The Broader Markets

Last Week – Markets made another outsized move last week, this time to the upside. SPY was higher by more than 6%, a significantly larger move than the 2.7% move options were pricing. That follows weekly moves of more than 5% lower the past few weeks. The majority of last week’s move higher happened on two days, Tuesday to start the week, and Friday to end the week.

This Week – SPY options are pricing about a 2.4% move for the upcoming week (about $9 in either direction), which is slightly less than last week. This week includes the end of a month and quarter for markets on Thursday (so an additional ETF expiry on Thursday) followed by a weekly expiration Friday into a 3 day Holiday weekend. So a lot of variables that options sometimes have a difficult time pricing.

Implied Volatility / VIX – The VIX closed the week near 27, down from 31 the prior week. From last week’s write-up:

the VIX was near 35 several times last week which is close to the highs the VIX has seen in earlier spikes this year (March and early May). In both those earlier cases a VIX above 35 marked a temporary low in the market.

A VIX spike to 35 once again marked a tradeable low in the markets. Prior market bounces this year ran out of steam with the VIX 19 in early April, and 23 in early June before stocks reversed lower. The VIX is still historically higher than average.

Expected Moves for This Week (via Options AI)

- SPY 2.4% (+/- $9)

- QQQ 3% (+/- $9)

- IWM 2.8% (+/- $5)

- DIA 2% (+/- $6)

In the News

One month ago we checked in on oil & gas stocks and noted that despite the stocks “crashing higher” alongside the price of oil, implied volatility in the equity options was not spiking like implied volatility in commodity options tends to. That left equity options vulnerable to underpricing a reversal in oil prices:

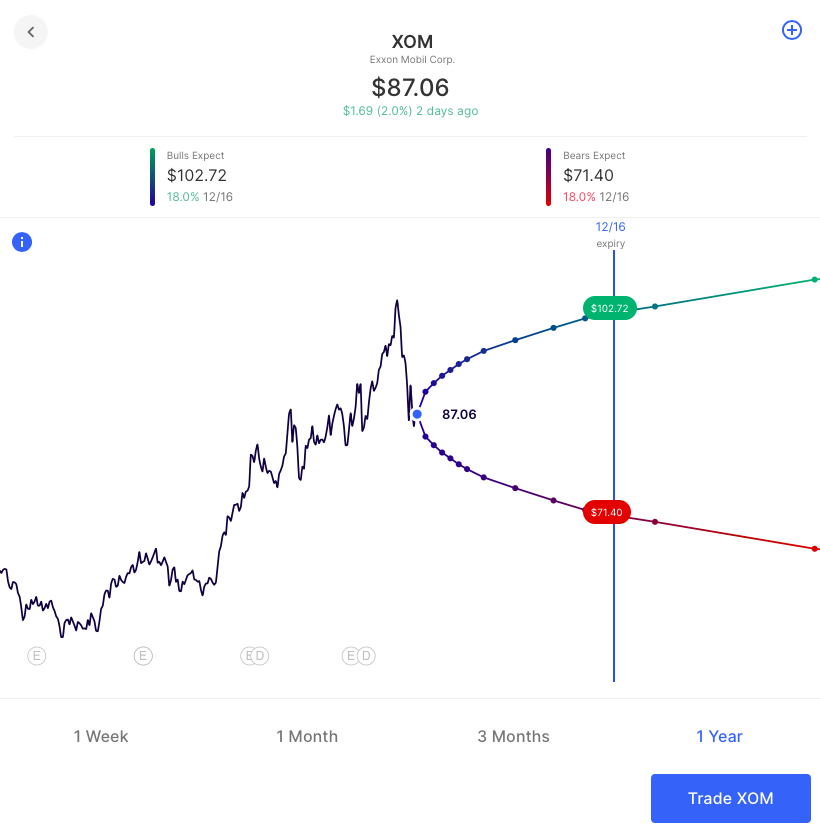

For example, OXY was a $10 stock in Summer 2020 and a $28 stock to start 2022. It is now $70. Exxon Mobil started 2022 near $60 and is now approaching an all-time high near $100. Despite a move from under $85 to $98 in the past 3 weeks, XOM options aren’t pricing that sort of move, higher or lower until September. OXY is up $15 in the past month yet options are not pricing that sort of move until September either.

These stocks have seen investors pour in and the stocks have “crashed higher” towards all-time highs alongside oil itself, but the implied volatility of options in the single names are acting more like a stock near highs and less like a volatile commodity near highs where one typically sees IV increase as the commodity price goes higher. Meaning Puts and Put Spreads in particular may cost less than might otherwise be expected. Something to keep an eye on, especially for those looking to hedge.

The commodity side of things did indeed reverse the past few weeks, to the tune of about 15% in some cases. And Occidental (OXY) and Exxon Mobile (XOM) followed suit. OXY and XOM are both down roughly 18% in the past month, even more than Oil. XOM options are pricing a move of around 20% for the rest of 2022. A move that wouldn’t even take XOM back to its highs of a few weeks ago. This is one example of how the expected move can be used as a gut check versus the stock chart itself, a way to see implied volatility for what it truly is… how options are pricing moves in the stock versus how the stock is actually trading.

Earnings

Links below go to the Options AI calendar where you can see the other companies each day and click through to see charts (free to use). Recent earnings moves (actual) start with the most recent:

- Nike NKE / Expected Move: 6.8% / Recent moves: +2%, +6%, -6%

- Bed Bath & Beyond BBBY / Expected Move: 17% / Recent moves: -1%, +8%, -22%

- Paychex PAYX / Expected Move: 7.6% / Recent moves: +3%, +6%, +4%

- Micron MU / Expected Move: 6.5% / Recent moves: -4%, +5%, +11%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.