An epic squeeze in high short interest stocks is the big story of the week. The traditional short squeeze is being super-charged by what’s happening in the options market. We’ll give a bit of a primer in what’s going on from an options perspective and check-in with what options are pricing next for these stocks.

First, what is a short squeeze? A short squeeze is a not uncommon market inefficiency where a heavily shorted stock increases rapidly in price because there are not enough shares outstanding (of the total float) to be sold to new buyers. The squeeze is is exacerbated by those that are already short the stock needing to cover their shorts at higher prices as new buyers push the stock higher. Essentially, everyone becomes a buyer, both new buyers, and existing shorts.

The term that many are using to describe recent market action is a short gamma squeeze. That refers to the options side of things. Here’s how that plays out. When retail order flow is overwhelmingly buying upside calls, that leaves the sell side of the options market (market makers) short upside strikes. When those calls are initially sold, the market makers hedge, to stay delta neutral. But that hedge is based on the delta of those calls at that time. As the stock rises, the short deltas of those calls increase (gamma), meaning the market makers need to buy more stock to stay delta neutral. This aspect of the options market adds yet another buyer of stock as it rises. When there is so much activity in the calls, that gamma squeeze can end up being one of the more significant factors of the overall short squeeze in the equity. The market makers themselves end up being the leverage to the initial call buyers.

From an options perspective it does not go on forever. Because market makers are buying increasing amounts of stock to cover the out-the-money calls (as volatility increases, the delta needing to be hedged when the call is first sold gets larger and larger), the first extended period of time where the stock is going down, or even sideways, means those market makers become sellers of stock – as they have essentially over-hedged all of those upside calls that are now at risk of expiring worthless. No one knows when a short squeeze ends, but it does eventually, and the options market again plays a major role.

With that in mind, a look at the expected moves of a sampling of these stocks shows just how how much options are pricing for future moves and how much the pendulum can shift once the short squeeze tires. Simply as an example we’ll compare 4 of these short squeeze stocks, Gamestop, AMC Entertianment, Blackberry, and Virgin Galactic.

If you want to compare these stocks directly the Options AI expected move calculator can overlay stocks to compare by expected move.

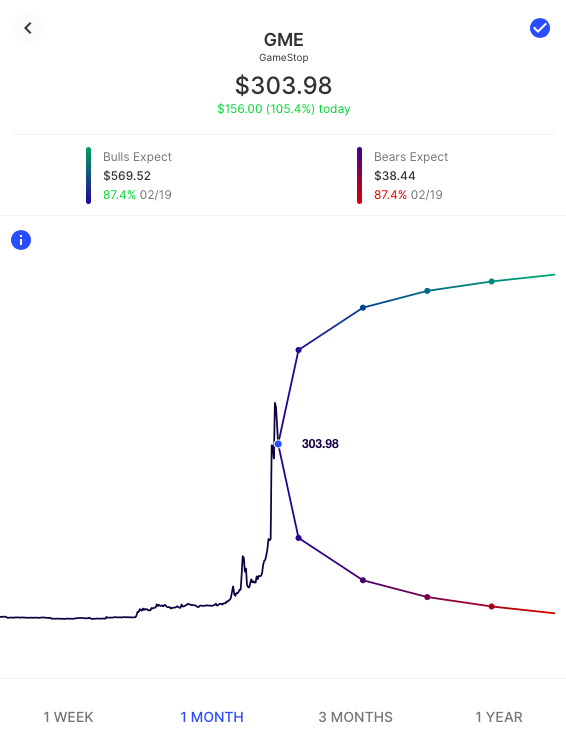

First Gamestop (GME), currently trading near $300 with an 87% expected move for the next month. That corresponds to $570 and $39 in the stock:

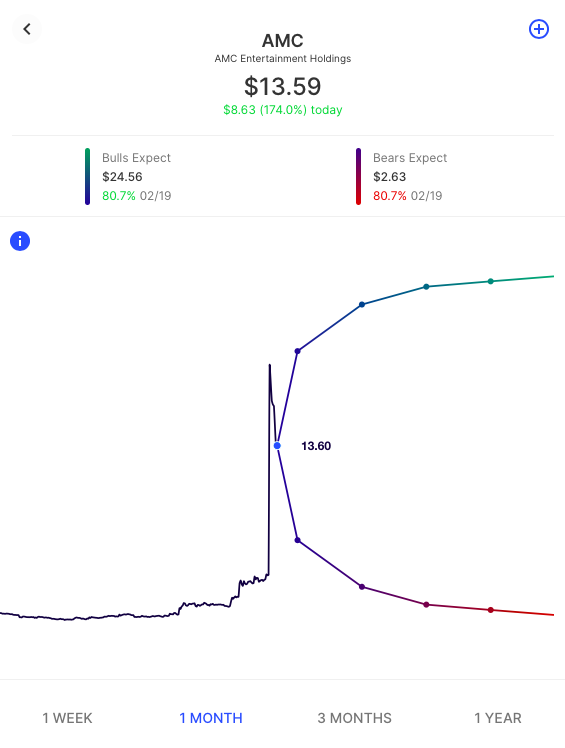

Next, AMC Entertainment (AMC) with an 80% expected move for the next month, corresponding to $25 and $3 in the stock:

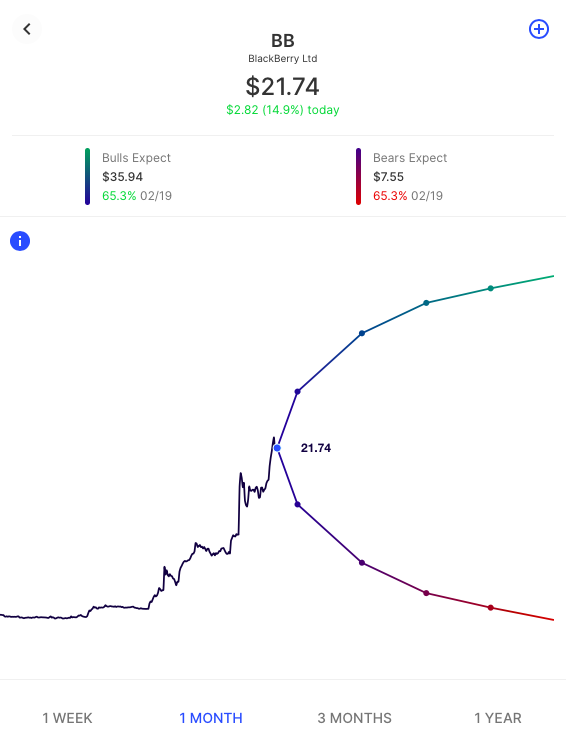

Blackberry (BB) with a 65% expected move, corresponding to $36 and $7 in the stock:

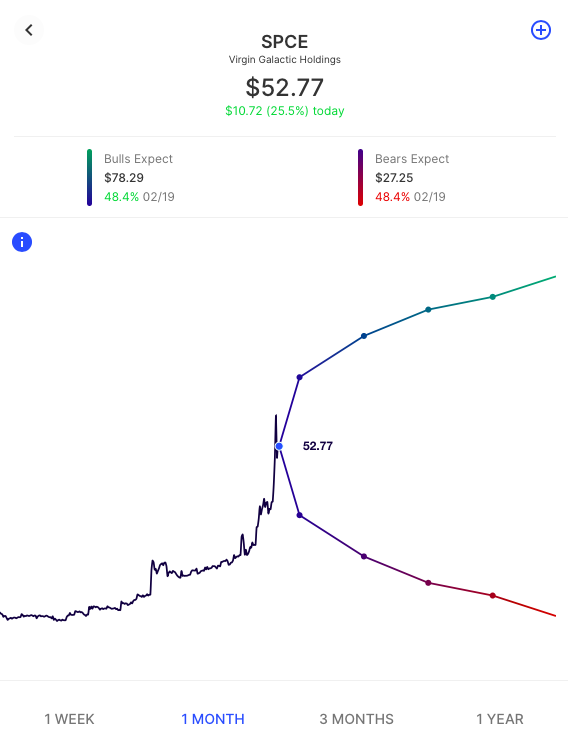

Virgin Galactic (SPCE) with a 50% expected move for the next month, corresponding to $78 and $27 in the stock:

Using Option Spreads and the Expected Move

The Options AI expected move chart helps traders visualize just how much volatility option traders are pricing into stocks like Gamestop and AMC and in what timeframe. And when the expected move is this large, it follows that buying options can be expensive. The fact that options are so expensive contributes to the eventual end of a short squeeze and traders should take into account what strategies best fit them and any new paradigm that emerges.

That’s why Options AI puts the expected move at the heart of its chart-based platform. Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading. The concepts can apply to any stock and it is simply used here in the short squeeze names for illustrative purposes.

[…] Yesterday we discussed how options contribute to a short squeeze, and also how they can contribute to its end. For more detail read here. […]

[…] Yesterday we discussed how options contribute to a short squeeze, and also how they can contribute to its end. For more detail read here. […]