Market View

Last Week – Another positive week and with it lower IV

SPY was up 1.4% on the week, less than the 2.6% move options were pricing. However, once again the market had multiple swings and had about. 2.6% range. The week saw an FOMC announcement and some guidance of what’s next, but also saw some mixed signals from Treasury on deposit backstops for the banking industry. The VIX fell from 26 to start the week to 22 to end the week. The banking sector was once again the focus. The regional bank etf KRE had an 8% range for the week but finished the week where it started. XLF saw about a 5.5% range and also finished about unchanged. The 2-year yield closed the week at 3.77%, down slightly on the week and down from 5% on March 7th.

This Week – GDP and The Fed’s Preferred Inflation Report

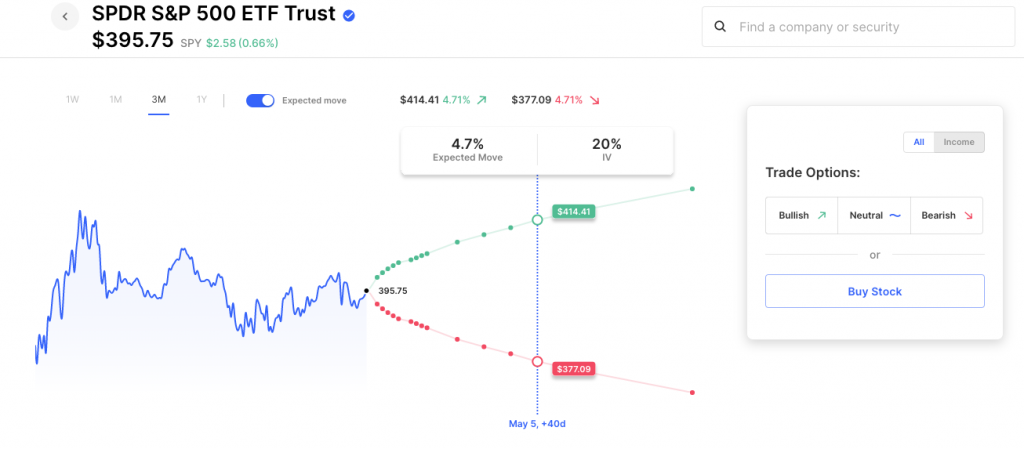

SPY options are pricing about a 2% move for the week. Earnings season is winding down and the next one picks up in Mid-April. In between the market will of course be watching bank stress, but this week also sees the GDP print an important inflation report (PCE) on Friday. The SPY is about 4.5% above its 2023 lows and about 5% off its 2023 highs. With IV a bit lower now, the options market is not currently pricing a move to either level until early May:

The Russell 2000, which saw the largest decline of the market etf’s over the past few weeks saw the largest decline in IV last week. Options are pricing a 2.7% move in IWM this week, compared to nearly 4% last week.

Expected Moves for This Week (via Options AI free tools)

- SPY 2%

- QQQ 2.2%

- IWM 2.7%

- DIA 1.8%

Economic Calendar

- Tuesday – Case Shiller Home Prices

- Thursday – GDP, Initial Jobless Claims

- Friday – PCE, Fed Williams Speech

Unusual Option Volume Friday

- DB, NFLX, PCG, SPG, FRC, ABBV, MOS, SQ, BYND

Earnings This Week

Via the Options AI Earnings Calendar. Expected move, weekly IV, and prior earnings moves (starting with most recent).

Tuesday

- Lululemon LULU / Expected Move: 7.2% / Recent moves: -13%, +7%, -1%, +10%

- Micron MU / Expected Move: 6.1% / Recent moves: +1%, -2%, -1%, +3%

Wednesday

- Restoration Hardware RH / Expected Move: 8.2% / Recent moves: +3%, +5%, +1%, -13%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.