Earnings and Expected Moves

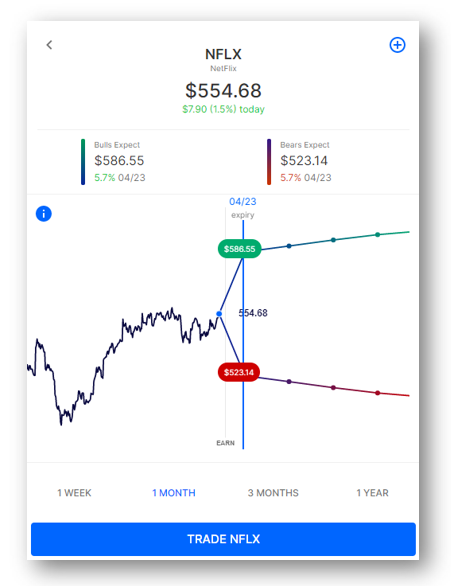

Netflix (NFLX) is the first of the FAANG stocks to report Q1 earnings, with the announcement coming after the bell today (Tuesday April 20). Weekly options are pricing an almost 6% expected move in the stock through the event.

With the stock near $555 that translates to a potential upwards move to the all-time highs of around $586 (from January) and potential downwards move to around $523, which would erode all of April’s gains.

Whether an investor agrees with either the bullish or bearish consensus, or simply thinks the options market is over-pricing the move altogether, knowing the expected move can serve as a useful gut-check before any major catalyst event.

Below, we’ll explore further how the expected move might be utilized by option traders themselves. Particularly in helping guide strike selection in strategies that seek to reduce costs in higher priced stocks at a time of elevated volatility.

Alternatives to Stock (or Calls)

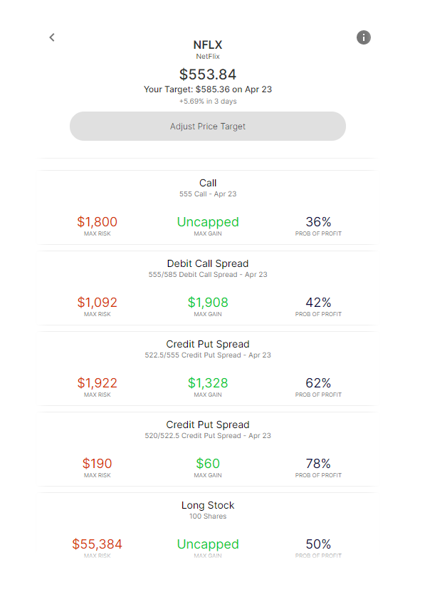

At the time of writing, buying 100 shares of stock would cost over $55k. Buying a weekly (Apr 23 expiry) $555 (at-the-money) Call costs around $18, or $1800 in premium. In order for the call to be profitable on Friday’s expiration, the stock would need to be above $573.

Now, lets take a scenario where a trader generally agrees with the 6% expected move and uses that move to guide strike selection when creating a defined risk option spread.

Using the Options AI options trading platform, we’ll look below at some alternative strategies that have been generated with the expected move guiding strike selection.

The Debit Call Spread lowers the cost of buying the at-the-money call by simultaneously selling a Call around the expected move level. In turn, this brings down the break-even level to around $566, while increasing the probability of profit and allowing for additional profits if the stock went to $585. The trader has also reduced their overall exposure to elevated volatility in the options versus an outright call. Less capital is at risk, and a lesser move higher is needed in order to at least breakeven.

Aside from the additional potential risks of option spreads (such as early assignment and liquidity), it is important to note that a spread caps potential profits (if the stock moves beyond $585). One way of looking at this is that the trader has joined the option market consensus with a view that the stock is less likely to move beyond 6% and therefore is willing to cap gains at that point.

The Credit Put Spread is another strategy to express a bullish sentiment, but in contrast, this might be thought of as ‘selling to bears’ rather than joining the bulls. Essentially mirroring the setup for a Debit Call Spread, a trader might sell an at-the-money Put option while simultaneously buying a lower-strike Put at the expected move level. In this case the trader has completely removed their exposure to elevated volatility into the event via a net credit and a breakeven below where the stock is trading.

Alternatives to Puts

If a trader is interested in positioning for a move lower in the stock, the bearish consensus can serve as a guide. Again, using the Options AI platform, with April 23rd expiry:

Hedges With a Price Target

Options AI can also generate trades based upon a user’s price target. In this example we’ll assume a trader is long shares of Netflix and wants to protect against an outsized move to the downside. A price target is placed down 12% in the stock, twice the move options are expecting (although any target could be used):

The 530/490 debit put spread is simply an example. It costs about $700 but would protect shares from around $523 down to $490. In this case the trader has used a target to hedge against a scenario where the options market gets it wrong.

Options AI provides a couple of free tools like an expected move calculator, as well as an earnings calendar with expected moves. More education on expected moves and spread trading can be found at Learn / Options AI.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC a registered broker-dealer.