Credit vs Debit Spreads, Breakevens, and Probability of Profit.

The Probability of Profit shown on Trade Comparison pages is based on the breakeven of the trade vs where the stock is currently trading. Use it to compare trades but also to better understand Credit vs Debit trades, Single Leg vs Multi-Leg, and how breakevens determine a trade’s probability.

Options AI features a Trade Comparison page in many of its trade creation modes. This is a core concept of the platform that helps to surface multiple trades to express a view, rather than being limited to a particularly pre-defined strategy.

When comparing trades, users will see debit trades that typically have less than a 50% probability of profit at expiry, and credit trades that typically have a probability of profit at expiry of more than 50%. That is based on the fact that with a debit trade (debit call spread, call, debit put spread, etc) the stock needs to move directionally past the breakeven of the trade. In the case of a credit trade (credit put spread, Iron Condor etc.) the probability is based on the stock not moving outside or beyond the trade’s breakeven(s).

A good use case of this is using Fast Trade. Here…

Call versus Call Spread

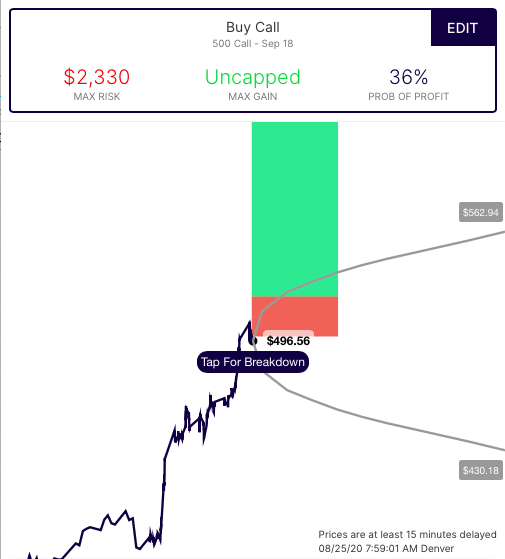

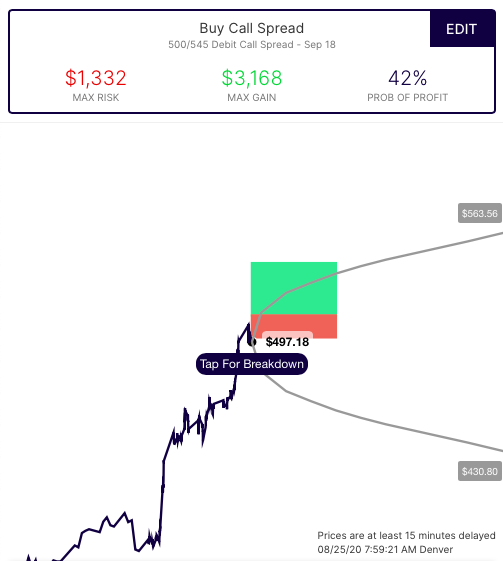

With a bullish price target to consensus we see 3 options trades, long call, long call spread, and short put spread. First, let’s compare the long call and long call spread, side by side:

What’s immediately apparent is the difference in cost of the two trades. The difference in cost, like everything in options is because of tradeoffs. The call has unlimited profit potential, but it sacrifices for that potential by having a higher cost, and a higher breakeven level from the current stock price (and therefore has a lower probability of profit).

The call spread is less expensive, and has a breakeven closer to the current stock price (and therefore a higher probability), but it sacrifices by having its upside potential capped.

The bullish consensus for September in Apple is around $545. The debit call spread uses that to sell any move above that area, lower its cost and establish a lower breakeven of around $513 in the stock, versus $523 in the call.

Credit (Bullish) Put Spread

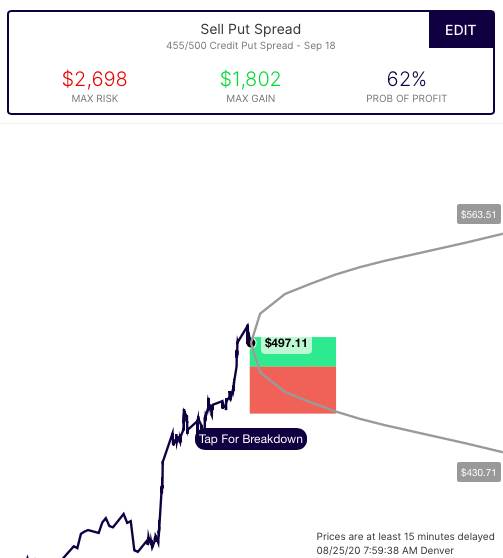

Next, let’s look at the third trade, the bullish credit put spread:

The first thing to notice is the inverted risk reward. It risks more, to make less. That’s its main sacrifice. But with that tradeoff comes a much lower breakeven (lower than where the stock is trading) and much higher probability of profit than either buying a call, or buying a call spread. This trade is a profitable anywhere above $482 on expiration (with the stock currently $499) and has a max gain if the stock is above $500. It defines the risk of selling the 500p by buying the 455p at the bearish expected move.

Summary

What we see here is 3 different ways to express a bullish view, each with tradeoffs. Those tradeoffs are easily understandable if we compare the risk/reward, and the probability of profit, based on the breakeven level established in the stock:

Long Call

- Risk: $23.30

- Reward: unlimited

- Breakeven: $523.30

- Probability: 36%

Long Call Spread

- Risk: $13.32

- Reward: $31.68

- Breakeven: $513.32

- Probability: 42%

Short Put Spread

- Risk: $26.98

- Reward: $18.02

- Breakeven: $481.98

- Probability: 62%

The risk-reward and probability of each trade can be found on the trade comparison, as well as each trade’s payout diagram. Within the payout diagram, you can click “Tap for Breakdown” to see the exact breakeven (live pricing) as well as the max gain and max loss levels.

Add comment