Roku (ROKU) and Applied Materials (AMAT) are a couple of the names set to report earnings Thursday after the bell. Here’s a quick look at how the options market are pricing their moves as well as some spread examples in Roku – whatever your trading view.

Expected Moves

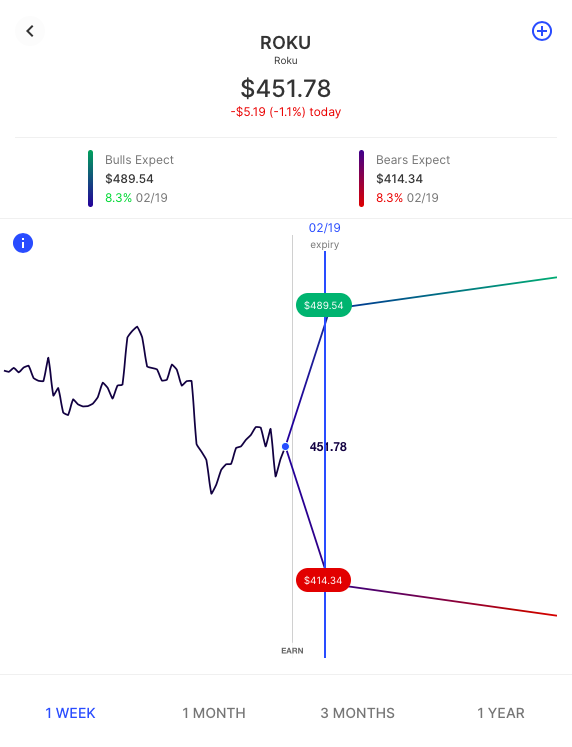

First, a look at expected moves alongside how the stocks’ actual moves for prior earnings events, via Options AI:

Roku 8.5% (link)

Applied Materials 4.2% (link)

Roku, Bullish Spreads

Using ROKU as an example, we can see how option spreads might be used to reduce capital outlay and potentially improve probability of profits (versus buying outright calls or puts). We will also look at how the expected move can be used to help guide strike selection on spreads, both debit, and credit.

Please note, any stocks and/or trading strategies referenced are for informational and educational purposes only and should in no way be construed as recommendations. The strategies depicted represent just a few of the many potential ways that options might be used to express any particular view. All prices are approximate at the time of writing. Option spreads involve additional risks that should be fully understood prior to investing.

With Roku trading near $455 we can use the 8.5%, or just under $40 in the stock, expected move to generate a couple of spreads, debit and credit, and compare those to an outright call:

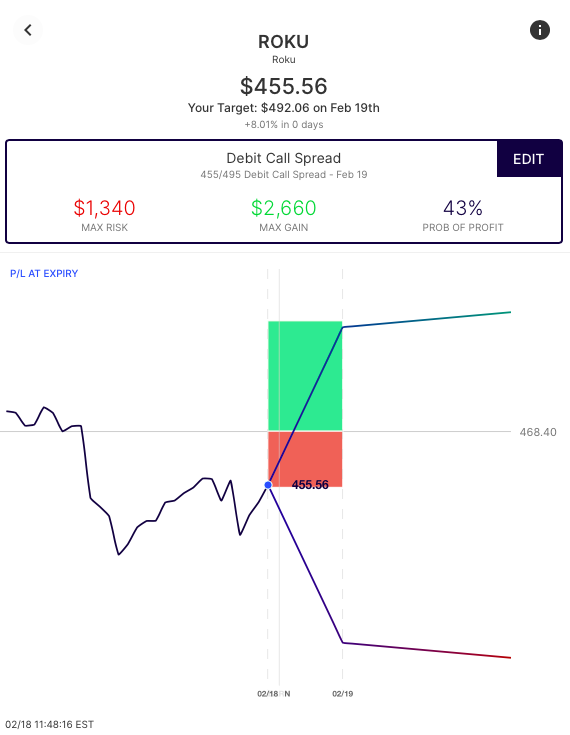

Bullish Debit Spreads

Knowing that the options market is pricing a move of just under $40 in either direction for earnings, we will now look at an example of the bullish spread based on that expected move, the Feb 19th +455/-495 Debit Call Spread (buying a 452.50 cal, simultaneously selling a 490 call). Based on the stock at $455, this spread is trading at approximately $13, as compared to $22 for the outright 455 call, risking $1,300 versus $2,200. Here’s how that trade looks on the Options AI chart:

With a spread, the out-of-the-money 495 call is sold to help finance the purchase of the at-the-money 455 call. That spread creates a breakeven near $468 in the stock. It sells the 495 call at around $10. In other words, not only does the spread lower the cost basis (and breakeven) versus an outright call at or near the money, but the spread itself costs just a little more than buying the 495 call (the out of the money call).

Bearish – The same process can be applied to Bearish Debit Spreads, with the ROKU +455p/-415p debit put spread trading at a similar price.

Bullish Credit Spreads: ‘Selling to the Bears’

Even by using a debit spread to reduce trade costs in an $450 stock, capital outlay can still be relatively high. Now we’ll dive into credit spreads, with a focus on an out-of-the-money Credit Spread that can utilize a higher probability of profit, while potentially reducing the capital at risk. Remember, this should be balanced with an understanding of other risks specific to spreads (such as assignment and execution risk).

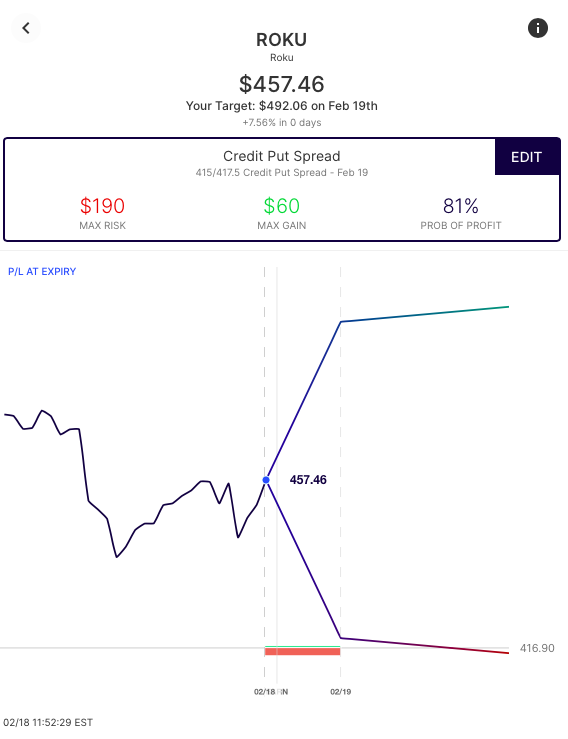

Below is an example of a Credit Put Spread, placed at the bearish expected move:

In this example, the Credit Spread sells the 417.50 put and buys the 415 put (Feb 19th). This creates a credit spread, that collects about $260, as long as the stock is above $417.50 on expiry. With this credit spread, more has to be risked ($190) than the potential reward ($60). But, because the trade only needs the stock to be above $417.50 on expiry, it carries a high probability of profit.

This “bullish by not being bearish” stance is one way traders can express a view in an 450 dollar stock without the high costs associated of trading options nearer to the current stock price. On a credit spread, the defined ‘risk’, can be thought of similarly to the ‘cost’ one would associate with a long option or a debit spread.

Bearish – The same view can be expressed for bearish positioning, in this case with the -495c/+500c credit calls spread at a similar risk/reward.

Selling a credit to both the Bulls and the Bears

Finally, let’s consider the scenario where you believe that the options market is overpricing the move in both directions and believe that a stock will stay within the expected move on a given timeframe. Rather than “not bearish” or “not bullish” like the Credit Spread above, this is a trade that ‘sells the move’ to both the bulls and the bears – the Iron Condor. Here’s an example, using the stock’s expected move to initially set strikes:

The Iron condor, which involves simultaneously selling an out-the-money Credit Call Spread, and a Credit Put Spread seeks to collect the premium (income) received if ROKU stays within its expected move.

On the chart above one can see the max gain range in the stock, and the points at which the trade becomes max loss, if the stock has a larger than expected move in either direction.

Summary

Remember, the above are just examples of the many ways a trader might express a view using options. They are based on where the stock is trading at the time of writing and are intended solely to demonstrate how the expected move can help provide actionable insight to consider before making any trade – particularly into an uncertain event – and how it might be used for more informed strike selection. Learn / Options AI has a couple of free tools, including an earnings calendar with expected moves, as well as education on expected moves and spread trading. The concepts shown in Roku can apply to any stock and are simply used here for illustrative purposes.