2021 began with a slew of wild stock moves involving SPACs and Meme stocks. Out of-the-money Call buyers in a stock like Gamestop who were able to time those moves on the way up saw outsized returns. But as those parabolic moves came to an end, traders needed to adjust to implied volatility collapsing as stocks went lower or sideways. Even out-of-the-money Put volatility declined as meme stocks declined. In other words, if implied volatility is declining it’s difficult to be right with out-of-the-money Calls or Puts, even when you have the direction right.

Earnings moves are similar. A stock set to report earnings has options pricing in a certain expected move based on the uncertainty surrounding the earnings release. This can lead to elevated premiums (making options more expensive). After earnings, with the uncertainty gone, options reset to price more day-to-day expected moves. That means that further out-the-money Calls or Puts, particularly beyond where the stock moves, may see a sharp overnight decline in implied volatility (making them less expensive). In other words, you may not realize a profit, even if you were right on direction.

In options however, there are more ways to trade than just Calls or Puts. Debit spreads can reduce the overall exposure to premium by lowering cost, while giving some protection to declining volatility. Credit Spreads position to actually benefit from declining volatility by being net short premium (selling options and receiving premium rather than buying and paying a premium). Of course, direction is still the most important variable, but smarter positioning can lessen, eliminate, or even benefit from some of the other variables. This said, there are additional risks associated with spreads, including liquidity and assignment, that every investor should also be aware of.

Below we’ll look at some of the expected moves for companies reporting this week, and use NIO as an example to highlight some of the various ways Spreads can be used as an alternative to outright Calls and Puts.

Expected Moves

The expected move is the amount that options traders believe a stock price will move up or down. It can serve as a quick way to see where real-money option traders are pricing the future movement of a stock. That consensus is derived from the price (or implied volatility) of at-the-money options. An easy way to think about it is if the stock moves inside the expected move, options were overpriced, and if the stock moves outside the expected move, options were underpriced.

Knowing this consensus before making a trade can be incredibly powerful, regardless of whether you’re using stock or options to make your trade. Below we’ll see how it might also be as a basis for starting strike selection. Options AI puts the expected move at the center of its trading experience.

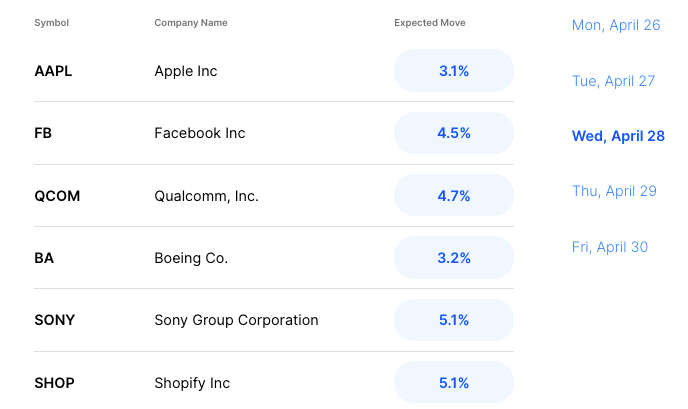

Expected Moves for Companies Reporting Earnings This Week

Below are expected moves for some of the bigger cap stock reporting this week, via the Options AI Earnings Calendar (free to use):

Wednesday

Thursday

NIO (NIO) reports earnings Thursday after the close. Options are pricing an almost 7% expected move in the stock.

At the time of writing the stock is around $41. The 7% expected move means options are pricing a bullish consensus of around $44 in the stock and a bearish consensus of around $38. Via Options AI:

Below, we’ll explore further how the expected move might be utilized by option traders themselves. Particularly in helping guide strike selection in strategies that seek to reduce costs, or reduce exposure to declining volatility.

Call Alternatives

At the time of writing, buying a weekly (Apr 30 expiry) $41 (at-the-money) Call costs around $1.70, or $170 in premium. In order for the Call to be profitable on Friday’s expiration, the stock would need to be above $42.70.

A slightly out-of-the-money Call, the $42 for instance, lowers the cost of a Call slightly, to about $1.25. But buying that Call would need the stock above $43.25.

Now, let’s take a scenario where a trader wants to position for a move higher but with a breakeven closer to where the stock is currently trading. One way to do that is to use the 7% expected move to guide strike selection, creating a defined risk option spread. One that lowers the breakeven when compared to an outright out-of-the-money or at-the-money Call.

Using the Options AI options trading platform, we’ll look below at some alternative strategies that have been generated with the expected move guiding strike selection. We can start by directly comparing the at-the-money 41 Call to a +41/-44 Call spread.

The 41/44 Debit Call Spread lowers the cost of buying the at-the-money call, from around $170 to $105 by simultaneously selling a Call around the expected move level (the 44 Call it sells is currently around 0.65). In turn, this brings down the break-even level to around $42.05, vs $42.70 for the 41 Call outright, while increasing the probability of profit (by lowering the break-even level required at expiration) from 36% to 42% The trader has also reduced their overall exposure to elevated volatility in the options versus an outright call. Less capital is at risk, and a lesser move higher is needed in order to at least breakeven.

Aside from the additional potential risks of option spreads (such as early assignment and liquidity), it is important to note that a spread caps potential profits (if the stock moves beyond $44). One way of looking at this is that the trader has joined the option market consensus with a view that the stock is less likely to move beyond 7% and therefore is willing to cap gains at that point. But in so doing, receives $65 from the 44 strike call buyers to lessen the cost of a bullish position.

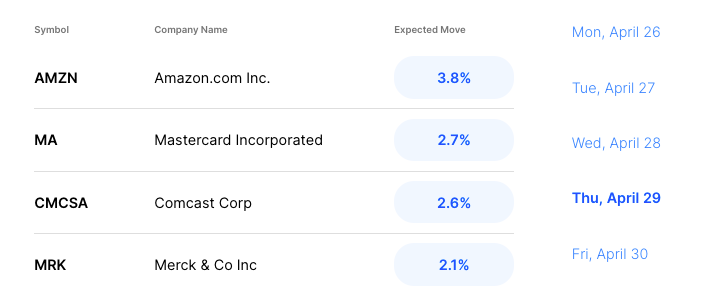

Put Alternatives

If a trader is interested in positioning for a move lower in the stock, the bearish consensus could also be used for initial trade setup. Again, using the Options AI platform, with April 30th expiry:

The +41/-38.5 Debit Put Spread creates a breakeven just about a dollar lower in the stock. Closer than out-of-the-money puts are able to do. If a trader wants to position for the stock going lower, the magnitude of the move would need to be lower than the breakeven. The Debit Put Spread is able to get that breakeven closer to where the stock is currently trading.

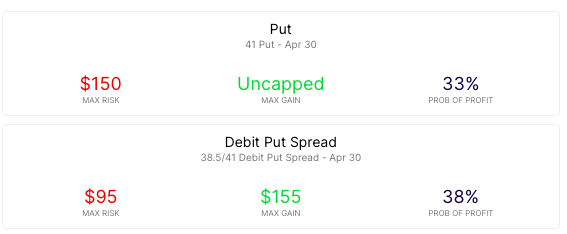

Credit Spreads

Another way for a trader to express a view is by selling premium in the form of a Credit Spread. This trade typically risks more to make less, but instead of requiring the stock to move in the direction of the traders’ view, it is profitable if the stock doesn’t move in the opposite direction. It can be thought of as selling to those that are positioning for a move, upwards or downwards.

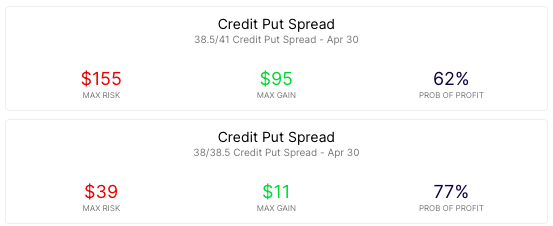

Below are examples of bullish Credit Put spreads based on the expected move, one at-the-money, the other out-of-the-money:

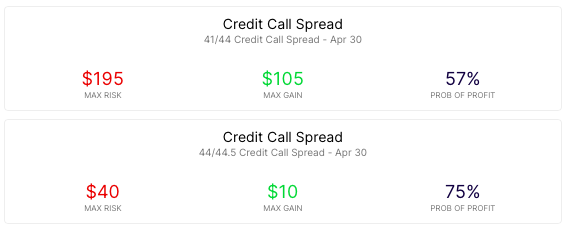

And bearish credit call spreads:

Out of the money Credit Put and Call spreads can even be combined to form an Iron Condor, a credit spread that looks to make money if the stock stays within the strikes (in this example, outer strikes based on the expected move):

In this example, the trade sees maximum profit if the stock is anywhere between approximately $38.50 and $44 on Friday’s expiration. It is max loss above approximately $44.50 or below $38. A move that would mean that options were underpriced.

Options AI puts the expected move at the heart of its trading platform. It allows traders to quickly generate and compare more ways to trade, by entering an informed price target or using the expected move for initial strike selection.

Options AI provides a couple of free tools like an expected move calculator, as well as an earnings calendar with expected moves. More education on expected moves and spread trading can be found at Learn / Options AI.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC a registered broker-dealer.