Market View

Last Week – No Santa Clause Rally, but stocks were steady the past 2 weeks.

SPY closed flat on the week, for the second straight week. The two weeks of holiday trading couldn’t muster a year-end rally but the market did bounce 1.5% from its lows of the week. The final damage for 2022 looked like this: The S&P 500 was down about 20%, the Dow was lower by about 9% and the Nasdaq was the worst of the major indices, down about 33%. The VIX closed the week around 21.5, a slight uptick from the prior week.

This Week – 2023 positioning begins.

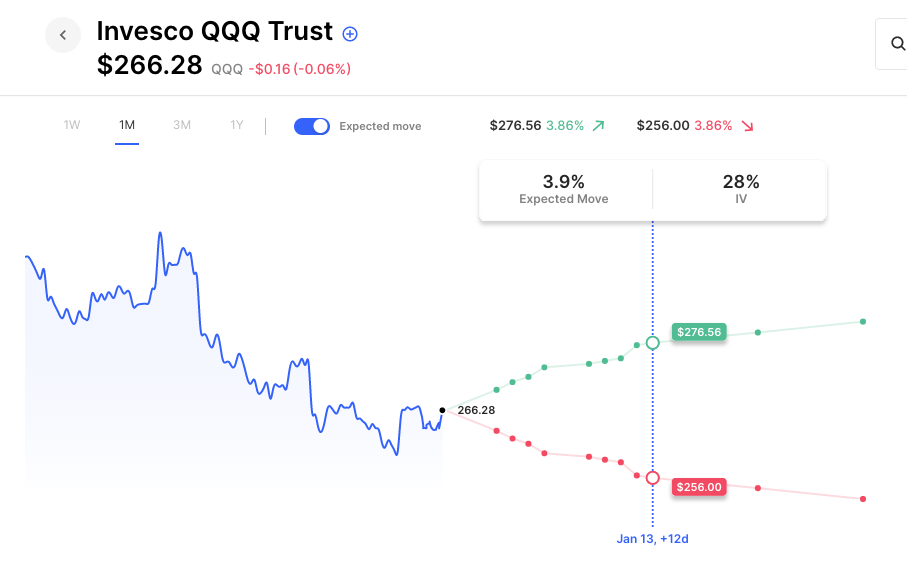

SPY options are pricing a 1.9% move for the upcoming 4 day trading week. The earnings calendar is light this week but the first few days of the calendar year could see some volatility from start of year positioning. The economic calendar starts to pick up this week with Non-Farm Payrolls on Friday, and the market-moving CPI report on January 12th. Mid-January also sees the beginning of earnings season. Illustrative of the uncertainty in mid to late January, QQQ IV is in the low 20’s for the next week but jumps to near 30 around Jan 12th. You can see that spike in vol on the expected move chart below:

Expected Moves for This Week (via Options AI free tools)

- SPY 1.9%

- QQQ 2.5%

- IWM 2.2%

- DIA 1.7%

Economic Calendar

- Wednesday – ISM Manufacturing, FOMC Minutes

- Thursday – ADP Employment

- Friday – Non-Farm Payrolls, ISM Services

In the News: Record Put Call Ratio, What’s Going On?

There were multiple headlines the past few weeks highlighting record high Put/Call Ratio (PCR) and how this is a signal that investors are growing increasingly bearish into 2023. This may be so, but institutional traders know that there may be other things going on too.

Put Call Ratio is the number of Put options traded divided by the number of Call options traded for a given period of time. A PCR of 1 means the number of buyers of Calls is the same as the number of buyers of Puts. Over the past few weeks, the market has seen days with a PCR above 2.0

So what’s going on?

Not only are we in a bearish market with investors growing more cautious, but we are also seeing higher interest rates for the first time in years. These higher interest rates mean there is now a more significant cost to carrying long stock positions and therefore to the pricing of options contracts (rho). This is combined with the fact, a down-market has left large open interest in now deep in-the-money Put options.

This allows professional traders to target a specific type of arbitrage opportunity. To target Puts in high open interest contracts as part of a zero delta spread and then to early exercise those Puts.

To explain, here’s an example of how this might work: Two traders target deep ITM , high open interest put strikes by crossing a 0 delta put spread (buying a 100 delta put, while selling a 100 delta put as a net zero delta put spread) with each other (for the max value of that spread). The traders then early exercise the long puts on their spreads. But because assignment does not happen directly with eachother, but rather assignments are given out randomly on a wheel to all those that are short that strike, the professionals will only be assigned on part of their spread. That leaves them with a short stock vs long 100 delta put, and an arb between the carrying cost of the put, and the rebate from the short stock.

What does this mean for me?

Firstly, from a markets perspective, the volume associated with this professional arbitrage activity means that the PCR may be somewhat distorted as an indicator at the moment.

Secondly, but more importantly, everyday investors should be aware of this activity, since the options they have sold may have a higher chance of being assigned. To explain, let’s take an example.

You have sold 10 contracts of a Credit Put Spread in XYZ stock. The stock price falls below both the short and long strike of the spread, implying that the spread may expire at maximum loss. However, prior to expiration, the 10 short Put contracts are early assigned. This means that the original spread of -10 Puts / +10 Puts transforms into a +1,000 shares / long 10 Puts position.

The position still has defined risk, so there is no immediate cause for alarm. But, the position now contains a key change. Your account must now have sufficient funds to own 1,000 shares of the underlying stock. If your account does not have sufficient funds to own the stock position, you will likely face a margin call that is due on the stock settlement date (2 business days after the assignment). In other words, your brokerage will request that you post sufficient funds. If you cover the margin call, you might carry the position. If you don’t, either you or your brokerage will want to immediately close the position.

If you don’t meet the margin call by posting sufficient funds, you still have several options, closing the position, or exercising the long option.

But, in a high-interest rate environment, another factor enters the frame. Even if you exercise the long Put to flatten the stock position, or if you sell the assigned stock, settlement of the exercise (or stock sale) is also 2 business days. Since you are reacting to an assignment that took place the previous day, there will always be at least one business day where you will need to borrow funds to carry the long stock position. Worse, the settlement mismatch may occur over a weekend, meaning you must now borrow funds for 3 business days. And, even worse, there might be a holiday too, meaning you must unavoidably borrow funds for 4 days.

In a low-interest-rate environment, borrowing money is obviously relatively cheap. You may not even notice the interest charge applied by the clearing broker, relative to the original known maximum loss of the trade. But, in a new high-interest rate environment, this can suddenly change. If a 10 contract assignment translates into 1,000 shares of stock worth $300,000, and despite immediately closing the position, your settlement straddles a holiday weekend, you could end up with 4 days of interest at say, 8%. That’s over $250 in interest that would need to be factored in, on top of the original maximum loss of the spread.

The new reality is, in this market of higher interest rates, early assignment on deep-in-the-money options will happen more often.

So, with all this said, what can traders do to adapt? There are ways to help to avoid the borrowing costs of an early assignment. More active trade management often holds the key. Regular scanning of both winners and losers that have moved deeper in-the-money and might be prone to assignment. Taking both winners and losers off sooner by closing positions earlier.

A good rule of thumb is to look for positions that are at or near 100 deltas on both the long and short strikes. Closing those positions when they are at or near max loss, or max gain, before they have the chance to be early assigned.

Earnings This Week

Very few earnings reports this week. Things start to heat back up the second week of January.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.

3animus