Option hedging strategies are used by investors to reduce their exposure to risk, protecting against a decline in anything from an individual stock to an entire...

The Latest

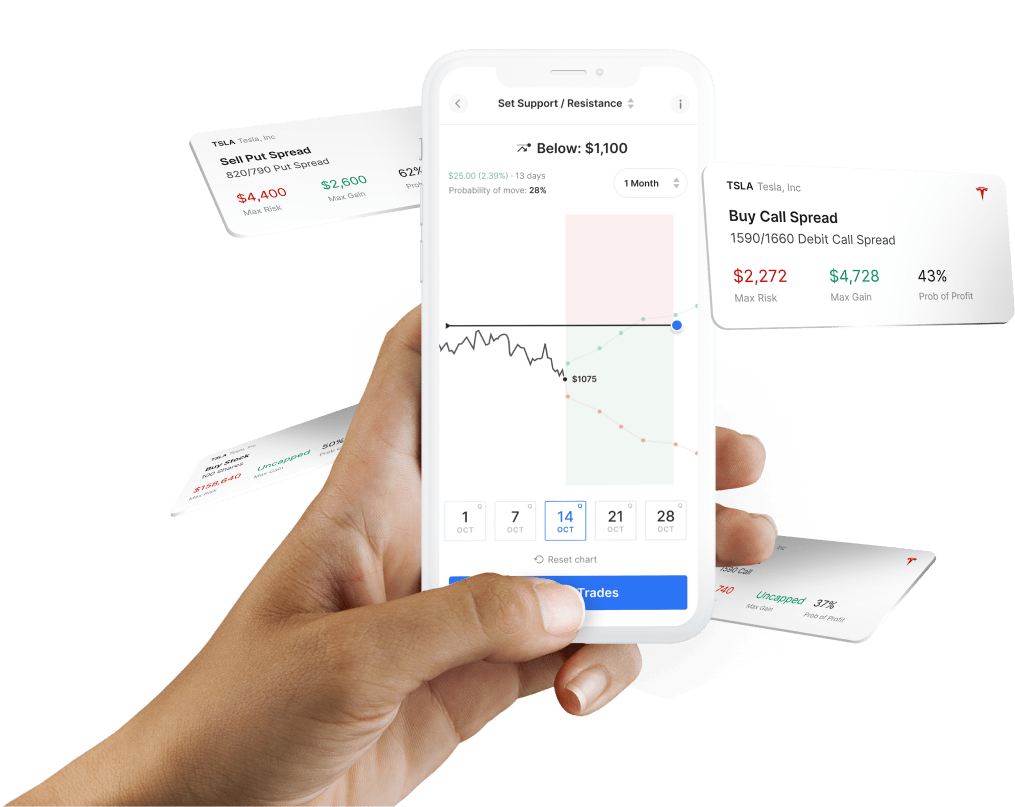

A vertical credit spread is an option strategy that consists of the sale of one option and the purchase of a second option with a different strike price in the same...

A vertical debit spread is an option strategy that involves buying one strike (call or put) while simultaneously selling another strike (in the same...

Regular assignment/exercise – The settlement price of an option is the official closing price at the end of the day on its expiry. The closing price of the stock...

The time value of an option refers to the additional premium (or extrinsic value) of an option beyond its intrinsic value. An easy way to think about time value is that...

The expiration date is the last day that an option contract or contracts (in the case of a spread) are valid. On or before this day investors should decide what to do...

Stay in the loop

Be the first to hear product announcements and get daily market content from The Orbit.