Chewy (CHWY) and Lululemon (LULU) report earnings today (Tuesday) after the close.

- CHWY options are pricing about an 8% move, or just under $6.50 in either direction.

- Chewy was lower by -5% on its most recent earnings report and saw moves of -10% and -4% in the two prior.

- LULU options are pricing about an 5% move, or just under $18 in either direction.

- Lululemon was lower by -7% on its most recent earnings report and saw moves of -7% and -4% in the two prior.

A full calendar of expected and recent earnings moves can be found on the Options AI Earnings Calendar. Links to Chewy here and Lululemon here.

Chewy: Using the Expected Move to Help Create Options Spreads

Using CHWY as an example, we can see how the expected move might be used to help guide strike selection on options spreads, both debit and credit. We can also see how option spreads might be used to help reduce capital outlay and potentially improve probability of profits (versus buying outright calls or puts).

Chewy Debit Call Spreads

With ZM trading near $79 we can use the 8% expected move to generate spreads, both debit and credit and then compare those to outright calls and puts. Here’s an example of bullish spreads based on the expected move via Options AI:

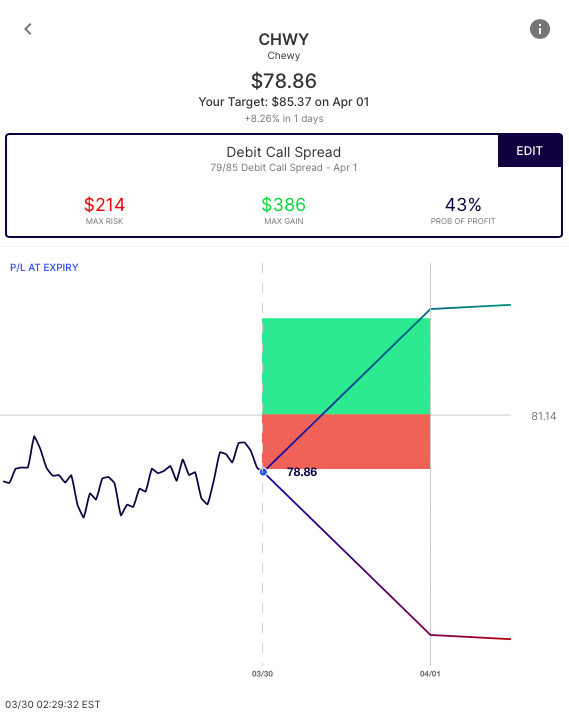

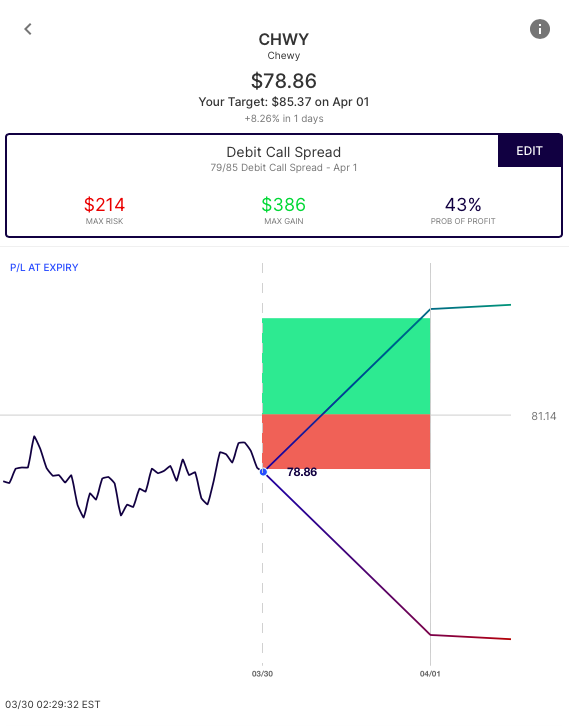

We see two credit spreads and one debit spread. We’ll focus first on the April 1st +79/-85 Debit Call Spread. This spread is trading at approximately $2.15. Here’s how that trade looks on the Options AI chart, with a breakeven near $81.15:

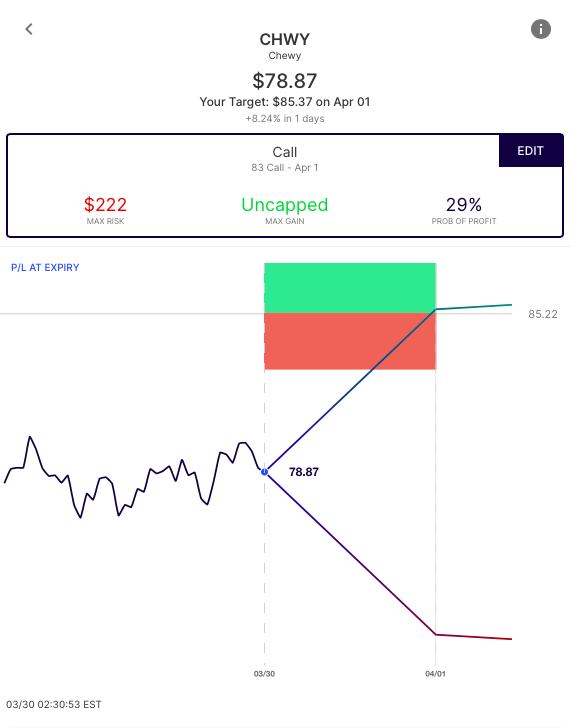

With this Debit Call Spread a trader is able to position for a move higher at a cost of about $2.15. The trade needs the stock to be above approx. $81.15 by Friday’s expiration in order to be profitable. A trader can directly compare the cost of that spread to an out of the money call. A trader would have to go up to the 83 Call to find something similarly priced (the 83 Calls are roughly 2.25). Here are those two trades side by side for comparison:

CHWY +79/-85 call spread (April 1st)

CHWY +83 call (April 1st)

In other words, the 79/85 spread is looking for a move above $81.15 with a max profit above $85. While the 83 Call is looking for a move above $85.25, with unlimited profits above that level. But the spread can make 3.85 at or above $85 in the stock. The 83 Call needs the stock to be at or above $89.10 to do the same. The difference in breakeven is reflected in the probability of profits, with the spread 43% and the call 29%.

Bearish Debit Spreads – The same process can be applied to Bearish Debit Spreads, with the CHWY +79/-72.50 Debit Put spread trading at about $2.55:

Directional Credit Spread

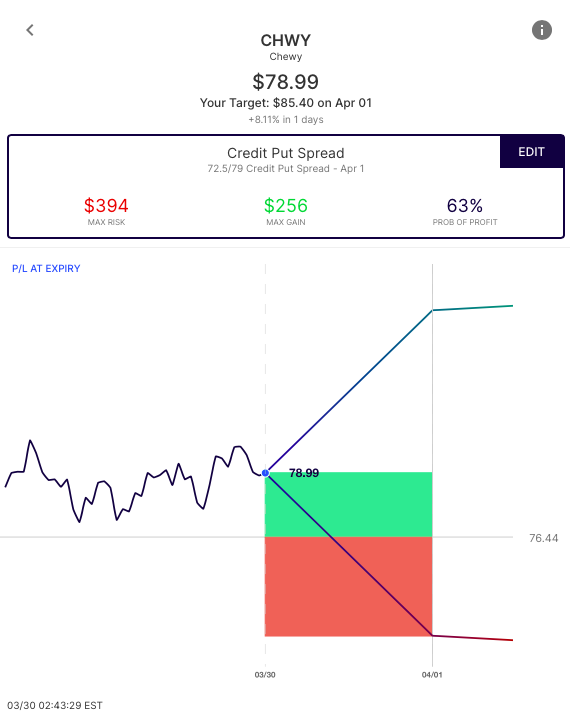

Next, we’ll focus on credit spreads. Using CHWY once again as an example, we’ll use the expected move to help guide strike selection for an out-of-the-money bullish credit put spread. These trades are bullish, but may be best thought of as being bullish, by not being bearish. Here are two examples, the first is an at-the-money credit spread using the expected move for the long strike:

In this example, the credit spread collects about $255, as long as the stock is above 79 on expiry. With this credit spread, more has to be risked ($395) than the potential reward ($255). But, because the trade only needs the stock to be above approx. 76.45 on expiry, it carries a higher probability of profit than debit call spreads. It also is a net seller of premium so it avoids the higher implied volatility associated with buying premium into an earnings.

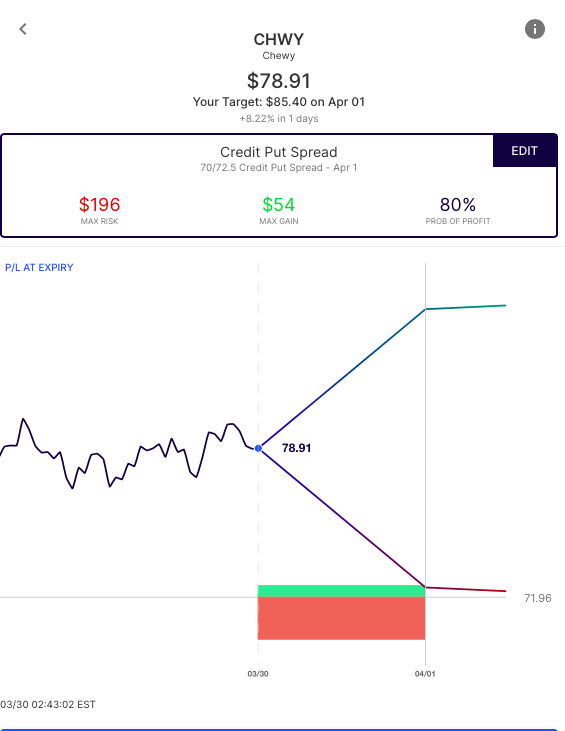

The second version of a credit spread using the expected move is an out-of-the-money credit put spread:

This is the same concept but risks more to make less because it is out of the money. It can best be thought of as attempting to profit by positioning against a large move lower.

Remember, this should be balanced with an understanding of other risks specific to spreads (such as assignment and execution risk).

Bearish Credit Call Spread – The same view can be expressed for bearish positioning via credit call spreads based on the expected move.

Lululemon Iron Condors – Using the expected move to sell a credit to both the Bulls and the Bears

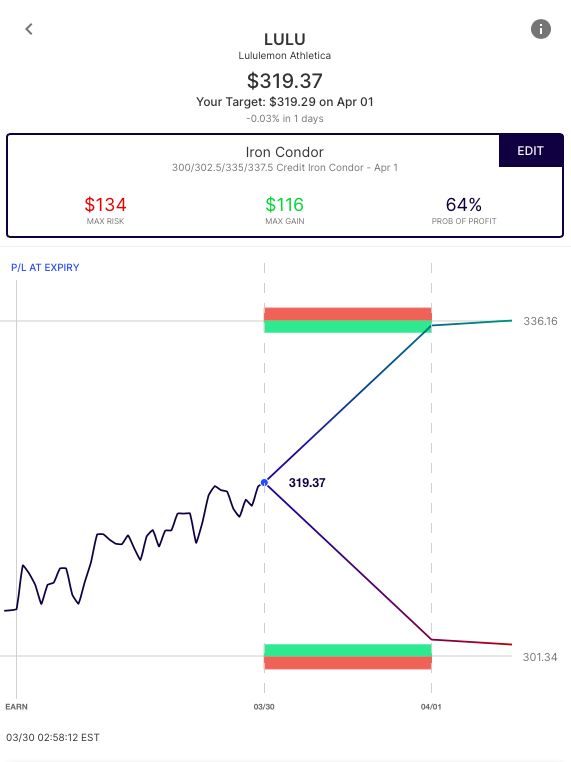

Finally, let’s consider the scenario where a trader believes that the options market is overpricing the move in both directions and believes that a stock will stay within the expected move. Rather than not bearish” or not bullish like the directional Credit Spreads above, this trade, an Iron Condor, ‘sells the move’ to both the bulls and the bears. An an example, here’s an Iron Condor, selling at a $115 credit:

The Iron condor, which involves simultaneously selling an out-the-money Credit Call Spread and Credit Put Spread seeks to collect the premium (income) received if the stock stays within its expected move.

An Iron Condor is a strategy some traders utilize when they expect implied volatility to go lower. But in this case, with so little time to expiration, the best way to think of this strategy is that if the stock stays within the expected move, it is profitable. If the stock moves beyond the expected move, it is unprofitable.

Note

Please note, any stocks and/or trading strategies referenced are for informational and educational purposes only and should in no way be construed as recommendations. The strategies depicted represent just a few of the many potential ways that options might be used to express any particular view. All prices are approximate at the time of writing. Option spreads involve additional risks that should be fully understood prior to investing.

Learn / Options AI has a couple of free tools, including an earnings calendar with expected moves, as well as education on expected moves and spread trading.