Earnings season kicks off with some of the large financial stocks reporting Friday before the open. We’ll look at the expected moves for JP Morgan, Wells Fargo and Citigroup and spread strike selection based on those expected moves.

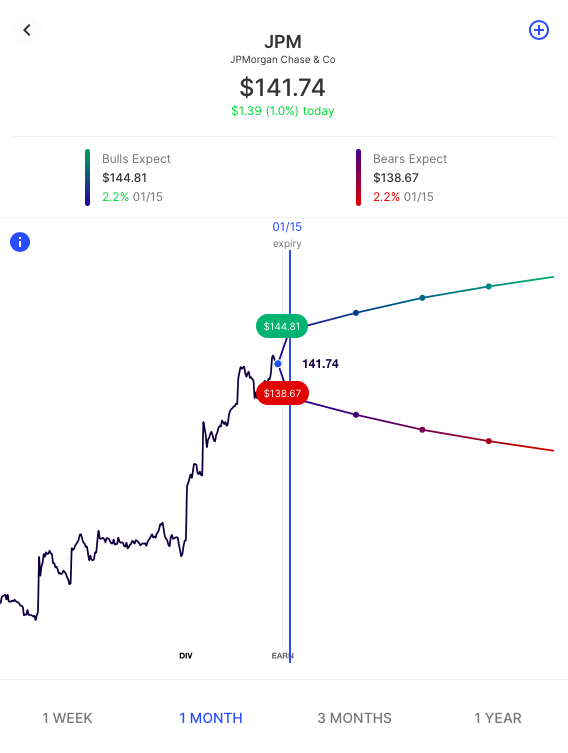

JP Morgan – Friday (BMO)

With JPM stock near $142 the expected move by Friday’s close is about 2.2%. Bullish consensus is around $145 and the bearish consensus near $138.50:

Citigroup – Friday (BMO)

With C stock near $169 the expected move by Friday’s close is about 3.1%. Bullish consensus is around $71 and the bearish consensus near $66.50:

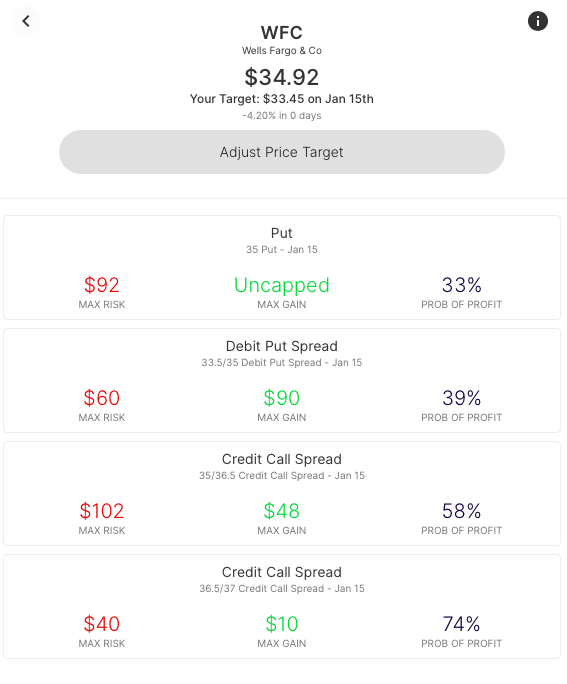

Wells Fargo – Friday (BMO)

With WFC stock near $35 the expected move by Friday’s close is about 4.3%. Bullish consensus is around $36.25 and the bearish consensus near $33.25:

What is the Expected Move?

The expected move is the amount that options traders believe a stock price will move up or down. It can serve as a quick way to cut through the noise and see where real-money option traders are pricing the future of a stock. On Options AI, it is calculated using real-time option prices and displayed on a chart.

Knowing this consensus before making a trade can be incredibly powerful, regardless of whether you’re using stock or options to make your trade. A helping hand with setting more informed price targets as well as a useful basis for starting strike selection.

Wells Fargo – Using the Move for Income Generating Strategies

First, we’ll look at a neutral view and income-generating trades, using Wells Fargo as an example. This is “selling the move” to both bulls and bears. A view that both buyers of calls and buyers of puts are over-estimating the size of the expected move. Premium (or income) received from selling options is kept if the stock stays within a range. Here’s a look at an iron condor and iron fly:

In this example, the +33.5p/-35p/-35c/+36.5 Iron Butterfly targets a specific area, $35 in the stock. Profits trail off in either direction.

Whereas the +33p/-33.5p/-36.5c/+37c Iron Condor example targets a range, with max gain constant between 33.50 and 36.50 in the stock.

The neutral trade you choose might depend on the specificity of your view – is it targeting a particular price target (Butterfly), or simply selling the move (Condor). Here’s a closer look at the risk/reward involved with both strategies:

Wells Fargo Directional Trading – Bullish

Using a bullish price target, we can directly compare a few spread trades also based around the expected move, a debit call spread to the bullish consensus, and a credit put spread, to the bearish consensus, as well as an out of the money credit put spread, at the bearish expected move :

Here’s a closer look at the comparison:

Each trade incorporates the expected move for strike selection. The Debit Call Spread can be seen as ‘trading with the bulls’ whereas the Credit Put Spread examples may be seen as ‘selling to the bears’.

Note that a far out-of-the-money Credit Put spread has the highest Probability of Profit (likelihood of the stock expiring higher than the breakeven level) but it also presents a relatively high risk to reward ratio.

Wells Fargo Directional Trading – Bearish

The same concepts apply to spreads to the bearish expected move:

Summary

The expected move can provide actionable insight to consider before making any trade, particularly into an uncertain event. Whether gut-checking your own expectations versus the options crowd, generating trade ideas from option market signals, or for more informed strike selection. Learn / Options AI has a couple of free tools including an earnings calendar with expected moves – be sure to bookmark and share.