A Put Spread is a directionally bearish strategy that buys a put, while simultaneously selling a lower strike put in the same expiration. An investor might use a Put...

Author - The Options AI Team

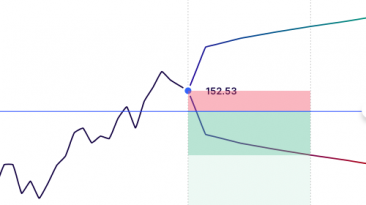

CREDIT CALL SPREAD A Credit Call Spread, or Bear Call Spread is a potential income strategy that sells a call, while simultaneously buying a higher strike call in the...

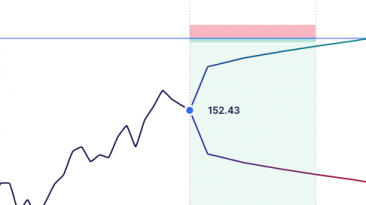

Credit Put Spread A Credit Put Spread, or Bull Put Spread, is a potential income strategy that sells a put, while simultaneously buying a lower strike put in the same...

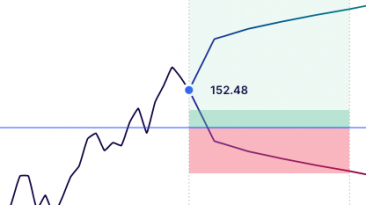

Iron CondorAn Iron Condor sells a credit call and put spread to create a profit zone where a max gain equal to the net credit can be received as long as the stock does...

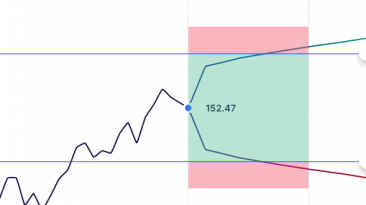

Iron Butterfly An Iron Butterfly is a potential income strategy that sells a Credit Put Spread, while simultaneously selling a Credit Call Spread with the same short...

The Broader Markets Last Week – SPY was higher by 4.2% last week, double the 2.1% move options were pricing. This Week – SPY options are pricing just a 1.6%...

The Broader Markets Last Week – SPY was higher by 2.4% last week, a little more than the 2% move options were pricing. This Week – SPY options are again...

The Broader Markets Last Week – Following a late week reversal higher, SPY finished the week lower by about 1%, inside the 2% move options were pricing...

The Broader Markets Last Week – After a down move to start the week the SPY was higher by about 2% last week, in line with the 2.1% move options were pricing...

The Broader Markets Last Week – SPY was lower by about 2.3% last week, in line with the 2.4% move options were pricing. That follows weekly moves of more than 5%...

The Broader Markets Last Week – Markets made another outsized move last week, this time to the upside. SPY was higher by more than 6%, a significantly larger move...

Stay in the loop

Be the first to hear product announcements and get daily market content from The Orbit.