Three of the big four banks JPMorgan Chase (JPM), Citigroup (C), Wells Fargo (WFC), as well as the first major regional, PNC Financial (PNC) all report Q1 earnings on Friday – providing vital insight into the depth of the banking crisis and setting the tone for the broader earnings season.

There’s little mystery in the notion that the big four banks have benefited from deposit inflows at the expense of the regionals, but for traders looking to make an earnings play, a key decision point will be around whether recent declines in stock prices adequately reflect the risk to future earnings given an overall net outflow of deposits to higher return alternatives such as money market funds.

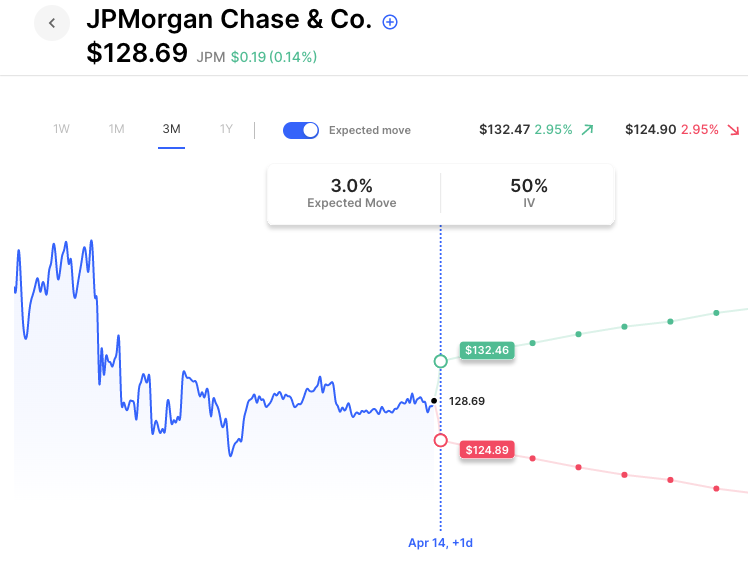

So, with all eyes on these underlying trends and future guidance, we first look at expected moves for JPM, C, WFC and PNC based on option market prices:

- JP Morgan JPM – Expected Move: 2.7% [Prior] +3% +2% -3 -3%

- Citi C – Expected Move: 3.1% [Prior] +2% +1% +13 +2%

- Wells Fargo WFC – Expected Move: 3.5% [Prior] +3% +2% +6 -5%

- PNC Bank PNC – Expected Move: 3.7% [Prior] -6% -2% +2%

In this example where we look at trading earnings with spreads, we take the largest of the U.S. banks – JPMorgan Chase (JPM). With JPM reporting before the bell tomorrow, we see the 1D expected move of JPM to be approximately 3% in either direction. That’s an expected move of ~$132.50 to the upside and ~$125.00 to the downside, close to recent lows on March 24th.

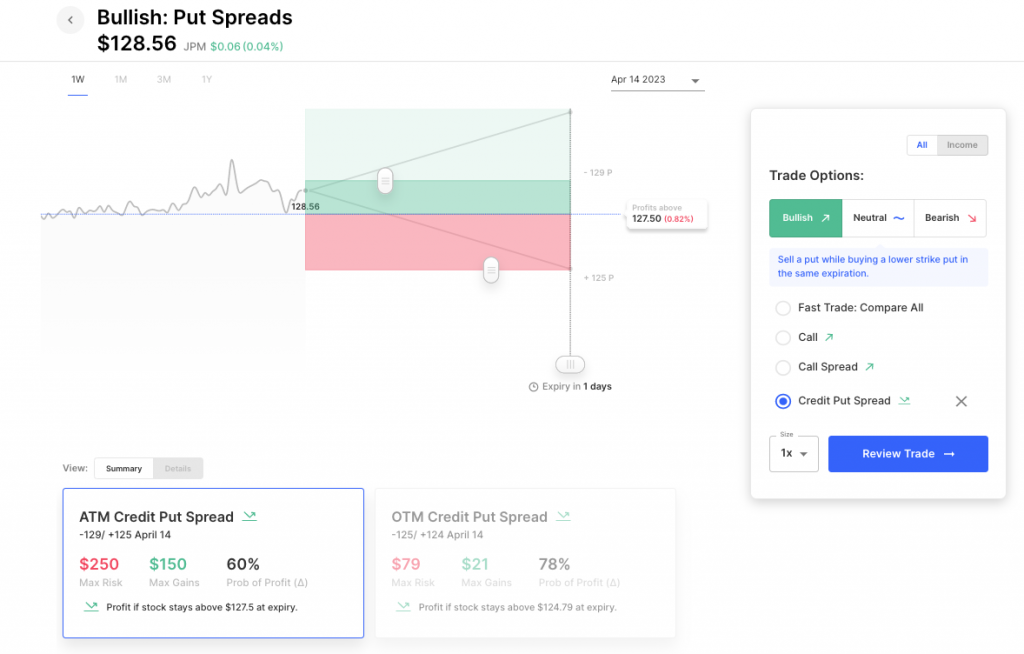

Let’s look at how a trader who is somewhat bullish and agrees with the 1D expected move, might use a Credit Put Spread as an alternative to buying an outright Call.

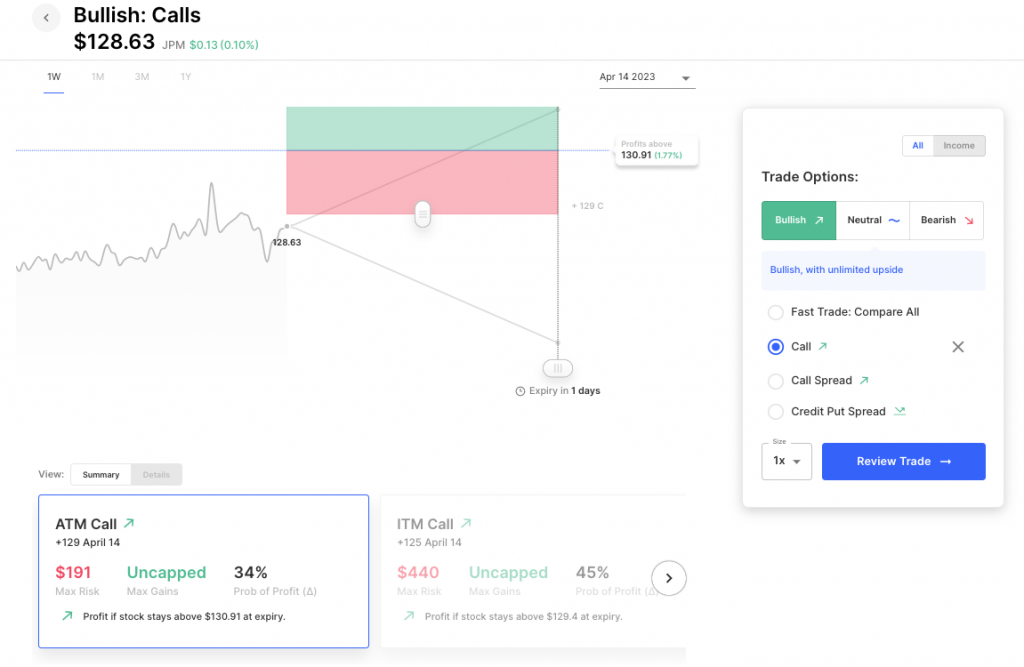

To start our comparison and with JPM trading at around $128.60, we see an at-the-money JPM Apr14 129 Call costs approx. $1.90, implying a breakeven level of around $130.40 in the stock. In the event the stock moves upwards to the expected move level of $132.40 the trader stands to make approximately $1.60, having risked $1.90. Of course, in the event the stock were to see outsized gains, profits are not capped.

Now, let’s compare that to selling to open a 1DTE JPM Apr 14 129/125 Credit Put Spread. In this example we sell the at-the-money 129 Put and buy the 125 Put for a net credit of approximately $1.50. In this case, our Breakeven is now down at $127.50. Put another way, we are being bullish by selling to the bears and positioning for a stock price drop not happening.

So, let’s look at some of the trade-offs: the Credit Put Spread risks more (~$250) than the outright Call (~$190) but it stands to generate similar profits if the stock is above the short $129 strike at expiration (its max gain), as opposed to the Call requiring the stock to be at $132.40 or above (in order to make $150). As mentioned, the outright Call does have the potential for unlimited gains if the stock makes an outsized move higher. However, the Credit Put Spread with its lower breakeven benefits from a greater probability of profit, since it allows the trader to enjoy a wider zone of potential profits.

You can see expected moves on stocks and ETF’s using Options AI’s free tools and even generate trades based on those moves to compare. And Options AI has an Earnings Calendar (free to use) showing upcoming earnings dates, expected moves, and past earnings moves for comparison.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.