With its highly-anticipated earnings call today after the bell, Tesla stock is up around 6% in the last 7 days and has weekly options pricing a further move of about 7% around the event.

As the below Options AI expected move chart shows, with the stock at ~$887 at the time of writing, this translates to an expected move of ~$950 to the upside and ~$825 to the downside:

Link: Options AI Earnings Move – TSLA

Whatever your trading view, with a high-priced stock like Tesla we’ll look at how option spreads might be used to reduce capital outlay and potentially improve probability of profits (versus buying an outright call or put). We’ll also see how the expected move itself can help guide strike selection through this process.

Please note, all trade strategies are for informational purposes only and pricing is approximate at the time of writing. They represent just a few of the many potential ways that options might be used to express a view.

Spreads to ‘Trade with the Bulls’ or ‘Sell to the Bears’

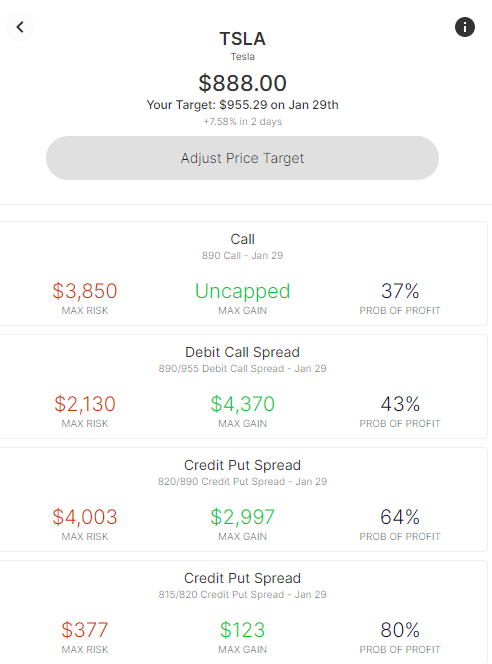

At the time of writing, with Tesla stock around $887 and a weekly TSLA 890 Call costing ~$38.50 buying the at-the-money Call involves risking approximately $3,850 to enjoy uncapped potential upside above a breakeven stock price of $928.50 (Strike Price 890 + Cost of Call 38.50).

Debit Call Spreads

Now, knowing that the options market is pricing an upside move to ~$955, let’s assume that a trader is inclined to agree with the crowd – that a move beyond $955 is indeed, less likely. In this scenario, when buying the TSLA 890 Call, one option would be to simultaneously sell a TSLA 955 Call to create a TSLA 890/955 Debit Call Spread. In this example, collecting ~$17.20 of premium for selling the Call, serves to reduce the overall cost (and risk) of the trade to ~$21.30 (lowering breakeven to $911.30 and thereby increasing probability of profit) in exchange for capping potential upside at the expected move level.

Credit Put Spreads

Now let’s turn to bullish spreads that can instead be thought of as ‘Selling to the Bears’ in order to collect premium / generate income. Firstly, selling an at-the-money TSLA 890 Put is of course a bullish strategy, but it also presents undefined risk should the stock fall significantly. With this in mind, one option would be to look at the corresponding bearish expected move level (~$820) and simultaneously buy a TSLA 820 Put to create a TSLA 820/890 Credit Put Spread. This strategy presents the benefits of knowing your maximum loss (difference between strikes, minus premium collected), as well as a higher probability of profit (as premium collected serves to lower breakeven) in exchange for a higher risk to reward ratio.

Finally, let’s explore a scenario where a trader is somewhat bullish but is still concerned with a potential downside move in the stock to the bearish expected move of ~$820. In this scenario, one option might be to sell the TSLA 820 Put while simultaneously buying an even further out-the-money Put (in this example an 815 Put) to create a TSLA 815/820 Credit Put Spread. Collecting premium (income) and being far out-the money beyond the expected move means a relatively high probability of profit, as well as the advantage of lowering the cost of participating in a stock like Tesla, but this should be balanced with an acknowledgment of the relatively high risk to reward ratio.

Let’s look at the above examples laid out side-by-side having generated bullish strategies around the expected move on the Options AI trading platform:

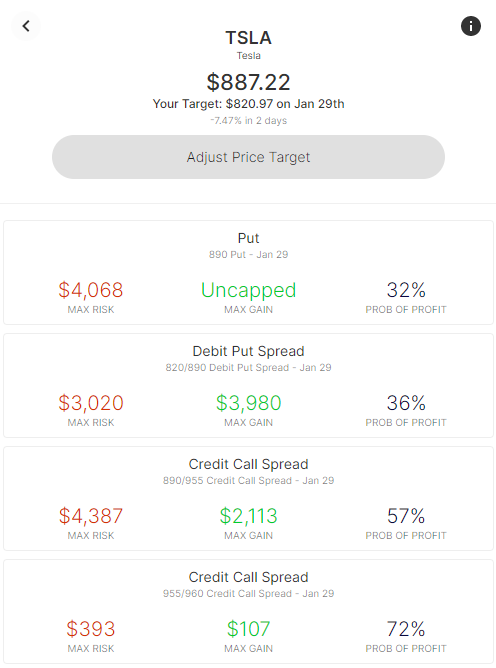

Spreads to ‘Trade with the Bears’ or ‘Sell to the Bulls’

Spread trades to express a bearish view around the expected move can be generated by inverting the methodology and thought-process outlined above. Let’s look at some examples below, starting with a base case of buying an outright TSLA 890 Put and then generating spreads around the expected move in either direction:

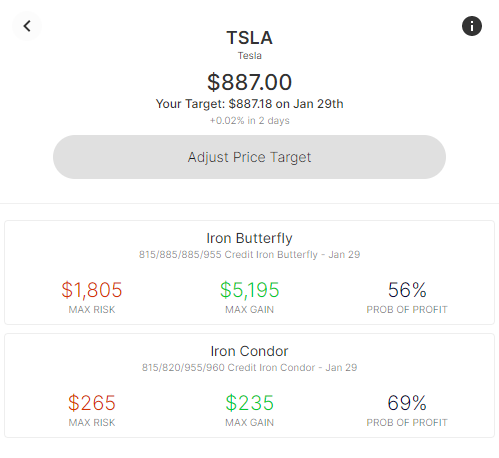

Spreads to ‘Sell to both the Bulls and the Bears’

Finally, let’s consider the scenario where you believe that the options market is overpricing the move and believe that Tesla will stay within the expected move on a given timeframe. We’ll explore two trades that ‘sell the move’:

Let’s look at an Iron Condor compared to an Iron Butterfly for this week’s expiration – two neutral strategies that seek to collect premium (income) if Tesla stays within the expected move:

And a detailed look at the range established by the Iron Condor, with max profit between 820 and 955 in the stock, and max loss beyond 815 or 960:

Summary

Remember, the above are just examples of the many ways a trader might express a view using option spreads. They are intended solely to demonstrate how the expected move can provide actionable insight to consider before making any trade, particularly into an uncertain event. Whether gut-checking your own expectations versus the options crowd, generating trade ideas from option market signals, or for more informed strike selection. That’s why Options AI puts the expected move at the heart of its chart-based platform. Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading. The concepts shown in Tesla can apply to any stock and it is simply used here for illustrative purposes.

[…] post Tesla – Earnings Preview and Trading With Spreads appeared first on Options AI: […]

[…] post Tesla – Earnings Preview and Trading With Spreads appeared first on Options AI: […]

[…] post Tesla – Earnings Preview and Trading With Spreads appeared first on Options AI: […]

[…] post Tesla – Earnings Preview and Trading With Spreads appeared first on Options AI: […]

[…] post Tesla – Earnings Preview and Trading With Spreads appeared first on Options AI: […]