Market View

Last Week – A less volatile week all around and a jobs number arrived with markets closed.

SPY finished lower by 0.4% last week, a quiet move inside what options were pricing. The VIX was down very slightly on the week from 18.70 to 18.40. The jobs number came out Friday but the stock market was closed so today is the first reaction in equities. Options vol took a breather last week, with a holiday week in between the banking turmoil of the past month and the earnings season kicking off this Friday.

This Week – CPI and bank earnings.

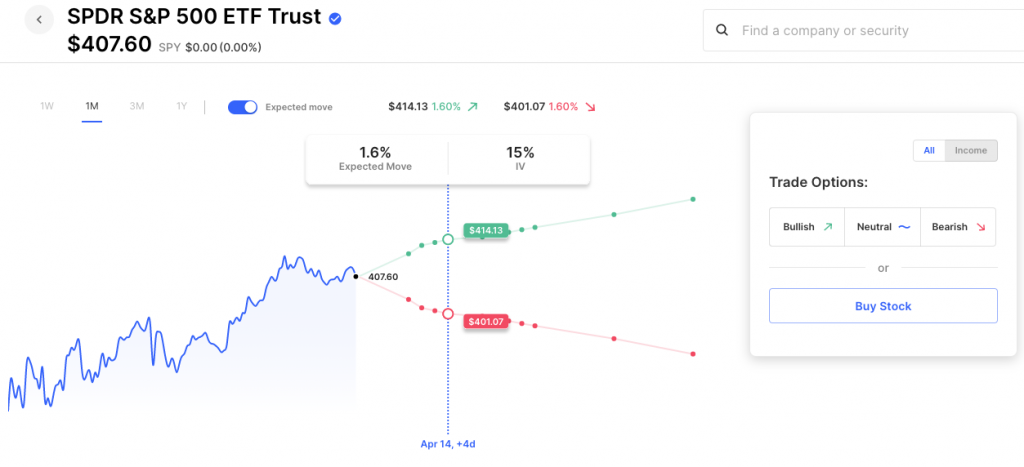

SPY options are pricing about a 1.6% move for the upcoming week. The CPI number is on Wednesday with SPY IV jumping from about 11 to 15 mid-week leading into the start of earnings season with what will be some closely watched numbers from JP Morgan, Citi and Wells Fargo on Friday. Again, this is some of the lowest IV the market has seen in months, especially on a CPI week. Here’s the SPY expected move with a range of about $414 to $401:

Today – Futures Lower following Jobs Number

Futures are lower before the bell on Monday, absorbing the Jobs number on Friday as well as pre-market moves lower in Apple, Tesla, and other big cap tech. Tesla is lower by about 3% pre-market following an announcement or more price cuts on certain vehicles.

Micron is higher by 5% following an announced cut to memory chip production from Samsung.

Expected Moves for This Week (via Options AI’s free tools)

- SPY 1.6%

- QQQ 2.1%

- IWM 2.3%

- DIA 1.4%

Economic Calendar

- Monday – Fed Speech (Williams)

- Tuesday – Fed Speeches (Harker, Kaskari)

- Wednesday – CPI, Fed Minutes

- Thursday – PPI

- Friday – Retail Sales, Consumer Sentiment

Unusual Option Volume Thursday

- ORCL, COST, AMC, ABBV, Z

Earnings This Week

Via the Options AI Earnings Calendar (free to use) showing expected moves as currently priced and past moves for comparison.

Tuesday

- Carmax KMX – Expected Move: 10.8% [Prior] -4% -25% +7 -10%

Friday

- JP Morgan JPM – Expected Move: 3.6% [Prior] +3% +2% -3 -3%

- Citi C – Expected Move: 4% [Prior] +2% +1% +13 +2%

- Wells Fargo WFC – Expected Move: 4.4% [Prior] +3% +2% +6 -5%

- United Health UNH – Expected Move: 2.5% [Prior] -1% +1% +5% 0%

- BlackRock BLK – Expected Move: 3.5% [Prior] 0% +7% +2% 0%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.