The Broader Markets Last Week – SPY was lower by about 1.3% last week, inline with the 1.3% move options were pricing%. Implied volatility was slightly higher on...

Author - The Options AI Team

Compare trades across up to 5 symbols The Options AI Trade Scanner allows you to compare up to 5 trades at once. Build a list of 5 symbols via search or categories...

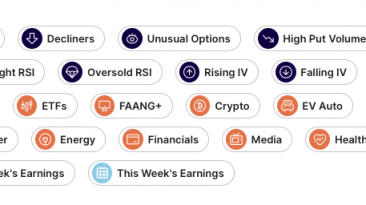

Dynamic categories with a market pulse. Search dynamic lists like Upcoming Earnings, Unusual Options Activity and Market Movers or simply browse Sectors for stocks that...

From inspiration to execution, our goal is to make your path to advanced trading ever more enjoyable and straightforward. So, today we’re excited to introduce our...

The Broader Markets Last Week – SPY was essentially unchanged on the week, but moved higher and then lower by almost 2%. Implied volatility was lower on the week...

The Broader Markets Last Week – SPY was higher by about 1.8% on the week, in line with the 1.8% move options were pricing. Implied volatility was lower on the week...

The Broader Markets Last Week – SPY was higher by about 6% on the week, a much larger move than the 2.8% move options were pricing. Implied volatility collapsed...

A Picture is Worth a Thousand Numbers. Enhanced chart overlays to clearly define where a stock needs to move for any options position to be profitable. Giving you a...

Custom Trade: Go directly to strategy, expiry and strikes. Users who already have a strategy in mind can go directly to Custom Trade via the Trade Menu. Strategies are...

The Broader Markets Last Week – SPY closed on Friday down 2.8% on the week, in line with the 2.7% move options were pricing. Implied volatility was unchanged for...

Credit vs Debit Spreads, Breakevens, and Probability of Profit. The Probability of Profit shown on Trade Comparison pages is based on the breakeven of the trade vs where...

Stay in the loop

Be the first to hear product announcements and get daily market content from The Orbit.