Big tech is set to report this week amidst a backdrop of already volatile markets. Whether you’re looking to trade an earnings view or looking to protect an existing position, we’ll cover some things to look out for and how spreads can sometimes make a smart alternative when using options.

1. Know the Expected Move

The Expected Move is a great place to start. It’s the magnitude of move that the options market is pricing – similar to a point spread in a football game.

Knowing the Expected Move can help gut-check your strategy. An investor who already owns a stock might view the Expected Move as presenting excessive risk and choose to hedge a position. A directional trader may think the Expected Move is under-priced and elect to buy options. An income trader may view the Expected Move as overstated and look to sell options to collect premium.

Irrespective of your view and particularly during these periods of higher volatility, Option Spreads can provide an alternative to buying (or selling) individual Calls or Puts.

Below, we’ll compare some trade examples, highlight things to watch out for and demonstrate how these trades can be clearly visualized using the Options AI platform. But first, via the Options AI Earnings Calendar here are the expected moves for the tech giants reporting this week. The list also shows the actual moves on the past 4 earnings dates:

- Microsoft / Expected Move: 5.1% / Prior moves: +3%, +4%, 0%, -3%

- Alphabet / Expected Move: 6.3% / Prior moves: +8%, +5%, +3%, +3

- Meta / Expected Move: 10.6% / Recent moves: -26%, -4%, -4%, -4%

- Apple / Expected Move: 4.6% / Recent moves: +7%, -2%, -1%, 0%

- Amazon / Expected Move: 5.7% / Recent moves: +14%, -2%, -8%, 0%

2. Watch out for a Vol Crush (and how Spreads can help).

Calls and Puts are often expensive into earnings given demand and uncertainty. In other words, higher volatility is priced into options and this is compounded by increased demand from options traders. Once earnings have passed, Calls and Puts tend to quickly contract to more ‘normal’ pricing. Traders call that a vol crush. It can be so severe that a trader may get the direction of the stock move right, but still not realize a profit on their options.

It follows that with elevated volatility (higher pricing) comes increased Breakeven levels for buyers of Calls and Puts. During these periods, an option buyer needs a larger stock move than normal to achieve a gain. Worse, a trader can be correct on direction and still not realize a gain due to the vol crush after the report.

At Options AI, we believe that having a clear picture of Breakeven levels and the associated Profit and Loss zones isn’t just important before executing a trade, it can simplify finding the right trade.

Let’s first look at how Spreads can reduce capital at risk and thereby reduce Breakeven levels for option buyers. Taking the example of a trader with a bullish view in Microsoft (though the principles remain the same for a bearish view) we’ll compare buying a Call to buying a Call Spread.

The first chart represents buying a 280 Call, while the second chart represents buying the same 280 Call and simultaneously selling a 295 Call to create a Call Spread. You may notice that this higher strike call is being sold at or near the Expected Move level (at the time of writing). This can be viewed as a Trader being bullish, but believing a move upwards beyond the Expected Move is less likely, so is willing to cap gains at that level in return for reduced capital outlay.

In this example, simply buying the Call creates a Breakeven level of $288.78. The trader needs the stock to be above this level (in the green profit zone) at expiration to realize a profit. In comparison, the green zone for the Call Spread begins at $286.08. That’s $2.70 lower and well below the Expected Move. That’s also approximately $270 in premium not at risk on a post-earnings vol crush or if the trader is wrong on direction.

3. You’re Bullish? Think about selling to the Bears.

We’ve discussed how elevated option prices combined with a potential ‘vol crush’, can make it tricky to trade a directional earnings view. So what about selling those expensive options to other traders and collecting the income (options premium) instead? In the next example, we’ll look at how a bullish AAPL trader might “sell to the bears”.

Firstly, we know that selling naked (unhedged) Calls or Puts can be a risky proposition as the Max Loss can be unlimited (or not ‘defined’). This is why we will again look to Spreads to create a defined risk position.

Whereas a bearish trader might look to buy a Put Spread (for a ‘Debit’), a bullish trader might look to actually sell that Put Spread to the bear and instead collect a ‘Credit’ as upfront income.

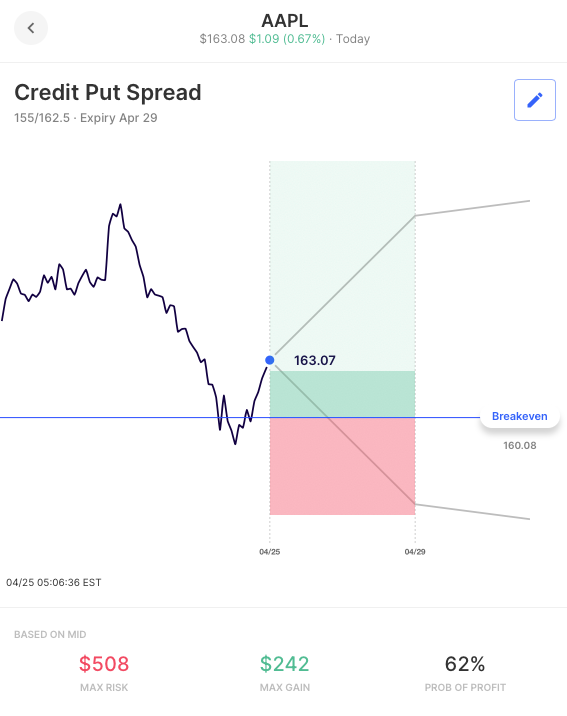

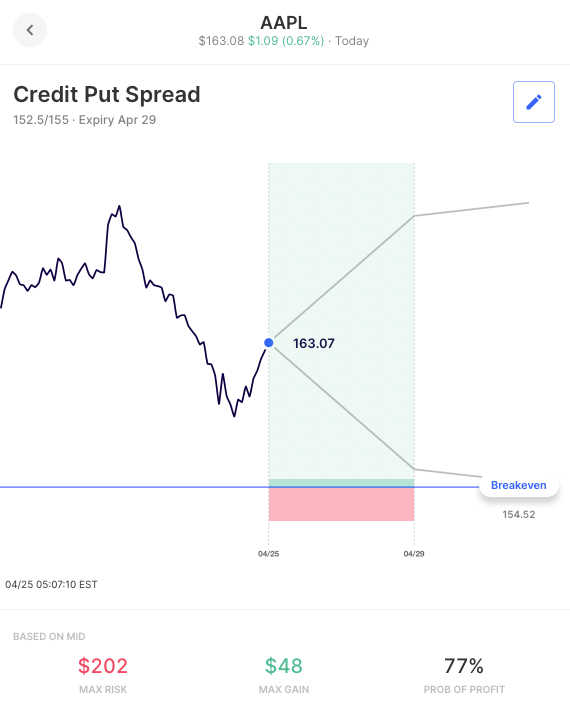

Here, we compare two potential Credit Put Spreads in AAPL. The first sells an at-the-money 162.50 Put while simultaneously buying a 155 Put (guided by the prevailing Expected Move level). The second, an out-the-money Credit Put Spread, instead uses the Expected Move to guide the sale of a 155 Put while simultaneously buying a 152.50 Put, one strike below.

These examples show trade-offs in terms of Risk, Reward and Probability of Profit (delta), but two things should be apparent: Firstly, a Put Spread seller is looking for AAPL to stay above the Breakeven level, which is below where the stock is trading. Secondly, the profit zone (green), as well as the Max Profit zone (light green) span a relatively wide portion of the overall Expected Move. Put simply, the Credit Put Spread trader needs a lot less to happen to realize a profit, relative to his or her Debit Put Spread counterpart.

Of course with options, there are always trade-offs. In general with Credit Spreads, the trade-off for enjoying lower Breakevens and higher Probability of Profit, is that the Risk to Reward ratios are increased. Comparing the two Credit Put Spread examples above, this can be exemplified further. The out-the-money Credit Put Spread, with the largest profit zone, has an approximately 4:1 Risk/Reward ratio, while the at-the-money Put Spread is closer to 2:1.

4. You’re Bearish? Think about selling to the Bulls.

Everything outlined above for Credit Put Spreads can be turned on its head and applied to Credit Call Spreads. The following shows an example of an out-the-money Credit Call Spread in Meta, where the Expected Move has again been used to guide the short strike. Here, the stock can move up, down or sideways for the trader to realize Max Gain – anything but an outsized move to the upside.

5. Want to fade the move entirely. Think about selling to both Bulls & Bears

For traders who believe the Expected Move is overstated and/or that a ‘vol crush’ will quickly bring down option prices, one available strategy is to combine the Credit Call and Credit Put Spread – creating an Iron Condor.

In the example below, we look at an Iron Condor in Alphabet, where both a Put Spread and a Call Spread have been sold, using the Expected Move to guide the short strike level. The result is a profit zone that spans the entire Expected Move. The trader is looking for the stock to do anything but make an unexpected, outsized move and for option prices to quickly contract after the event.

Options AI is Visual Trading.

Options AI is designed to make option spreads intuitive and straightforward. Set your profit zone and let Options AI do the legwork by generating spreads straight from a chart.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.