The Broader Markets

The past week saw the indices at new highs an the VIX near 20.

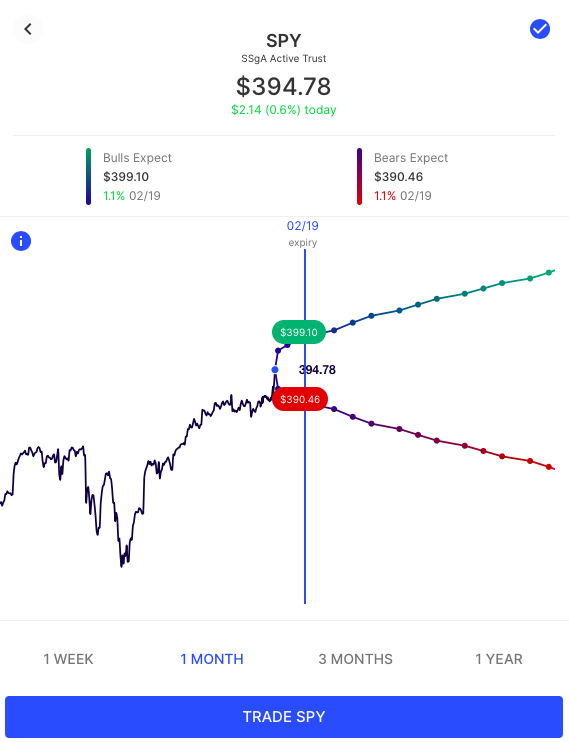

SPY options are pricing a 1.1% move in either direction for this shortened week. That corresponds to about $390 on the downside and nearly $400 on the upside:

Using the Options AI Expected Move Calculator we can compare the expected moves for the next 7 days in SPY, QQQ, DIA and IWM, with the largest expected move in IWM:

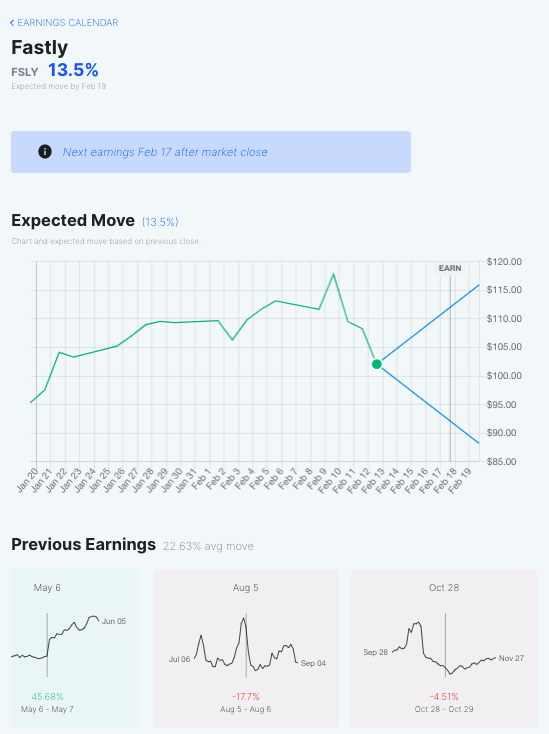

Expected Moves for Companies Reporting Earnings Next Week

We’ll highlight a few below with expected moves for next week, but a larger searchable list with expected moves and recent history can be found on the Options AI Earnings Calendar.

Options AI puts the expected move at the heart of its chart-based platform and Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading.