The Broader Markets

The major indices saw volatile swings in both directions this past week before finishing close to where they started. The VIX spiked to more than 30 on Thursday before ending the week near 25.

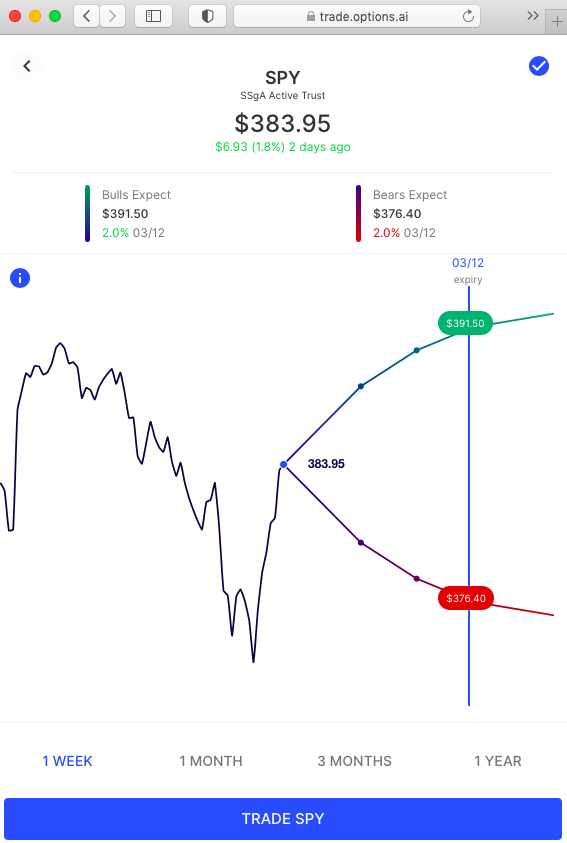

At the close on Friday, SPY options were pricing in about a 2% move in either direction for the upcoming week. That corresponds to about $376 to the downside and $392 on the upside. Here’s this week’s expected move chart via Options AI:

In the News

Beyond the overall volatility in the broader markets, former story stocks like Tesla continued to come under selling pressure. With the stock near $600, Tesla (TSLA) options are now pricing in an expected move for this week of about 9% and more than 15% for the month of March. We last detailed Tesla and how spreads could lessen costs while defining risk when the stock was near $800. (you can read more about that here).

Meme, short squeeze and SPAC stocks were once again some of the largest percentage movers this past week with Virgin Galactic (SPCE), for example, completing a round trip in its shares from the 20’s the the 50’s back to the 20’s since the beginning of 2021. We recently wrote about the uniqueness of option implied volatility and skew in stocks that are experiencing large price movements, using Gamestop as an example (you can read that here). For Virgin Galactic, options are currently pricing about an 11% move for this week and more than 21% for the month of March. That’s about a $6 move in either direction out to April 1st:

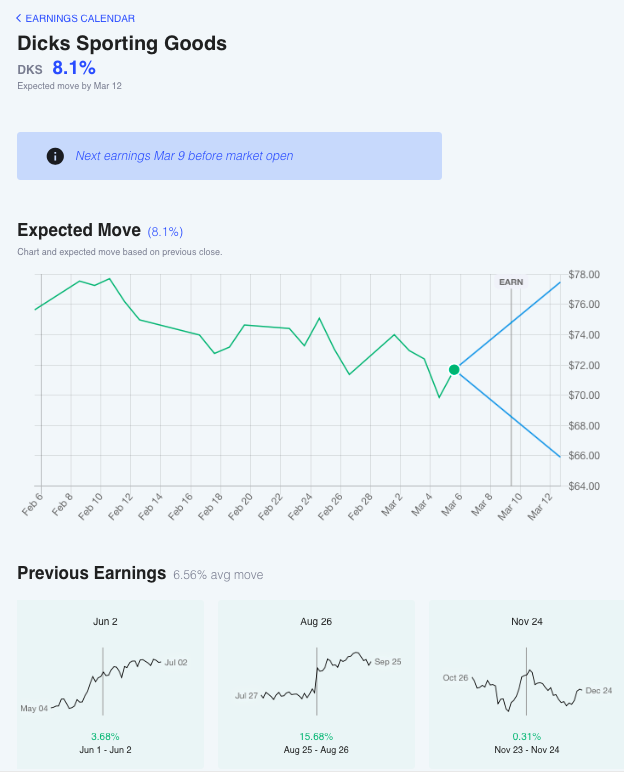

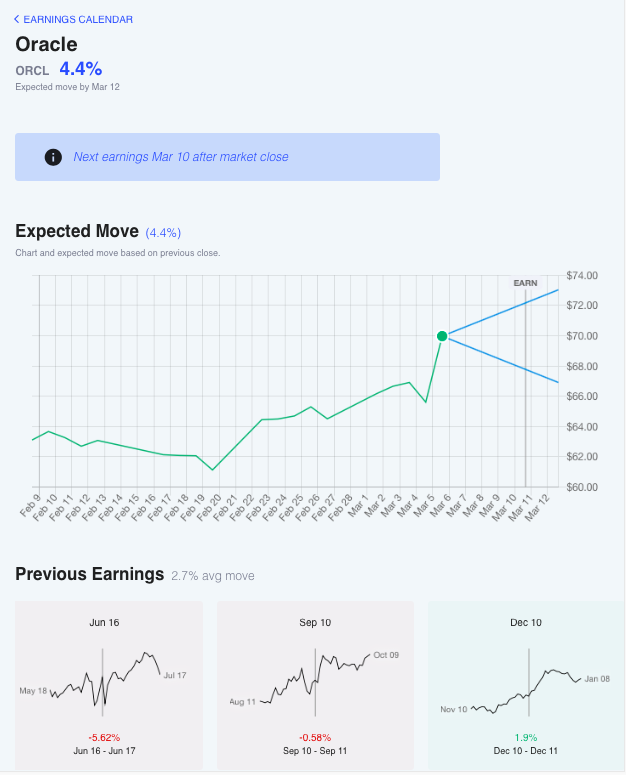

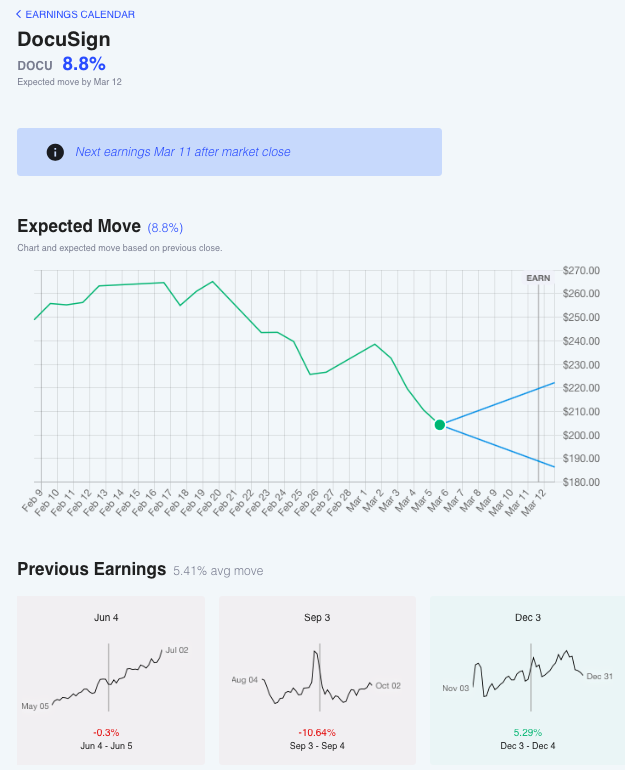

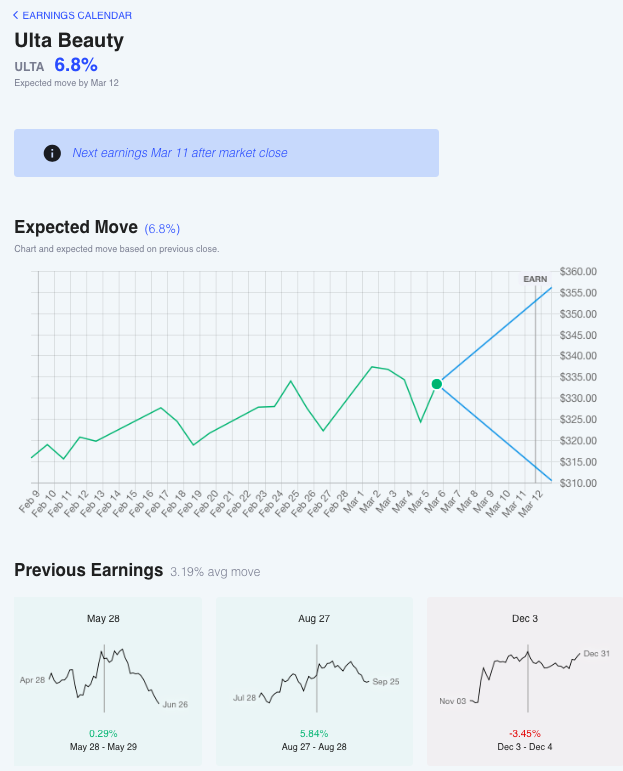

Expected Moves for Companies Reporting Earnings Next Week

Expected moves for some of the companies reporting earnings this week, including JD, AMC, DocuSign and Oracle. Each entry shows prior earnings moves for comparison. A larger searchable list can be found on the Options AI Earnings Calendar.

PRTS / 20%

DKS / 8%

AMC / 17%

CLDR / 12%

ORCL / 4.5%

JD / 7%

DOCU / 9%

ULTA / 7%

Options AI puts the expected move at the heart of its chart-based platform and Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading.