The Broader Markets

Last Week – Following a late week reversal higher, SPY finished the week lower by about 1%, inside the 2% move options were pricing. That’s 3 straight weeks of moves less or inline with option pricing following 3-4 weeks of moves that far outpaced option pricing.

This Week – SPY options are again pricing a 2% move for the upcoming week.

Implied Volatility / VIX – The VIX closed the week near 24. The VIX futures curve remains upward sloping to the end of the year with Oct, Nov and Dec futures all above 28.

Expected Moves for This Week (via Options AI)

- SPY 2% (+/- $8)

- QQQ 2.5% (+/- $8)

- IWM 2.4% (+/- $4.50)

- DIA 1.6% (+/- $5.50)

In the News

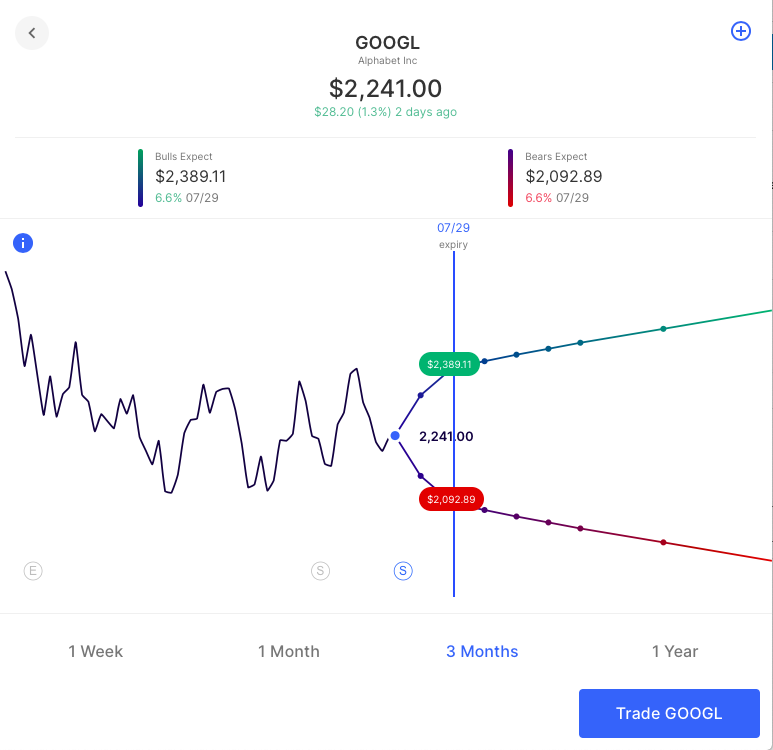

Alphabet (GOOG, GOOGL) completes a 20 for 1 split as of Monday morning. GOOGL was roughly $2240 on Friday which is $112 post split. The stock has been in a range over the past 2 months of about 2120 and 2380. That is a range of $106 to $119 post split. The company will report earnings the last week of July and the options market is pricing a move roughly in line with that range, just about 7% in either direction, corresponding to about $120 as a bullish consensus and $104 as bearish. Here’s the pre-split expected move for July 29th, the week of Alphabet earnings:

Education

Last week we compared covered call and credit call spread strategies. This week we focus on the other unique aspect of credit call spreads, and how they can be used as a potential income-generating strategy even when the contracts of the spread are greater than the shares held in the underlying, a potential advantage for investors vs a covered call that needs to be 1 to 100.

A smarter Limit Order to Sell

Assuming that you own at least 100 shares of an underlying stock, selling a Call with a Strike where you would otherwise place a Limit Sell Order is an often overlooked strategy. After all, if you are keen to take profits if a stock reaches a certain level, why not get paid for doing it?

A step beyond this is selling a Credit Call Spread. Here, we might place our short Strike at the same level we would place our Limit Sell Order and place our higher strike long Call at a level that we would want to re-participate in gains should the stock have an outsized move. Here, we are forfeiting some of the upfront premium collected for the ability to participate in additional upside. Of course, it should be noted that, if we definitively want to sell our underlying stock position if the price hits our level, then we should place a Limit Order to Sell since selling a Call Spread may not provide this certainty.

Income trades with less than 100 shares

Thirdly, at Options AI, we see a less obvious yet powerful reason why we might want to consider the Credit Call Spread over the Covered Call. We know that a Credit Call Spread has defined risk/reward (from last week’s example), we are risking $1.35 (Spread width less premium collected) to make $0.65. In other words, we are looking to add $65 of income to our $10,000 underlying stock position, and we risk missing out on $135 of gains as the stock moves between $103.65 and $105.00. But, beyond $105 we are once again participating in stock gains.

Put another way, by having a defined risk of $135, it matters a whole lot less that we own 100 shares of the underlying stock. We open the door to using income trades against stock positions of less than 100 shares.

For example, let’s assume that instead of 100 shares of XYZ stock, we own 50 shares, worth $5,000. If we were to simply sell the 103 Call against this position, we would still collect $100 in premium, but we would have undefined risk on the equivalent of 50 shares. If the stock moves above $104 we could suffer unlimited losses. In other words, a Covered Call is not an option for those with less than 100 shares.

However, with the Credit Call Spread, we have collected $65 income and the maximum we can lose is $135. If the stock moves up beyond $105 (the upper strike Call) we actually start participating in stock gains again. We can enjoy income trades when holding less than 100 shares if we focus on dollar amounts and percentages rather than needing the underlying stock as a hedge if things go wrong.

Don’t own any shares? No Problem.

Lastly, if we don’t need 100 shares to trade a Credit Call Spread, do we need any at all? The simple answer is no. Many investors use the Credit Call Spread as an income generating strategy when they believe that a stock will remain below a certain level at expiration. And, because risk is defined, it can be deployed as an income generating without owning any underlying stock. (or versus a portfolio of mixed long positions).

In the example we have above, that level is our Breakeven of $103.65. If the stock is below our lower strike of 103 at expiration we may realize Max Gain and if the stock moves up through our upper strike of 105, we will likely realize Max Loss. Since our Breakeven is 3.65% above where the stock is currently trading and above the Expected Move as priced by the options market, our Probability of Profit is typically greater than 50%.

Earnings

Links below go to the Options AI calendar where you can see the other companies each day and click through to see charts (free to use). Recent earnings moves (actual) start with the most recent:

- Bank of America BAC / Expected Move: 4.9% / Recent moves: +3%, 0%, -4%

- Goldman Sachs GS / Expected Move: 3.9% / Recent moves: 0%, -7%, +4%

- Charles Schwab SCHW / Expected Move: 4.9% / Recent moves: -9%, -4%, +4%

- IBM IBM / Expected Move: 5.1% / Recent moves: +7%, +6%, -10%

- Netflix NFLX / Expected Move: 12.4% / Recent moves: -35%, -22%, -2%

- Haliburton HAL / Expected Move: 5.7% / Recent moves: -1%, +4%, 0%

- Tesla TSLA / Expected Move: 6.7% / Recent moves: +3%, -12%, +3%

- United Airlines UAL / Expected Move: 7.3% / Recent moves: +9%, -3%, -1%

- Snap SNAP / Expected Move: 15.8% / Recent moves: +1%, +60%, -27%

- American Express AXP / Expected Move: 4.5% / Recent moves: -3%, +9%, +5%

Option trading without the legwork: get started with an Options AI platform subscription today!

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.