Yesterday we discussed how options contribute to a short squeeze, and also how they can contribute to its end. For more detail read here.

Today we’ve seen sharp selloffs in the short squeeze stocks but most stocks were able to find buyers, at least temporarily. That might seem odd considering a lot of new positions are restricted. So what’s going on? There’s obviously numerous factors at play, but below we provide a few thoughts and insights for you to formulate your own opinions.

Often, a short squeeze ends with a sharp sell-off, but … there are buyers in waiting, often those covering shorts, either for a profit from having sold higher, or seeing an opportunity to lock in a smaller loss from shorting below. That can provide temporary support in a stock that’s unwinding a short squeeze. In other words, if traders shorted the stock at $200, watched it go to $500, there may be willing buyers even before it gets back to $200, simply to end the pain. Then of course there are those that shorted at $500, they are buyers as well, at a profit.

But from an options perspective, things can be more complicated. The market makers are still likely short gamma and are sellers as the stock goes lower to remain delta neutral. In other words, they add additional selling pressure on the stock as it falls, just as they were adding additional pressure on the stock as buyers on the way up. This is because the stock they bought on the way up to remain delta neutral (from all the calls they sold) now needs to be sold on the way down to remain delta neutral, vs all the stock they bought against their short calls. This is how short gamma super-charges stock moves.

But, then there’s the buy side of all those calls. Those that have bought calls and sold stock against those calls higher are now buyers below those strikes. They are long gamma, and unlike those short gamma that have to buy high and sell low, those long gamma, can sell high and buy low, scalping stock against their options, all delta neutral, for a profit on the stock trades.

All of this is working behind the scenes, some of it cancelling itself out, some of it exacerbating moves. But these factors often mean it’s not always an “elevator up, elevator down” scenario in short squeezes. Short squeezed stocks sometimes end with an initial bang, but then can take a long time for the rest of the excess stock that needs to be covered lower to work through the system. After the big move down, the rest can feel like a drawn out whimper.

From a trading perspective all of this mania in options creates situations where premiums are high and using options to express any view can involve increased risk. Below are a couple examples of strategies where costs might be reduced (and therefore overall risk might be lessened) with multi leg strategies (vs the really high premium of single leg calls and puts) with visuals from Options AI. Remember, we use Gamestop purely as an example given the current high volatility in the name, but we in no way recommend trading GME or any of the strategies that we use for education purposes.

A note about the short squeeze stocks: This is an extremely rare situation with extreme volatility and uncertainty. Risks are elevated, particularly when using options. In addition, the specific risks inherent in multi-leg options, particularly liquidity and wide bid/ask spreads, can be exacerbated further. You should only participate in these kind of situations if you are willing to incur substantial loss.

Using a directional Butterfly to lessen cost

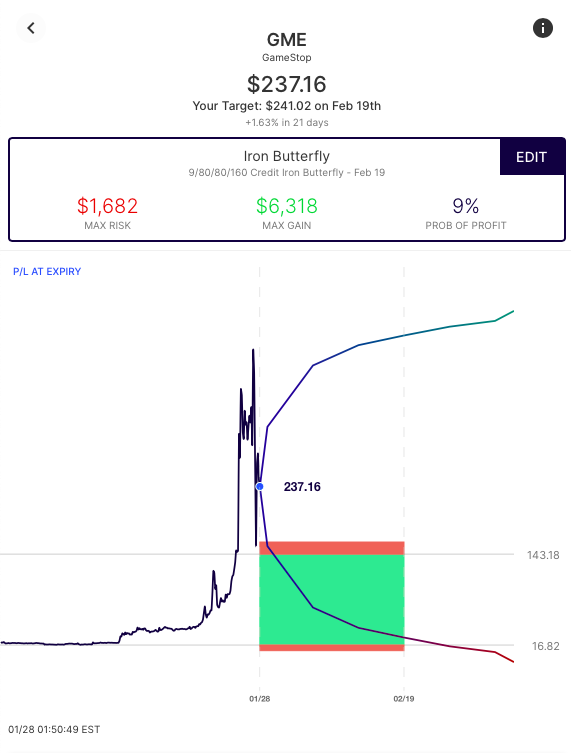

An Iron Butterfly lessens the premium at risk versus an outright option buy and even vertical spreads. It is typically thought of as a neutral trade but its center can be used as a rough price target in the stock, providing a wide range of profitability for a very low premium outlay

As an example, let’s look at a butterfly to the downside, in GameStop. This involves selling a call spread (+160c/-80c), and selling a put spread (-80p/+9p) with overlapping strikes at 80, creating a target near 80 in the stock. What makes this trade fairly inexpensive compared to other bearish strategies is it’s selling 2 options at an extremely high volatility:

This Iron Butterfly example is profitable anywhere between $143 and $17 in the stock with a max gain at $80. Its profits trail off the farther it is from $80 but it makes some money anywhere between those two breakevens (at expiration)

Its max loss is anywhere above $160 or below $9 in the stock. The strikes and where to center the butterfly is just an example above, the center should be thought of as a price target and is completely up to the trader where to target. Often in wild stocks these type of strategies can be found for very little premium outlay compared to the wide range in the stock where profitability in the trade is possible.

Using call spreads directionally to lessen cost

And for those that are bullish after large selloffs, again, spreads might be better utilized than simply buying an outright call. Here’s a Debit Call Spread, that takes advantage of the high price of out of the money calls to greatly lessen the required breakeven level in the stock:

Upside calls in these stocks are quite expensive and this type of trade takes advantage of that by selling those far out of the money calls to greatly reduce the cost of the near the money call being bought.

Selling to both the bulls and the bears, with defined risk

Then of course there is a completely neutral view. Here’s an example of using the expected move to create an Iron Condor, establishing a range of max gain if the stock remains between its short strikes:

Implied volatility in these stocks is off the charts. And it’s been rising as the stocks go higher, and will likely compress as the stocks go lower. Therefore, traders need to be very aware of the premium risk they are taking on both the long and short side of options.

Using Option Spreads and the Expected Move

The Options AI expected move chart helps traders visualize just how much volatility option traders are pricing into stocks like Gamestop and AMC, and in what timeframe. And when the expected move is this large, it follows that buying options can be expensive. The fact that options are so expensive can contribute to the eventual end of a short squeeze and traders should take into account how particular option strategies play out as any new paradigm emerges.

Options AI puts the expected move at the heart of its chart-based platform and Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading. The concepts can apply to any stock and GME is simply used here as a short squeeze name for illustrative purposes.