The Broader Markets

Last Week – SPY closed Friday at new highs, up about 1.6% on the week. Once again, that move was beyond what options were pricing (1.1%). The outsized move higher was not enough to affect implied volatility. The VIX was down slightly on the week, closing near 16.

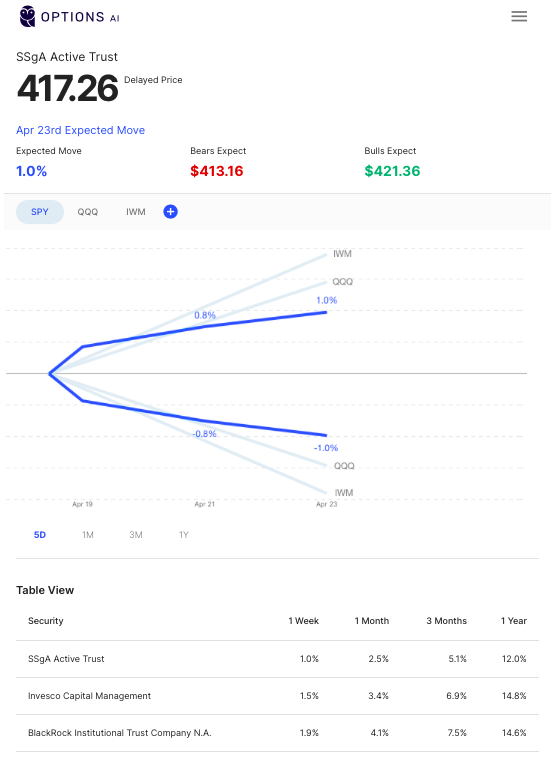

This Week – SPY options are pricing a 1% move (in either direction) for the upcoming week. That corresponds to about $413 as a bearish consensus and $421 as a bullish consensus, via Options AI.

Expected Moves for This Week (April 19th):

- SPY 1%

- QQQ 1.5%

- IWM 1.9%

Options AI provides a free expected move calculator. Here you can see SPY, QQQ and IWM relationships:

Although the current levels of implied volatility are the lowest in more than a year, they are not historically low. The VIX was 12 before the Covid sell-off in early 2020. It has spent the last few months compressing from the 30’s to where it is now and as the past several weeks have shown it is able to move in one direction (higher) beyond where options are pricing.

Earnings season heats up even more this week. Low levels of market volatility affect options pricing in individual stocks and there is always the possibility of idiosyncratic moves (on earnings misses or beats) that will be difficult for options to isolate ahead of time.

In the News

This big news of last week was the direct listing of Coinbase (COIN) shares. The stock closed the week near $340. Options in Coinbase have not been listed yet but that could happen by the end of this week.

Bitcoin itself saw some volatility over the weekend with a bit of a Flash Crash from 65k to 55k. BTC options are pricing about a 7% move for the upcoming week.

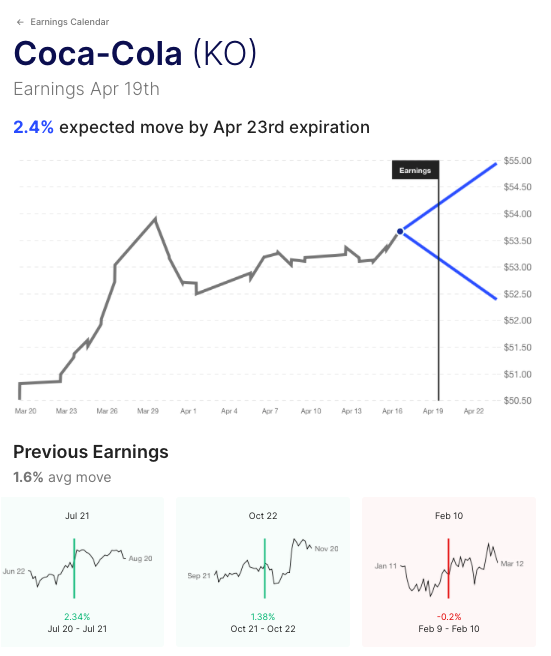

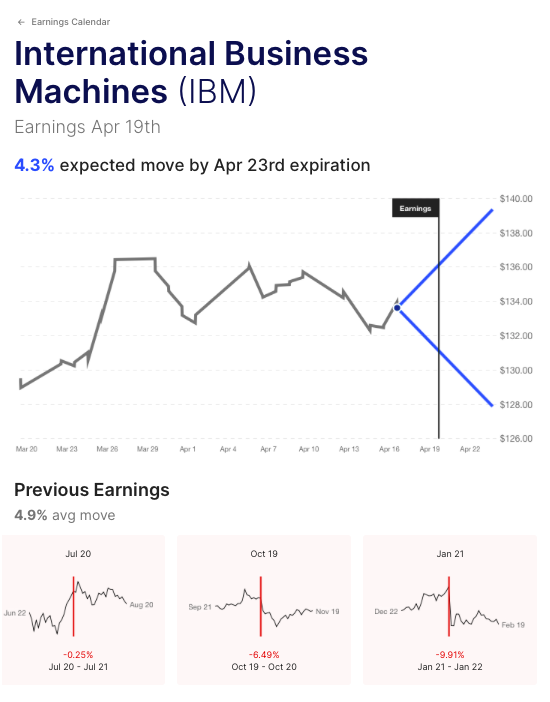

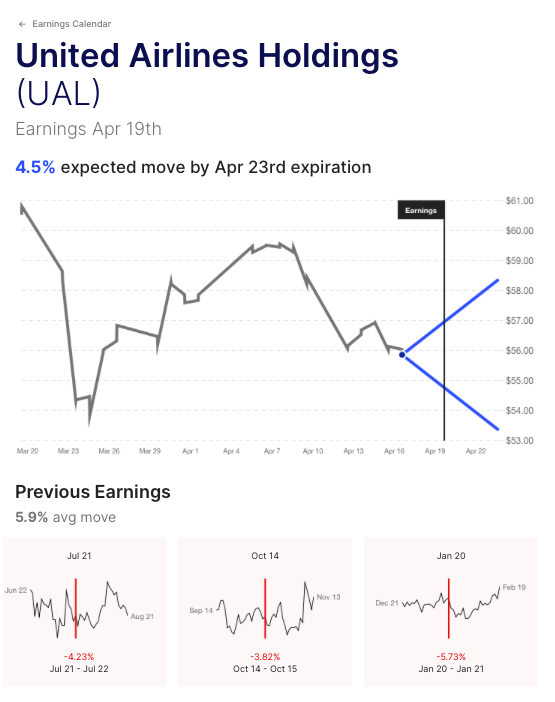

Expected Moves for Companies Reporting Earnings

The lower levels of implied volatility in the broader market coincide with earnings season. This week sees reports from IBM, Netflix, Snap, Intel, Chipotle and more.

The Options AI Earnings Calendar is a free resource to keep up to date on upcoming earnings, how options are pricing potential moves, and how that compares to actual stock moves on prior earnings events. (links below go to the stock’s expected move page):

KO / Expected Move: 2.4% / Recent moves: 0%, +1%, +2%

IBM / Expected Move: 4.3% / Recent moves: -10%, -6%, 0%

UAL / Expected Move: 4.5% / Recent moves: -6%, -4%, -4%

NFLX / Expected Move: 6.1% / Recent moves: +17%, -7%, -7%

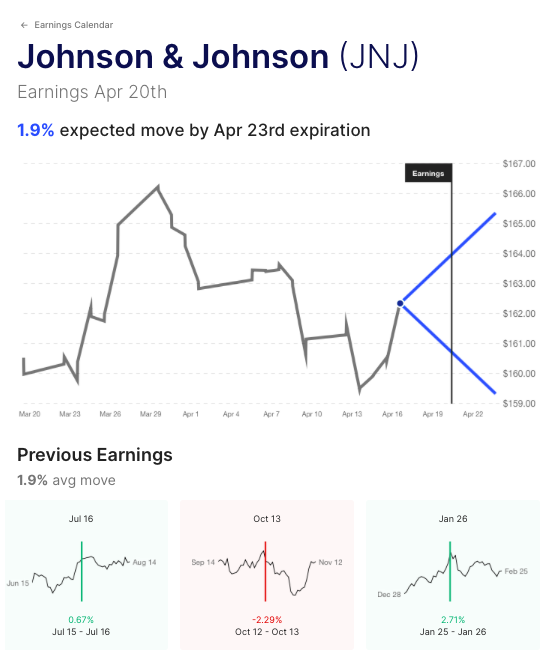

JNJ / Expected Move: 2% / Recent moves: +3%, -2%, +1%

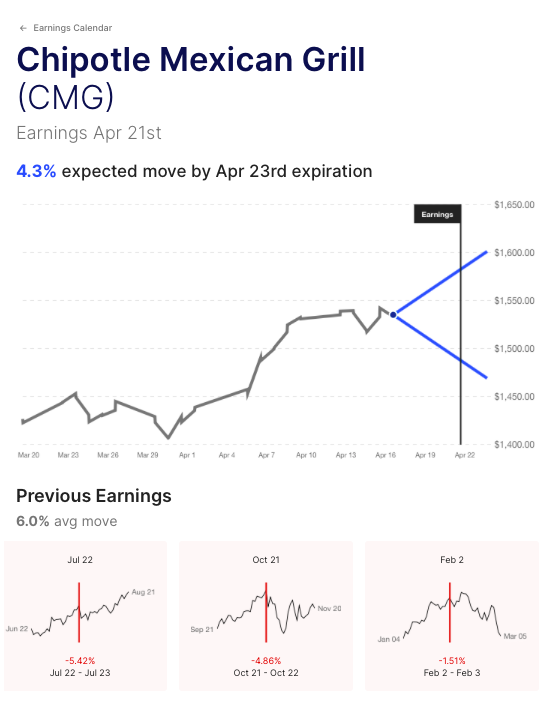

CMG / Expected Move: 4.3% / Recent moves: -2%, -5%, -5%

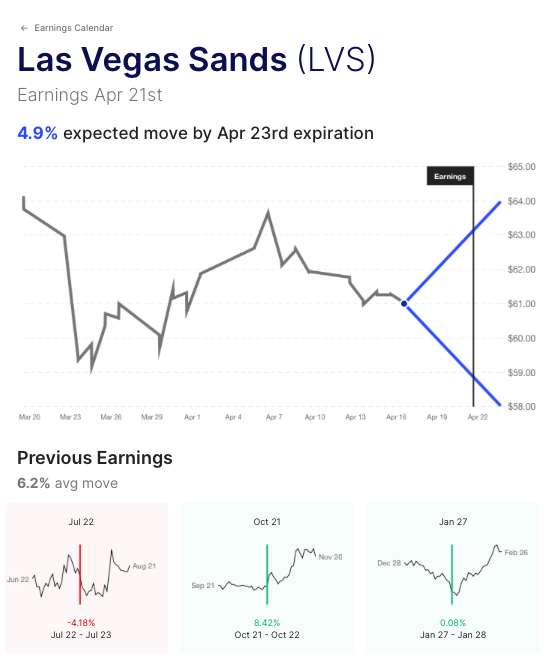

LVS / Expected Move: 5% / Recent moves: 0%, +8%, -4%

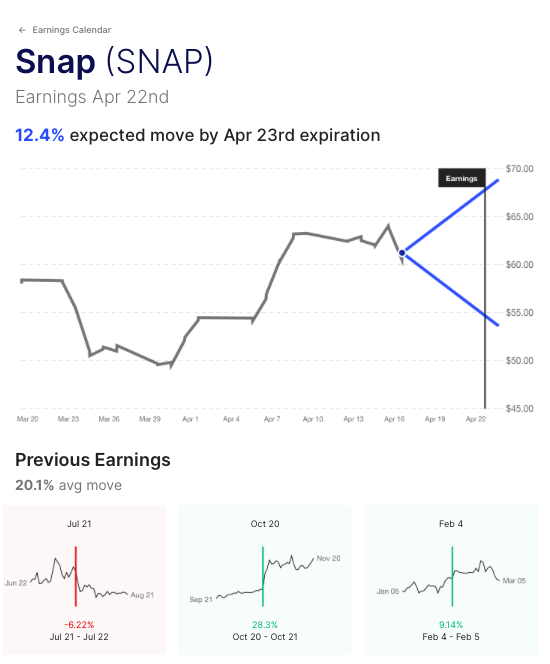

SNAP / Expected Move: 12.4% / Recent moves: +9%, +28%, -6%

INTC / Expected Move: 5% / Recent moves: -9%, -11%, -16%

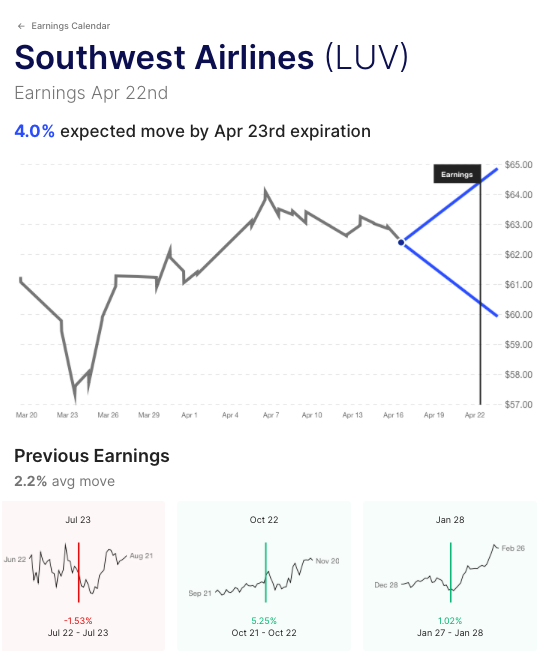

LUV / Expected Move: 4% / Recent moves: +1%, +5%, -2%

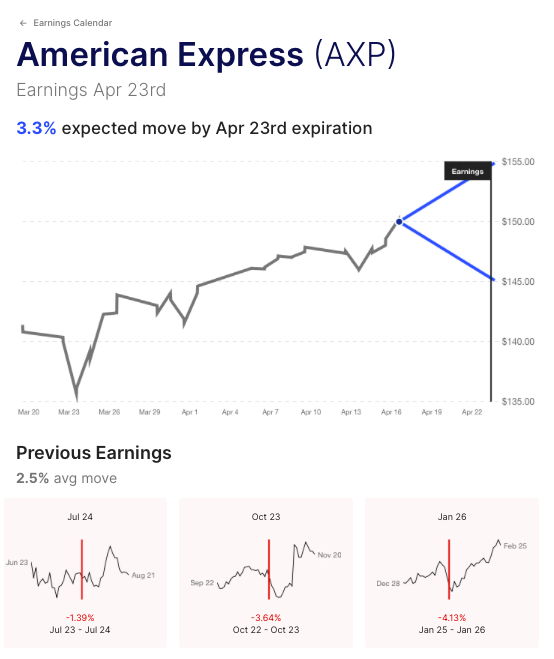

AXP / Expected Move: 3.3% / Recent moves: -4%, -4%, -1%

Options AI puts the expected move at the heart of its chart-based platform and Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC a registered broker-dealer.