A vertical credit spread is an option strategy that consists of the sale of one option and the purchase of a second option with a different strike price in the same expiry (both calls or both puts). The seller of the spread is looking for the price (the initial credit received) to decrease while taking on the risk that the price increases. It can be used to express either a bullish or bearish directional view but can also profit with a sideways move in the stock as the time value of the credit decays.

An easy way to think about a credit spread is you are being bullish, by selling a put spread to the bears, or you are being bearish, by selling a call spread to the bulls.

For example with stock XYZ trading 100:

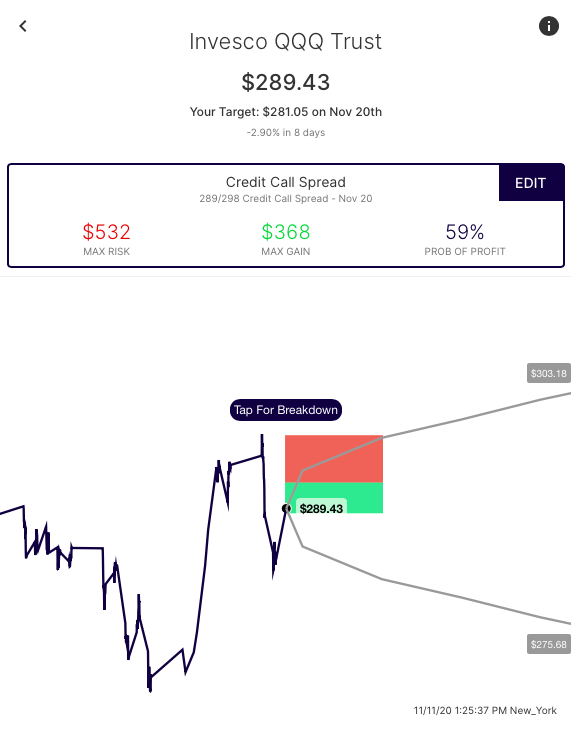

(Bearish) Credit Call Spread – A trader sells the 100 strike call at $5.00 and buys a 105 call for $3.00. They receive a net credit of $2.00. The resulting position would be risking $3.00, to make up to $2.00. The breakeven on the trade is $102 (100 strike + 2.00). At expiry they would see profits below $102 and losses above. The trade has a max gain of the stock expires at or below $100, and a max loss if the stock expires at or above $105.

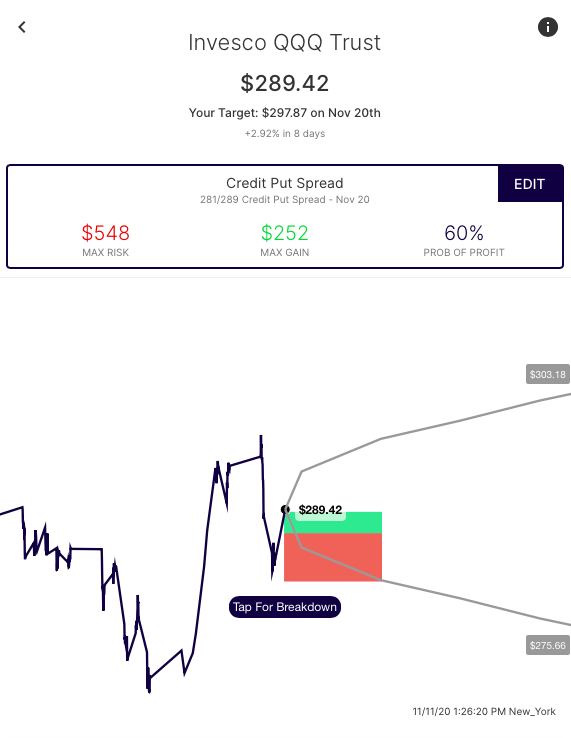

(Bullish) Credit Put Spread – A trader sells the 100 put at $5.00 and buys the 95 put for $3.00. They receive a net credit of $2.00. They risk $3.00 for a potential $2.00 reward on the $5 wide spread. Max gain occurs if the stock is above 100 on expiration, max loss below 95 and a breakeven on the trade at $98 (100 strike – $2.00) with gains above and losses below.

With a credit spread, the trader is the seller to the buyer of the debit spread. In the above examples, risking 3 to make 2, the buyer on the other side of the spread is risking 2 to make up to 3, but with a worse probability of profit as they need the stock to move past their breakeven.

Here’s an example, comparing a visual of a credit call spread (bearish) and credit put spread (bullish) side by side: