Market View

Last Week – Traders were still on edge from the week before.

SPY finished flat on the week but it wasn’t a straight line as it traded in about a 3% range. Options had been pricing about a 2% move for the week. The last batch of important economic data triggered some nervousness about future Fed hikes as jobs and GDP remained strong. That’s typically a good thing for markets, but in a bizarro world of recent market rallies being dependent on deflationary data, good can be bad for stocks. 2 and 10 year treasury yields were higher on the week, continuing a trend since early December.

The VIX closed the week under 21, lower that the week before. Implied vol in options for this week is very low, with market participants clearly expecting light volumes and smaller moves. SPY vol is 14 for this Friday and jumps to 20 for January monthlies. QQQ vol is 20 for this Friday and jumps to 25 for Jan monthlies.

This Week – Quiet on earnings and economic data

SPY options are pricing a 1.5% move for the upcoming 4 day trading week. Next week is another 3 day weekend as the New Years’ market holiday will be observed Jan 2nd. The economic and earnings calendar are both light this week

Checking in on markets year to date, the Nasdaq composite is the most beaten up index, down about 33%. The S&P 500 is down about 20%, the Russell 2000 is down 22% and the Dow is lower by about 10%. It’s been a bad year for most equities, but a really bad one for tech in particular.

Expected Moves for This Week (via Options AI free tools)

- SPY 1.5%

- QQQ 2%

- IWM 1.8%

- DIA 1.2%

Economic Calendar

- Tuesday – Housing prices

- Wednesday – Pending Home Sales

In the News

2022 has been a brutal year for Tesla shareholders and things have been particularly ugly since Elon Musk took over Twitter. The stock is down 45% since the Twitter deal closed. It’s down 60% since its 3-for-1 stock split in August and down 65% for the year. The downward stock trend is not happening in isolation though. It’s one of the worst-performing car stocks and gets the headlines because of the added Musk drama, as well as being included in a large-cap tech rout. But for comparison, GM stock is down 42% on the year and Ford is lower by 45%. So clearly the entire sector is suffering from a post-pandemic reckoning. Tesla’s price compression is happening from much greater heights, and as Reuters, pointed out this morning, Teslas are hitting the used car market faster, and remaining on lots longer than other car competitors at the moment, putting pricing pressure on new vehicles as well.

As if often the case in Tesla stock it has been particularly volatile day to day. Last week saw a 10%+ move lower in a single day. This morning the stock has traded down by more than 5% pre-market. With those day-to-day moves implied volatility has increased, with the stock’s 30 day IV rank near 100, indicating high relative IV.

For those looking to catch a falling knife with the hopes that 2023 starts off better than 2022 ended, or those looking to continue to press it from the short side, strikes based on the expected move can be helpful to reduce premium exposure. The expected move for February 17th is about a $25 move in either direction. As mentioned, outright calls or puts are relatively expensive because of high IV, but debit spreads to the expected move can reduce the premium outlay and actually create breakevens fairly close to where the stock is trading

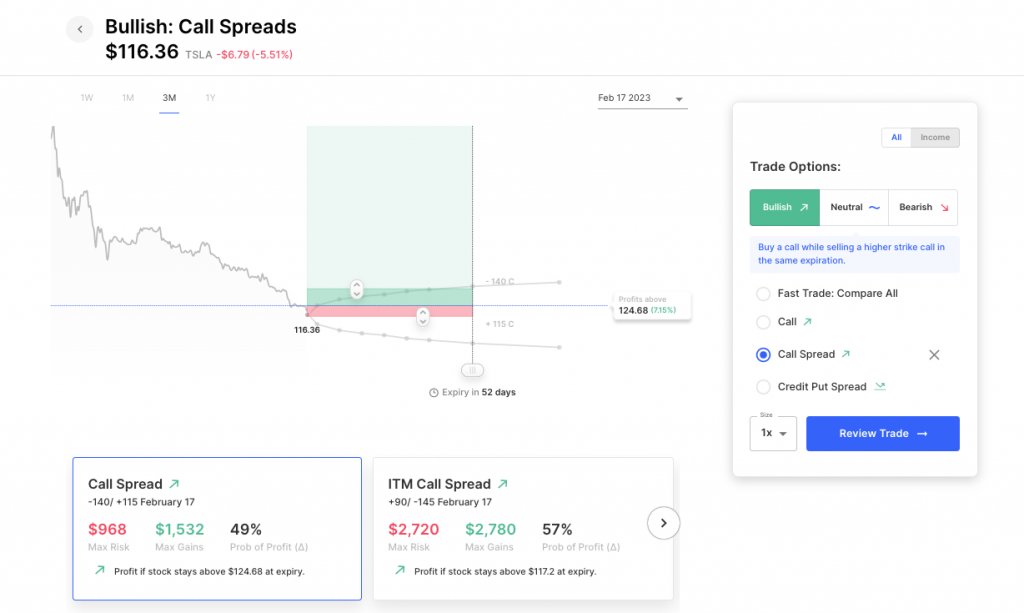

Let’s start from the long side. With the stock around 116, the Feb 115/140 call spread is about $10. The breakeven on the trade (about $125) is lower than where the stock was trading last week:

Choosing a spot to enter from the long side in a stock that’s been as ugly as Tesla recently is difficult enough, using a debit call spread to express that view at least creates a more realistic breakeven than buying calls outright.

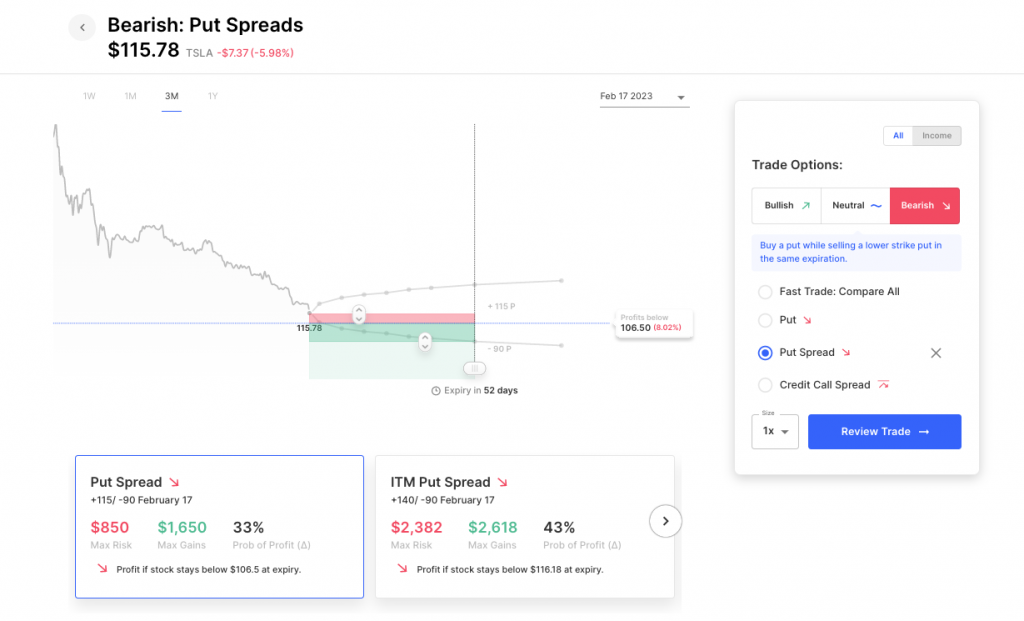

And the same is true from the short side. The stock’s RSI is 20, indicating very oversold conditions near term. But a put spread, in lieu of an outright put reduces the premium at risk to continue to press the stock at oversold levels. The +115/-90 is about $9 as well. Creating a very close breakeven in the stock, and setting up for the potential of up to $16 in profits if the stock is at or below $90 by February expiry:

Earnings This Week

Very few earnings reports the next two weeks. Things start to heat back up the second week of January as the banks report and then big tech begin the second week of January (with Tesla and more) and the third week of January sees names like Apple.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.