The Broader Markets

The past week saw the indices pull back slightly from their highs with a slight uptick in the VIX .

SPY options are pricing about a 1.5% move in either direction for the upcoming week. That corresponds to about $384 to the downside and $395 on the upside. Here’s this week’s expected move chart via Options AI:

Using the Expected Move Calculator we can compare the expected moves for the next 7 days in SPY, QQQ, DIA and IWM, with the largest expected move in IWM:

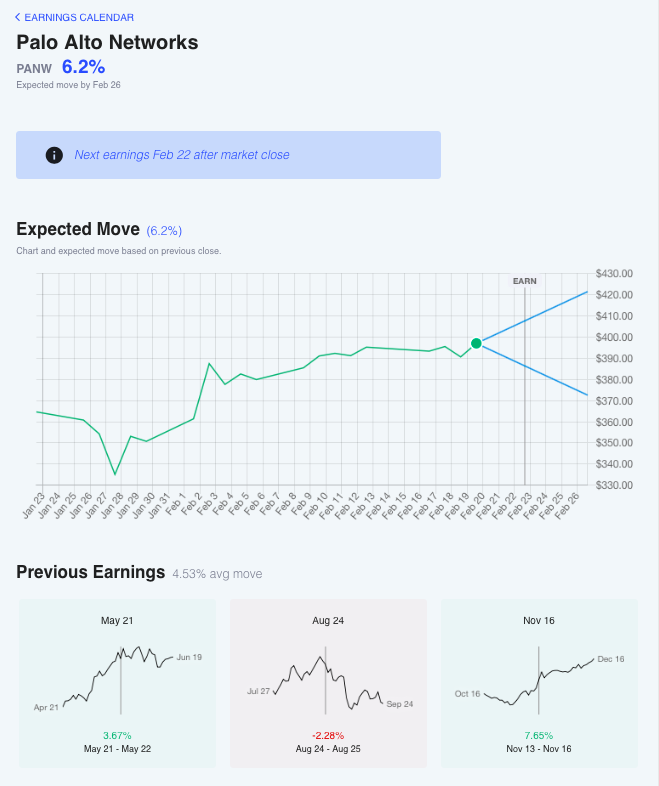

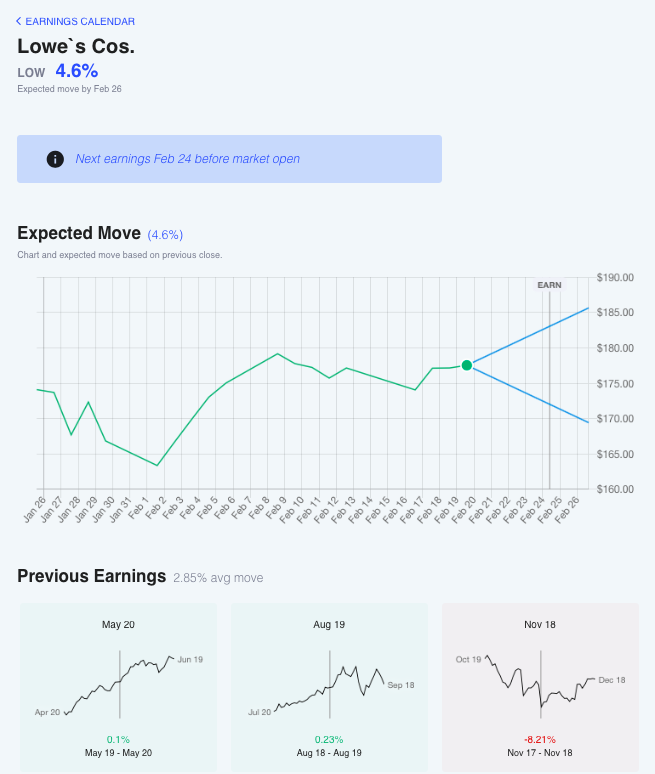

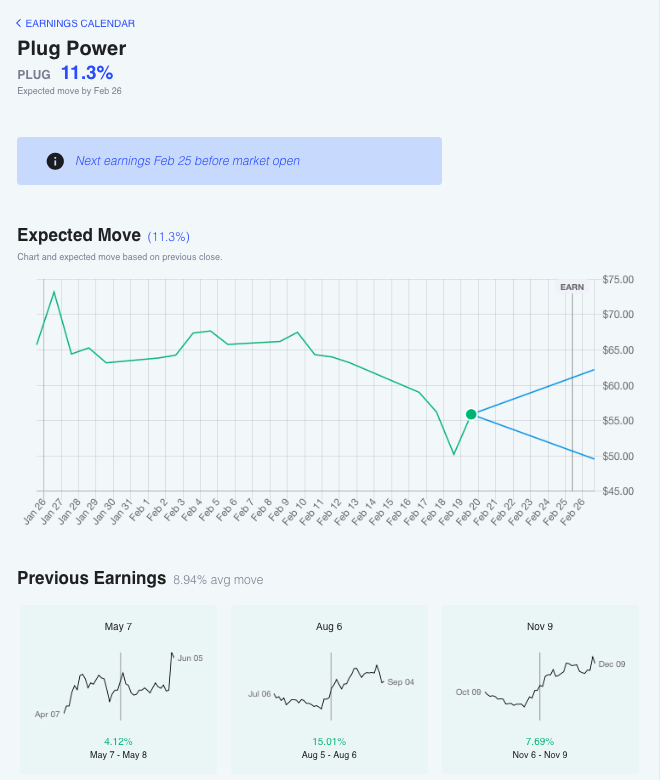

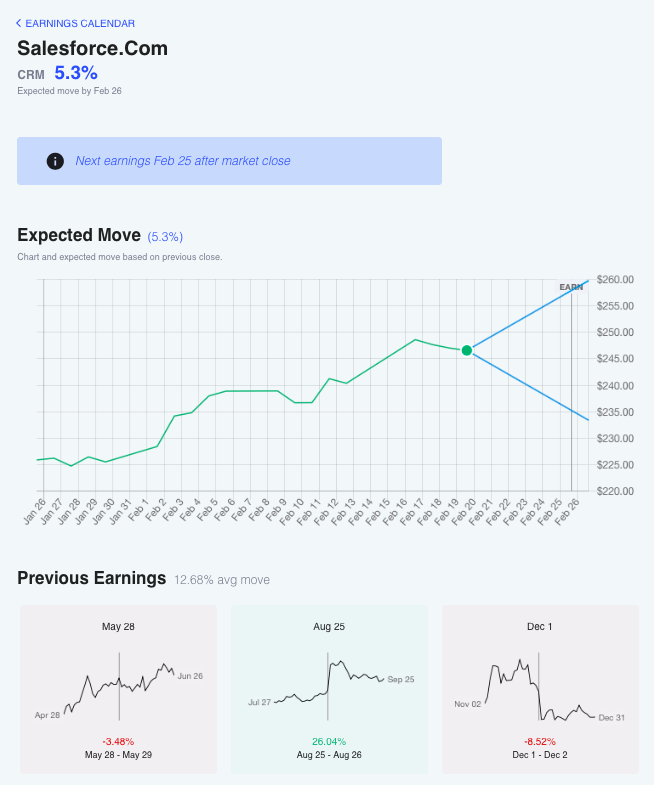

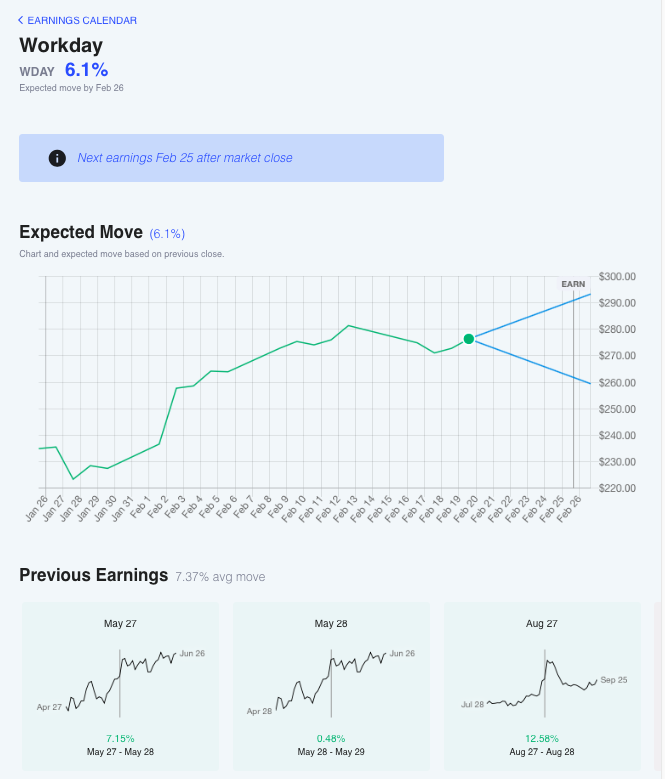

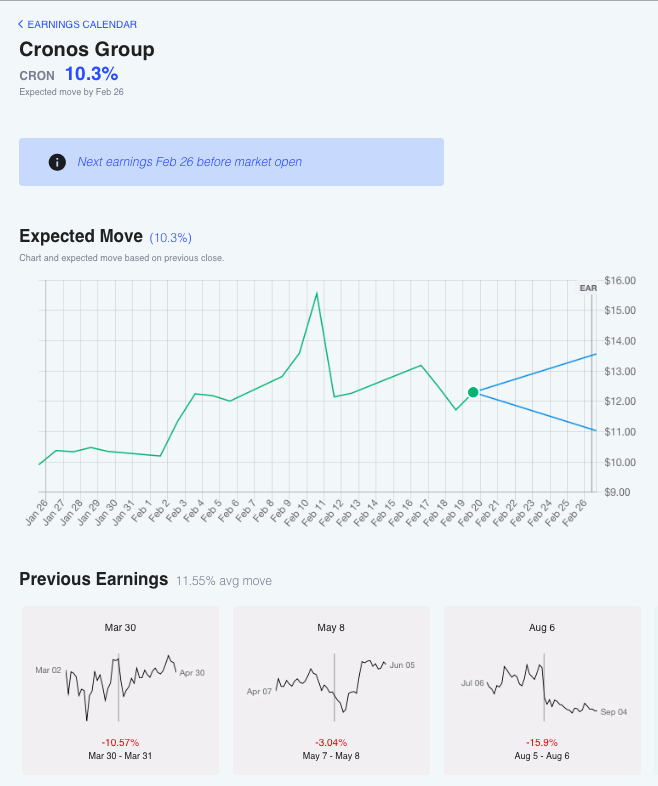

Expected Moves for Companies Reporting Earnings Next Week

Expected moves for some of the companies reporting earnings this week, with prior earnings moves below. A larger searchable list can be found on the Options AI Earnings Calendar.

Options AI puts the expected move at the heart of its chart-based platform and Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading.