Market View

Last Week – Another positive week and an IV collapse.

SPY was up 3.5% last week, a move much larger than options were pricing. But because the move was to the upside, and came on the heels of some relieving bank headlines, implied vol collapsed. The VIX is now within a point of its lowest levels of 2023 and is down from 26 to 18.70 since the SVB drama, and actually at or below its historical mean. IV for SPY options expiring this week are in the 10-13 IV range, down significantly from the weekly IV near 30 we saw into the CPI and FOMC in March. There is a slight uptick in SPY IV into the next CPI April 12th, but only to 16 IV at the moment. Last week’s move higher was a slow march higher from Tuesday until Friday and those conditions are often where the short premium trade risk is to the upside. IV usually spikes when stocks go lower, and contracts when they go higher. That can happen even when the moves higher are large.

This Week – A Jobs Report, but on a holiday.

SPY options are pricing about a 1.2% move for the 4 day week. This is a holiday week in the second half with Passover beginning Wednesday night and then markets closed for Good Friday. There will be some focus on the NFP release on Friday as market participants are now on the lookout for any signs of recession but the reaction will not come until the following Monday. Stock valuations are on the high side historically after the recent recovery in the market and the set-up into earnings season later this month isn’t necessarily pricing in the effects of a possible recession. So any signs of cracks on the economic front will be a focus. However, the bull case is that if the Fed is indeed winding down rate hikes and if inflation continues to moderate, the economy may have escaped the worst possible scenario. The NFP this week, CPI on the 12th, and the first 2 weeks of earnings reports in late April should give some clues.

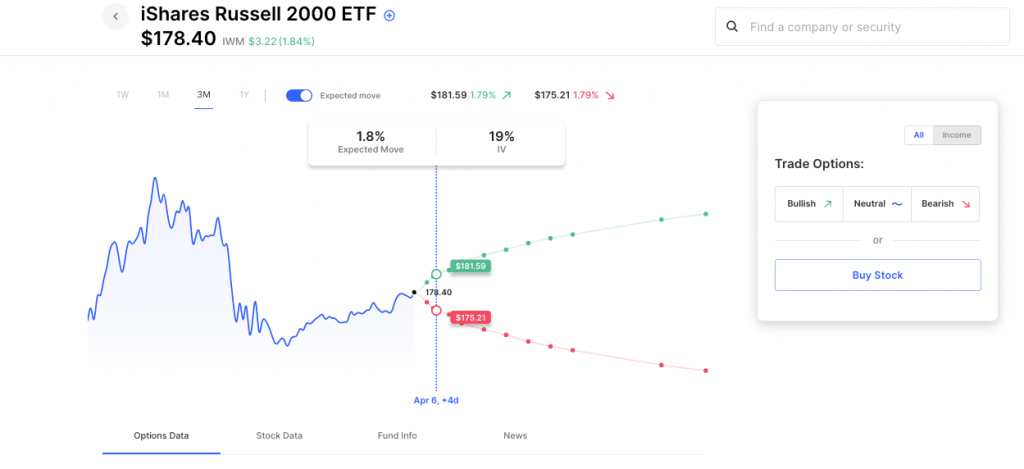

Last week we highlighted the rapid IV decline in The Russell 2000. Options in IWM were pricing in a 5-day move of 4% two weeks ago, 2.7% last week, and this week just 1.8% (4 day week). So the options market is now pricing in much more typical moves in small-cap stocks than in the midst of the banking turmoil. Below is the IWM chart showing the large recent moves and the much smaller expected move now as a result of a collapse in IV (with this Friday highlighted):

Expected Moves for This Week (via Options AI’s free tools)

- SPY 1.2%

- QQQ 1.6%

- IWM 1.8%

- DIA 1.1%

Economic Calendar

- Monday – ISM Manufacturing

- Tuesday – ADP Employment, ISM Services

- Friday – Non-Farm Payrolls (markets closed)

Unusual Option Volume Friday

- HAS, AI, BB, SNOW, TSLA, UPST, UBS, ARKK, CLOV, DDOG, QQQ, SPY

Earnings This Week

Via the Expected move, weekly IV, and prior earnings moves (starting with most recent).

Earnings are really light this week but pick up in the second half of April. Next week some of the banks report, with Citi and Wells Fargo late in the week, then things really heat up the week of April 17th with Schwab, Goldman and Bank of America followed by Netflix and Tesla. The week of April 24th sees the big tech names like Apple, Amazon, Microsoft, Alphabet etc.

You can take a peek ahead on the Options AI Earnings Calendar (free to use) showing expected moves as currently priced and past moves for comparison. Not all dates are confirmed yet obviously.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.