Option hedging strategies are used by investors to reduce their exposure to risk, protecting against a decline in anything from an individual stock to an entire portfolio. Hedging strategies typically require a debit to be paid if allowing for unlimited upside in the investment, but can also cap upside at a credit or cap upside and protect downside, defining risk in both directions, at little or no cost.

An easy way to think about hedging is it can define risk in a stock position, allowing an investor to hold onto positions through near term uncertainty. The amount of money set aside to hedge should be much less than what one hopes to make in the underlying itself over time.

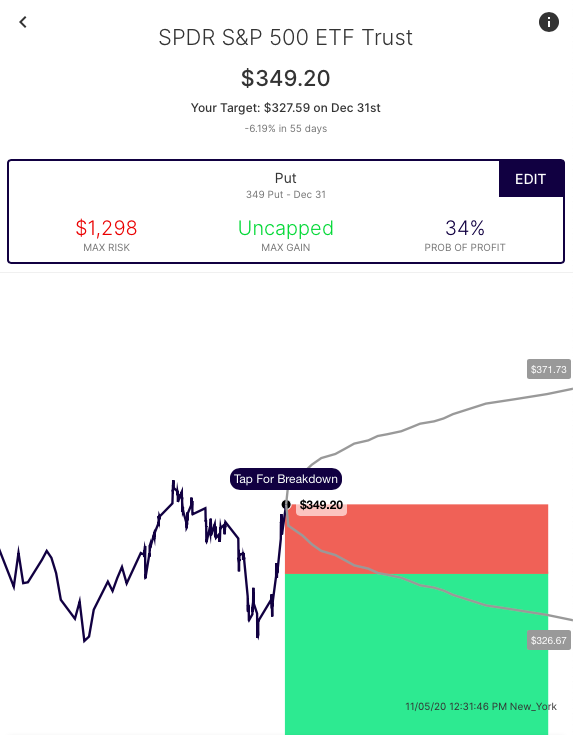

The simplest example of a hedge is a simple put purchase, with the debit paid subtracted from the cost basis of the investment. This establishes protection to zero below its breakeven.

Example: XYZ stock is trading $100. A trader buys the 100 put for $5. They now have protection below $95 in the stock (95 is the breakeven of that put, 100 – $5). The $5 debit counts against the cost basis in the original investment. Loss still occur in the stock for the first $5 lower, but are hedged below 95 in the stock.

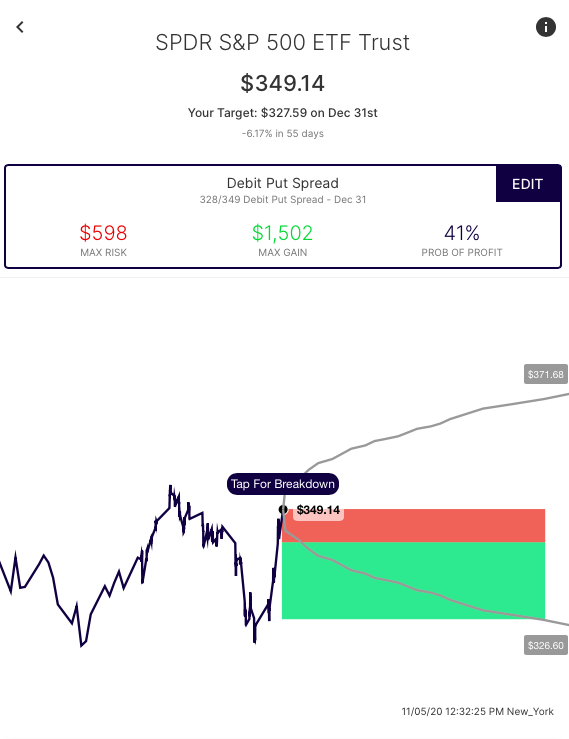

To lessen the debit paid, the trader may look to hedge a defined range, and establish a debit put spread. For instance, with XYZ trading $100, they could buy the 100/90 put spread, paying $5 for the 100 put and selling the 90 put at $1. That lowers the debit paid for the hedge to $4. Protection begins closer to the stock price, with. breakeven for the hedge at $96 rather than $95 with the outright put. But the hedge ends below the 90 strike, with any losses in the investment below 90, unprotected.

Using SPY as an example here’s a visual representation of an outright put versus a put spread to the expected move. Note the different costs associated with each trade and the protection levels (in green).