Expected Moves

Earnings season kicks off in earnest this week with some of the largest financial institutions in the world reporting over the next few days. This is happening in an option volatility environment that is the lowest since the pandemic sell-off this Spring. Here’s a quick look at the moves options are pricing:

Expected Moves for the Week of April 12th:

- JP Morgan (JPM) / 2.5%

- Bank of America (BAC) / 3.1%

- Wells Fargo (WFC) / 3.4%

- Goldman Sachs (GS) / 3.1%

- Morgan Stanley (MS) / 3.3%

Options are pricing fairly similar moves in these stocks. Wells Fargo with the largest expected move and JP Morgan the least.

For stock traders, knowing the expected move can provide a useful gut-check when coming into uncertain events like earnings. It can also offer insight when managing risk associated with existing positions.

For option traders it can also help inform strike selection – whether trading directionally, hedging a stock position or when looking to create income/overlay strategies.

On Friday we highlighted and compared two short premium strategies against long stock – the covered call and the Iron Condor.

Using The Expected Move To Create Bullish Spreads

Using Bank of America (BAC) as an example, we can see how the expected move might be used to help guide strike selection on option spreads – both debit and credit. We can also see how option spreads might be used to help reduce capital outlay and potentially improve probability of profits (versus buying outright calls or puts).

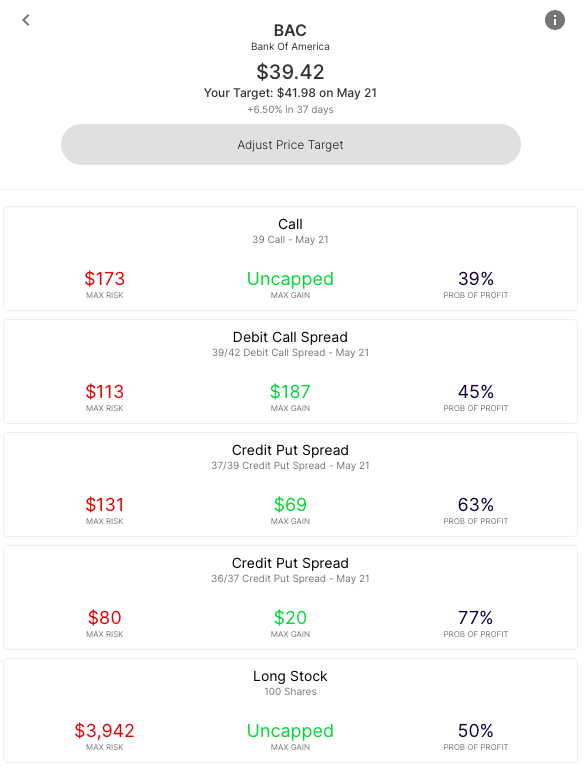

With BAC trading near $39.40, the expected move for earnings is about 3%. If a trader did not want to simply position for earnings, but wanted to look forward a few weeks, they can look out to May 21st expiration to generate spreads, both debit and credit and then compare those to outright calls and stock. Here’s an example with a bullish target, in line with the expected move for May 21st (6.4%), via Options AI:

Trades based on that move:

As one can see, the max risk/cost of each option strategy is significantly less than the stock equivalent of owning 100 shares. An outright 39 call would cost about $173 and has unlimited upside potential. However, it needs the stock above 40.73 on May 21st just to be profitable.

The 39/42 debit call spread reduces the cost (in comparison to the 39 call.) It caps potential gains (at 42 in the stock), but in so doing lowers the breakeven in the trade to 40.13, and therefore increases the probability of profit, from 39% to 45%.

Finally, we see two credit put spreads. These strategies can be thought of as being bullish by selling to the bears. The 39/37 credit put spread looks to collect up to $69 if the stock is at or above 38.31 on May 21st. It collects the entire $69 if the stock is above 39 on that date. The spread risks up to $131 to do so. If the stock is below 37 on May 21st, the entire $131 is lost.

The 37/36 credit put spread risks $80 to make up to $20. This trade only needs BAC above 37 on May 21st, but if the stock is below 36, it would lose $80.

How any of these strategies do is dependent on the stock itself. But they offer investors and traders options beyond stock or simple calls.

Using the Expected Move to Create Bearish Spreads

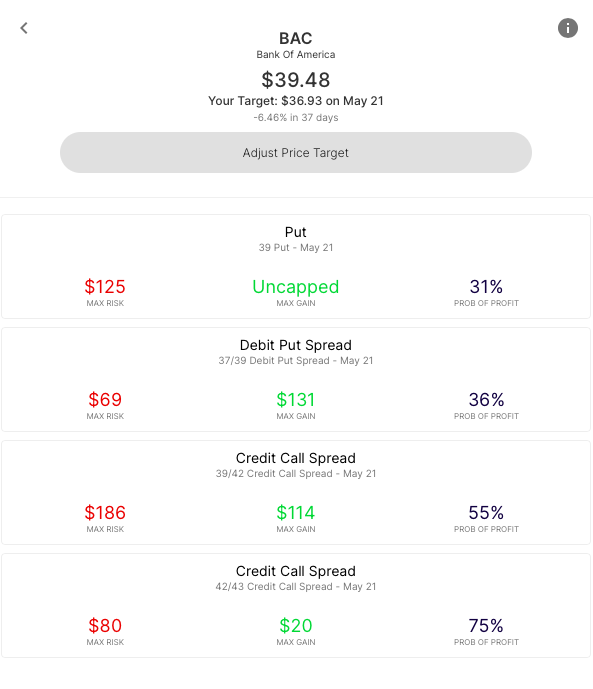

Traders can also use the expected move to create bearish spreads. These trade types can be used either outright, or against stock as a hedge or potential income strategy.

Here’s an example, again using a May 21st expiration in BAC:

And the trades generated based on that move:

Once again we can see an outright option, and several spreads. For those already long the stock, some of the spreads can be used to hedge into an earnings event, or even to potentially add income to the position.

For example, the 42/43 credit call spread risks $80 to make up to $20 if the stock is at or below $42 on May 21st. A more aggressive version of that trade type is show in the 39/42 credit call spread. In both cases if the stock went higher, through the short strikes, the positions would risk losing money versus any gains via the trader’s long stock. However, if the stock went lower, or even sideways, both trades would allow the traders to collect premium, and lower their cost basis in the stock.

The 39/37 debit put spread could be used as a hedge, potentially giving up $69 if the stock does indeed go higher over the next month.

Options AI puts the expected move at the heart of its chart-based platform and Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading.

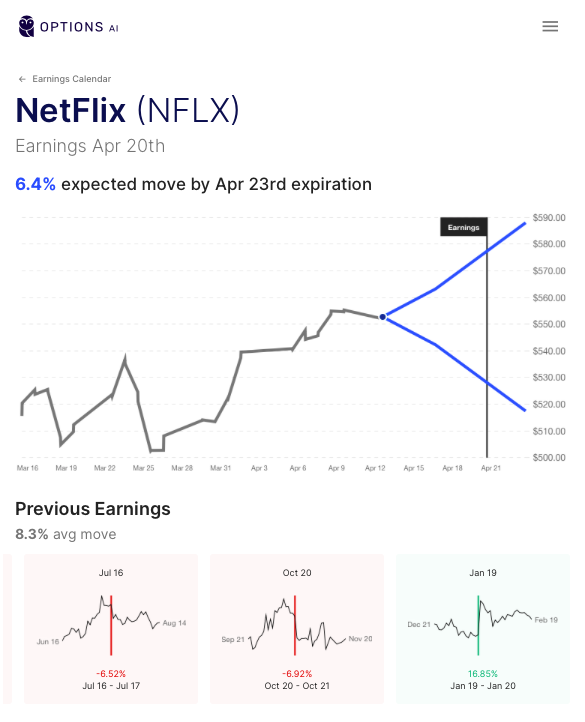

Here’s a peek ahead to next week and Netflix earnings, via Options AI’s earnings calendar:

NFLX / Expected Move: 7% / Recent moves: +17%, -7%, -7%

Please note, any stocks and/or trading strategies referenced are for informational and educational purposes only and should in no way be construed as recommendations. The strategies depicted represent just a few of the many potential ways that options might be used to express any particular view. All prices are approximate at the time of writing. Option spreads involve additional risks that should be fully understood prior to investing.