reported earnings last week and after sharp moves in both directions closed down on the week by about $20 or about 10%. Options were pricing in a roughly 30% move last week, and at one point the stock was down nearly 40%. With earnings out of the way options are pricing in more than a 20% for this week and more than 50% for the next month. This week’s expected move corresponds to about $140 for a bearish consensus and $220 for bullish:

Options in high volatility stocks like GameStop are somewhat unique, with swings in implied volatility based on which direction the stock is going and skew between in-the-money and out-of-the-money options. We recently wrote about the uniqueness of option implied volatility and skew in stocks that are experiencing large price movements like GameStop (you can read that here).

Big Tech names like Apple, Alphabet, Netflix, Facebook, Microsoft, Amazon and Tesla do not report earnings until late April and early May. Options are generally pricing in between 4-6% expected moves for those stocks over the next month (huddled in the chart below.) The exceptions are Netflix and Tesla. Netflix is expected to report earnings sometime around April 20th and as you can see in the comparison below how Netflix options diverge from the group that week. In the case of Tesla, options are pricing larger moves than the others every week, with a one month expected move closer to 15%. Expected moves are useful to spot the differences in opportunity and risk over a given time period and can be accessed for free on the Options AI expected move calculator:

Expected Moves for Companies Reporting Earnings Next Week

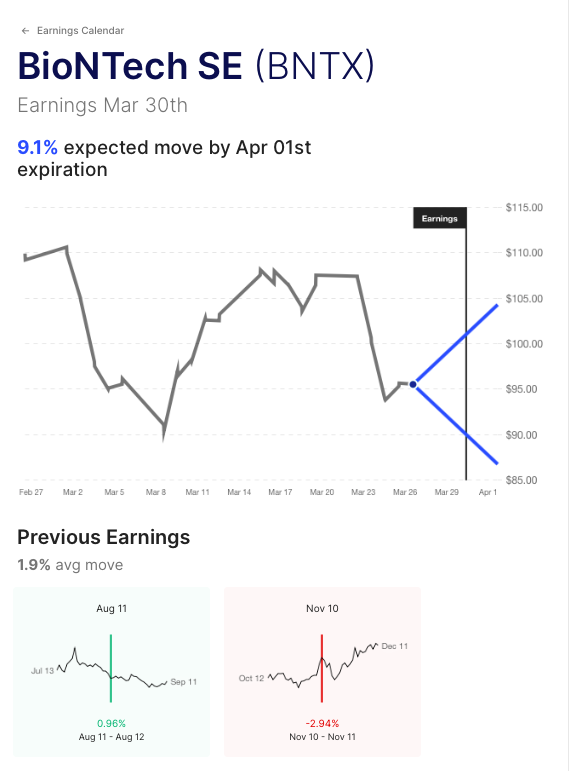

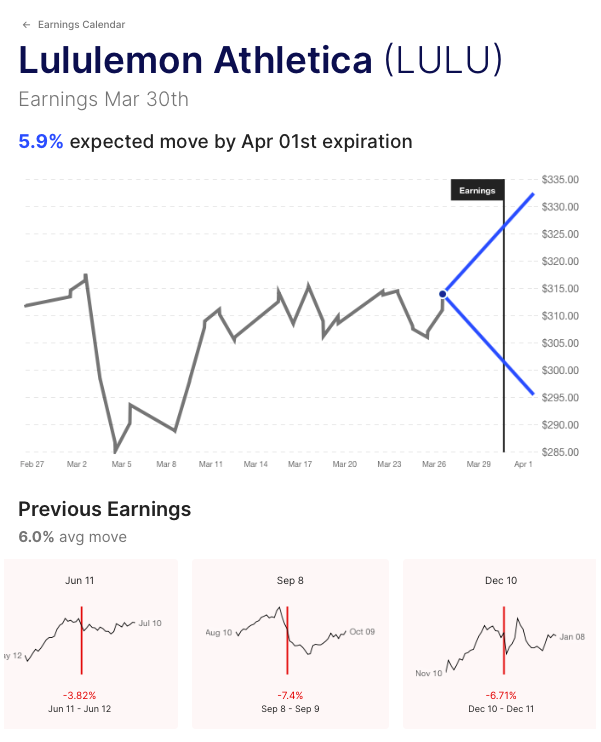

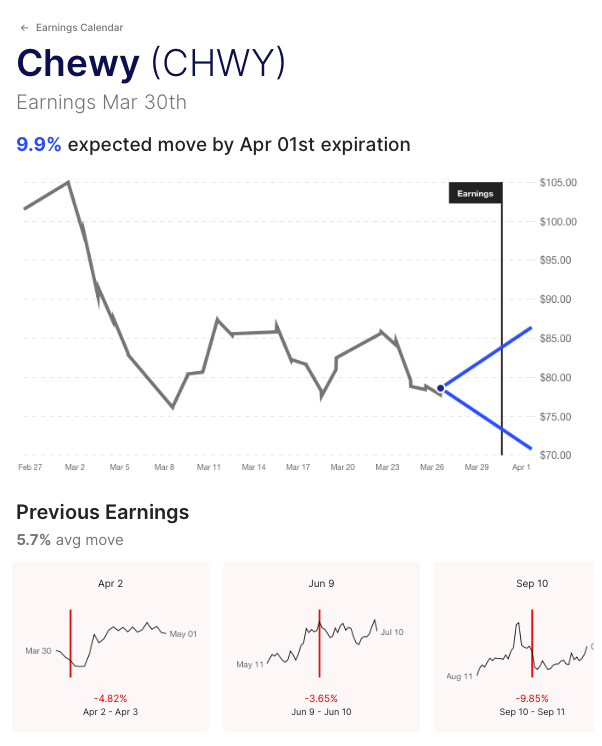

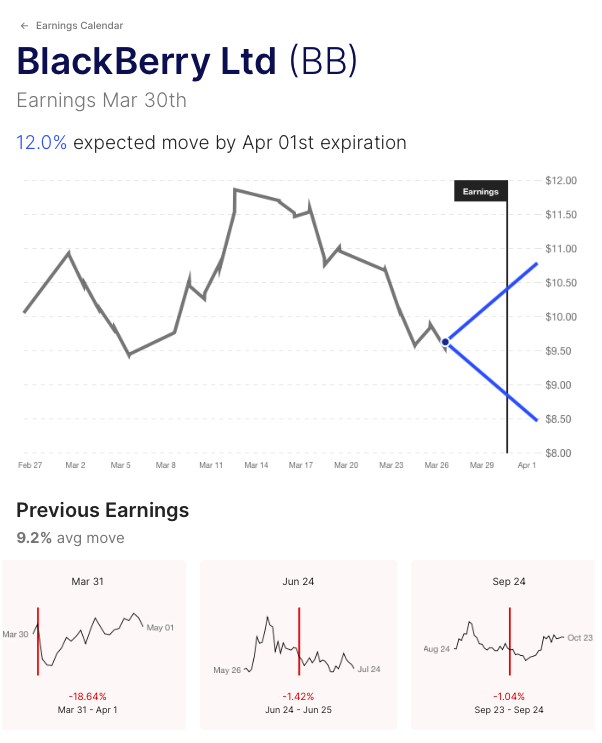

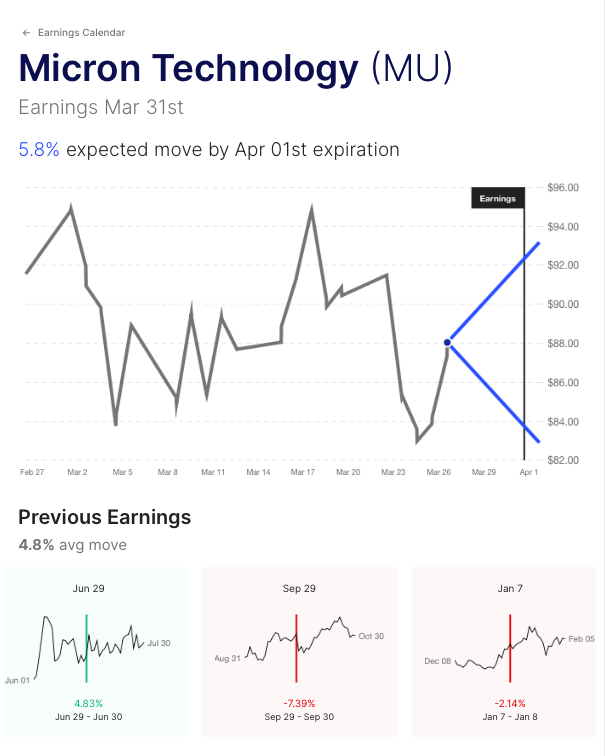

Expected moves for some of the companies reporting earnings this week, including Lululemon, Blackberry, Chewy, Carnival Cruise and Micron can be seen below. Each entry shows prior earnings moves for comparison. A larger searchable list can be found on the Options AI Earnings Calendar. Links for each stock go to charts for this week in comparison to recent earnings moves.

BNTX / Expected Move This Week: 9% / Recent moves: -3%, +1%

LULU / Expected Move This Week: 6% / Recent moves: -7%, -7%, -4%

CHWY / Expected Move This Week: 10% / Recent moves: -10%, -4%, -5%

BB / Expected Move This Week: 12% / Recent moves: -1%, -1%, -20%

MU / Expected Move This Week: 6% / Recent moves: -2%, -7%, +5%

CCL / Expected Move This Week: 5% / Prior moves +10%, -1%, +20%

Options AI puts the expected move at the heart of its chart-based platform and Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading.

[…] post What You Need to Know in Options this Week. Netflix, Tesla, Lululemon, Blackberry, Chewy, Gamestop, … appeared first on Options AI: […]

[…] post What You Need to Know in Options this Week. Netflix, Tesla, Lululemon, Blackberry, Chewy, Gamestop, … appeared first on Options AI: […]

[…] post What You Need to Know in Options this Week. Netflix, Tesla, Lululemon, Blackberry, Chewy, Gamestop, … appeared first on Options AI: […]

[…] Netflix, Tesla, Lululemon, Blackberry, Chewy, Gamestop, SPY and more. 17 hours ago. 3 min read …View full source […]