The Broader Markets

Last Week – SPY closed slightly higher on the week but below its intra-week highs. The VIX closed higher on the week, up to 18.60 from 17.

This Week – SPY options are pricing a 1.2% move (in either direction) for the upcoming week. That corresponds to about $412 as a bearish consensus and $422 as a bullish consensus.

Expected Moves for This Week via Options AI:

- SPY 1.1%

- QQQ 1.6%

- IWM 2.2%

QQQ vol (and expected move) is slightly less than last week with the earnings reports from Apple, Facebook, Amazon, Microsoft and Alphabet now out of the way. Options AI provides a free expected move calculator that allows you to compare expected moves on the same chart.

Expected Moves for Companies Reporting Earnings

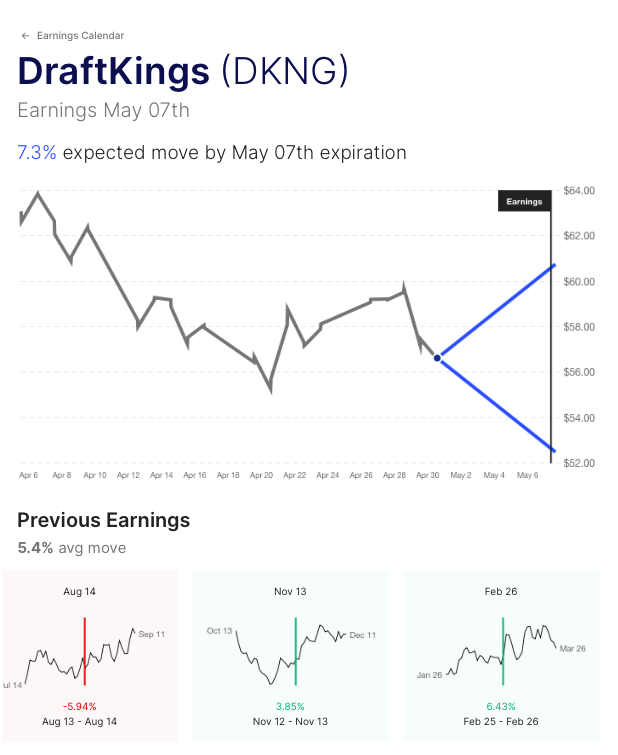

Following one of the biggest weeks of the earnings season that saw much of FAANG report, this week sees some smaller cap in the news stocks like Draftkings, Moderna, AMC, Viacom and Rocket.

The Options AI Earnings Calendar is a free resource to keep up to date on upcoming earnings, how options are pricing potential moves, and how that compares to actual stock moves on prior earnings events (starting with most recent). Here is a look for at this week (links go to the Options AI Calendar / Expected move page):

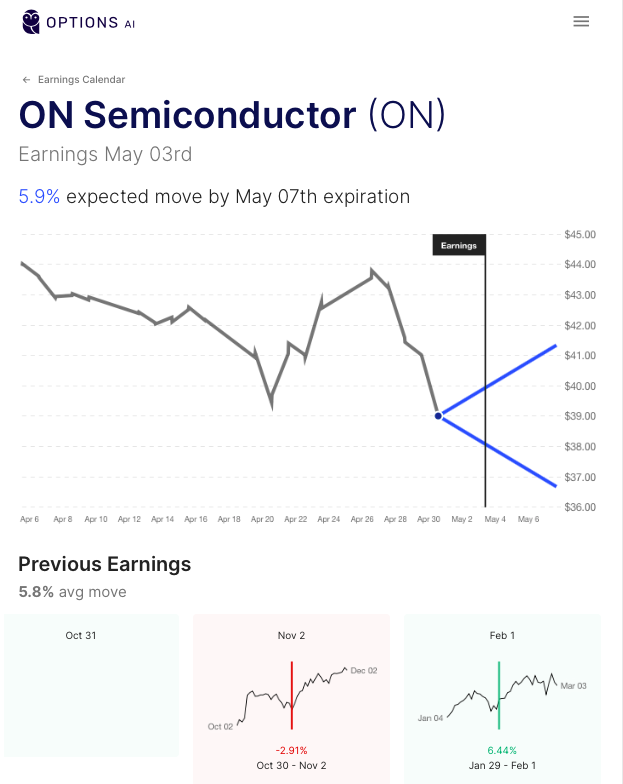

ON Semi ON / Expected Move: 6% / Recent moves: +6%, -3%

Pfizer PFE / Expected Move: 3% / Recent moves: -2%, -1%, +4%

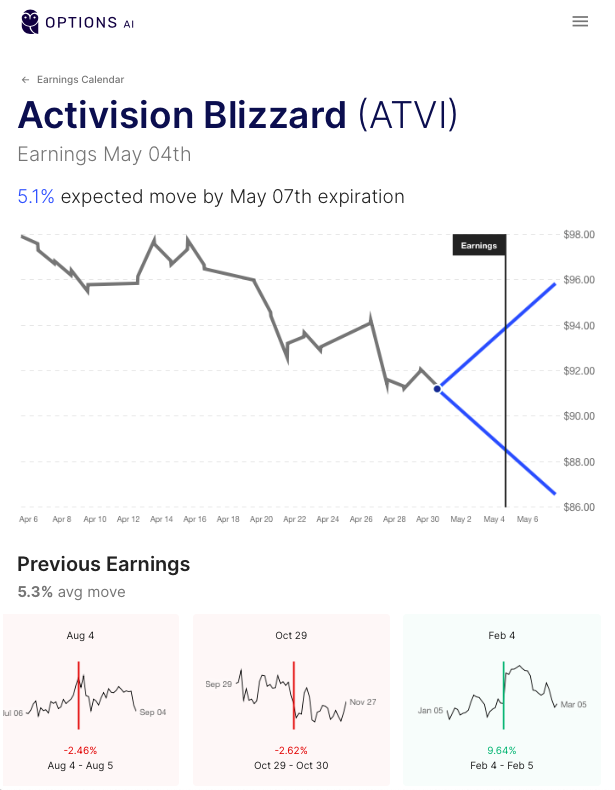

Activision Blizzard ATVI / Expected Move: 5% / Recent moves: +10%, -3%, -2%

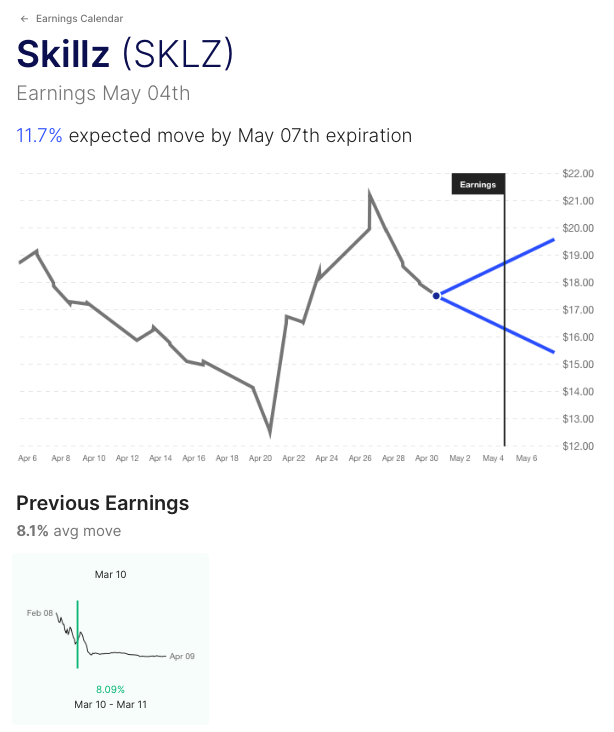

Skillz SKLZ / Expected Move: 12% / Recent moves: +8%

Zillow Z / Expected Move: 10% / Recent moves: +18%, +14%, +12%

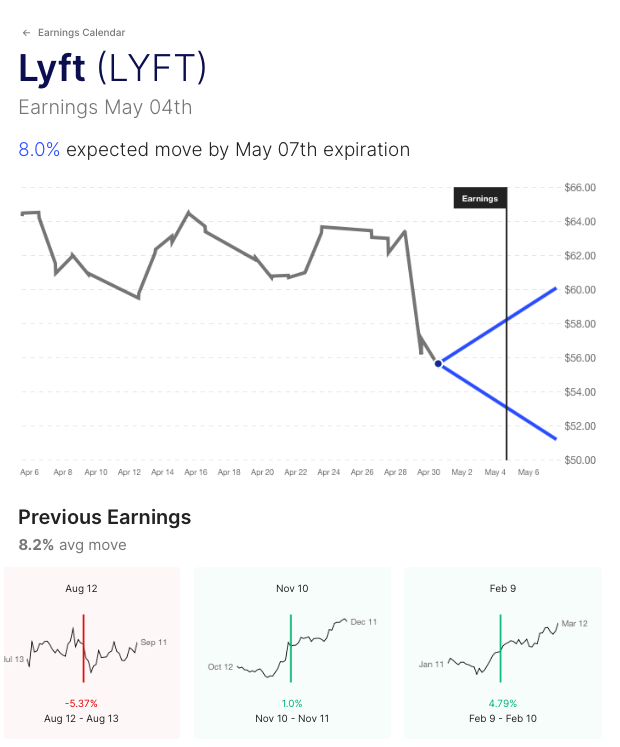

Lyft LYFT / Expected Move: 8% / Recent moves: +5%, +1%, -5%

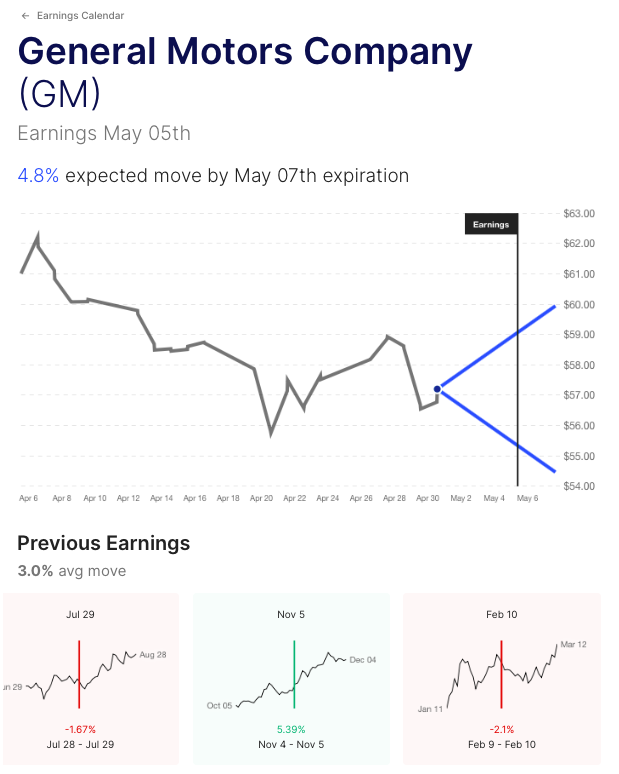

General Motors GM / Expected Move: 5% / Recent moves: -2%, +5%, -2%

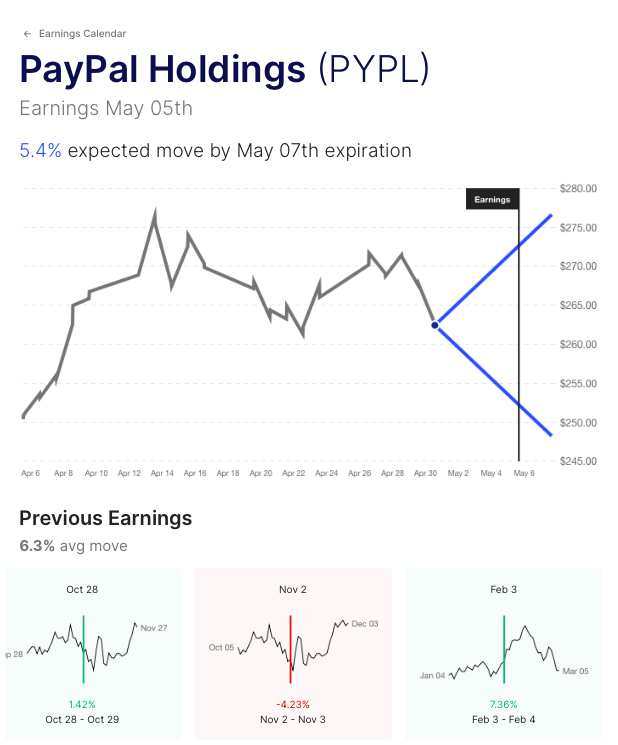

Paypal PYPL / Expected Move: 5% / Recent moves: +7%, -4%, +4%

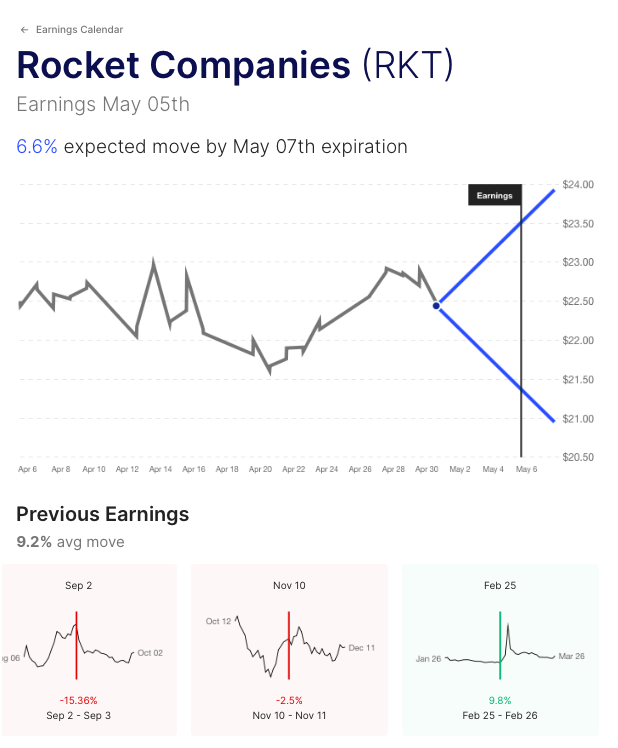

Rocket RKT / Expected Move: 7% / Recent moves: +10%, -3%, -15%

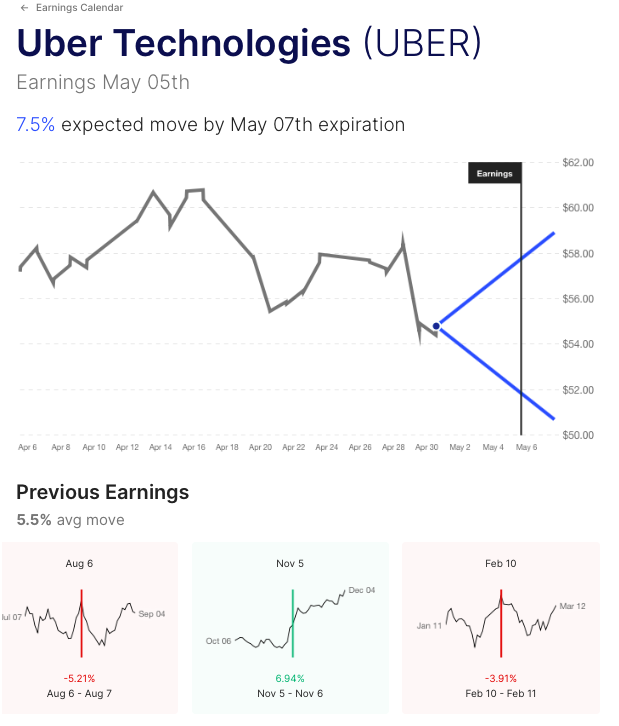

Uber UBER / Expected Move: 8% / Recent moves: -4%, +7%, -5%

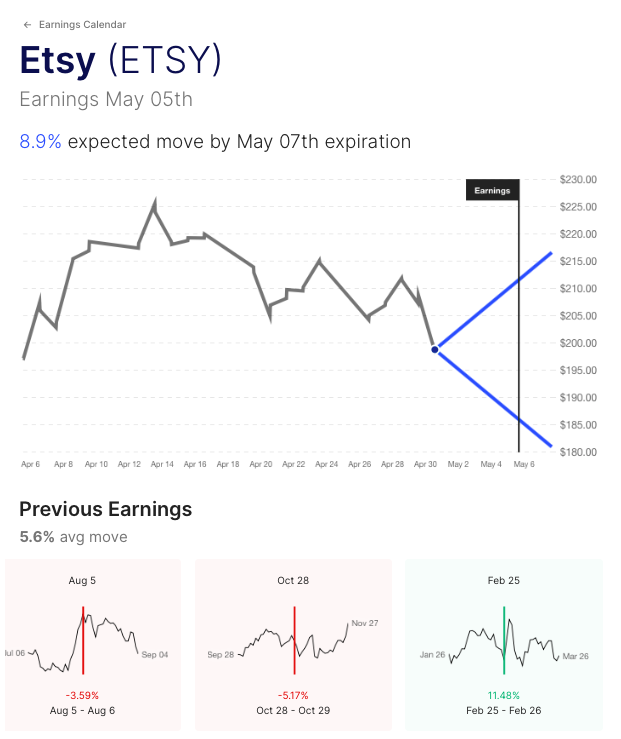

Etsy ETSY / Expected Move: 9% / Recent moves: +11%, -5%, -4%

Twilio TWLO / Expected Move: 8% / Recent moves: +8%, -5%, -2%

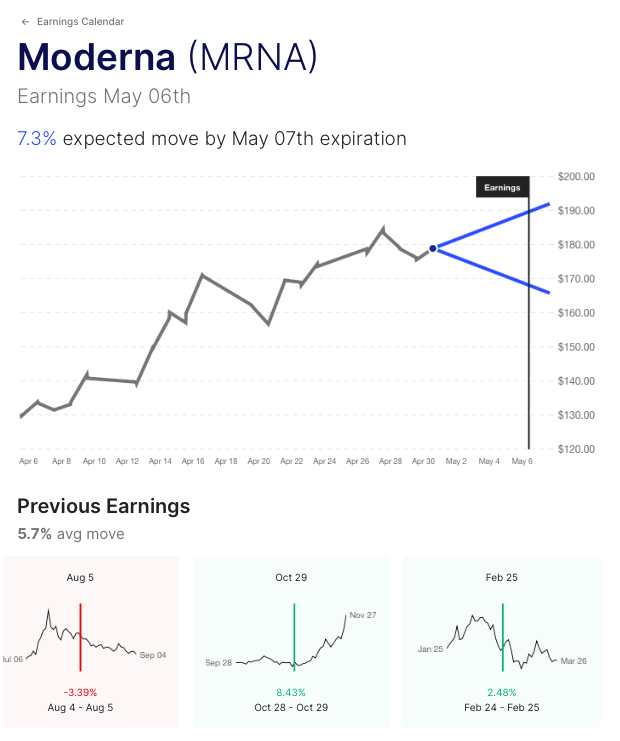

Moderna MRNA / Expected Move: 7% / Recent moves: +2%, +8%, -3%

Viacom VIAC / Expected Move: 7% / Recent moves: -5%, -6%, +3%

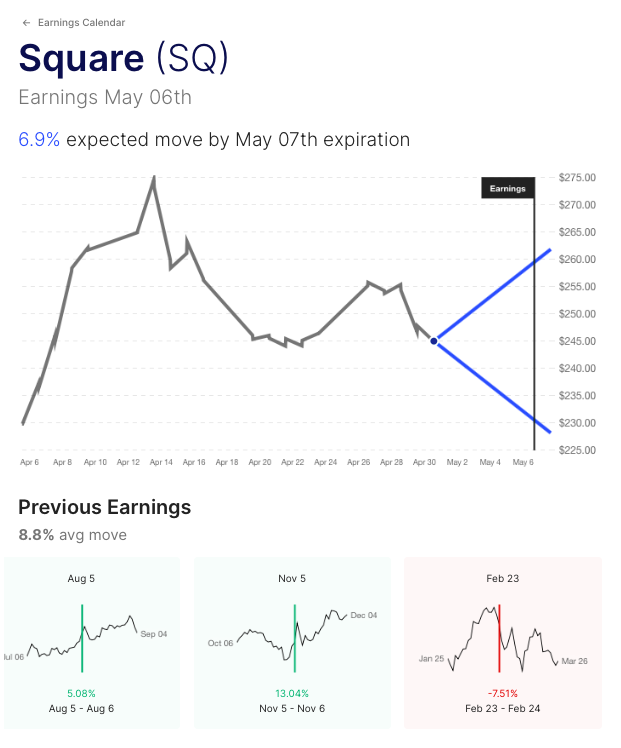

Square SQ / Expected Move: 7% / Recent moves: -8%, +13%, +5%

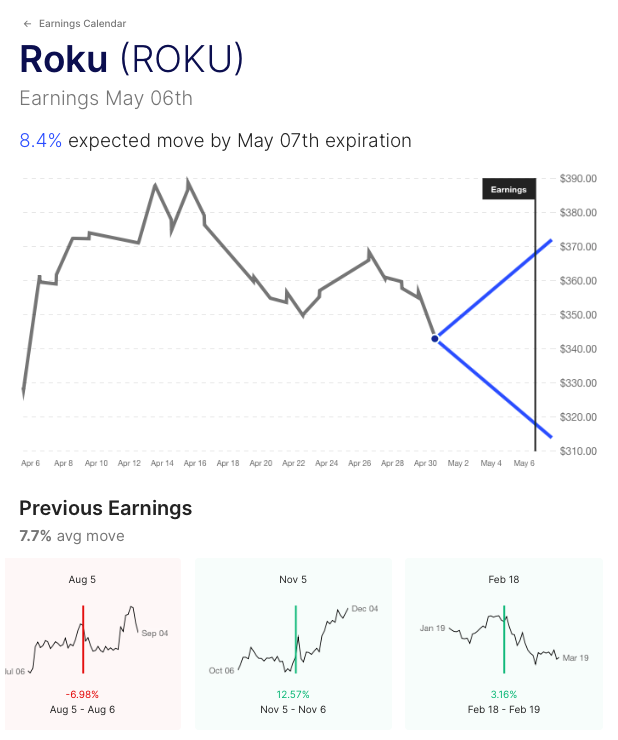

Roku ROKU / Expected Move: 8% / Recent moves: +3%, +13%, -7%

Peloton PTON / Expected Move: 9% / Recent moves: -6%, -1%, -4%

DraftKings DKNG / Expected Move: 7% / Recent moves: +6%, +4%, -6%

Cronos CRON / Expected Move: 8% / Recent moves: -3%, +17%, -16%

Options AI puts the expected move at the heart of its trading experience. Traders are able to quickly generate trades based on the move, or to place their own price target in context of the expected move. Options AI provides a couple of free tools like an expected move calculator, as well as an earnings calendar. More education on expected moves and spread trading can be found at Learn / Options AI.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC a registered broker-dealer.