Iron Condor

An Iron Condor is a potential income strategy that sells a credit put spread, while simultaneously selling a Credit Call Spread in the same expiration.

An investor with a generally Neutral view might use an Iron Condor when looking for a defined risk strategy that sees profits if a stock remains within a certain trading range.

The strategy might also be used instead of a Short Strangle. Here, an investor may be willing to accept less potential income in exchange for defining risk and lowering the margin required.

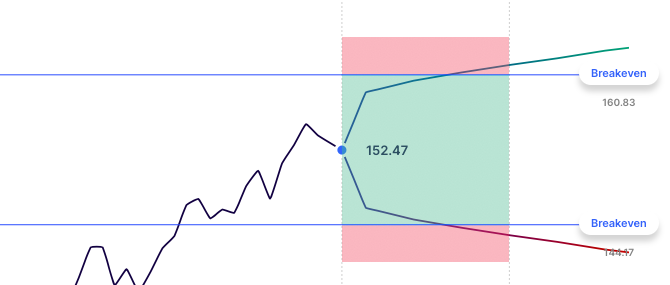

Maximum Gain from the Iron Condor may be realized if the stock finishes within the short strikes of the spread, while losses may occur if the stock moves above or below either of the breakevens. A Maximum Loss would occur with the stock outside the spread at expiration.