Hello!

Headlines

- Stocks are lower this morning, a follow-through on the post FOMC selling of yesterday afternoon.

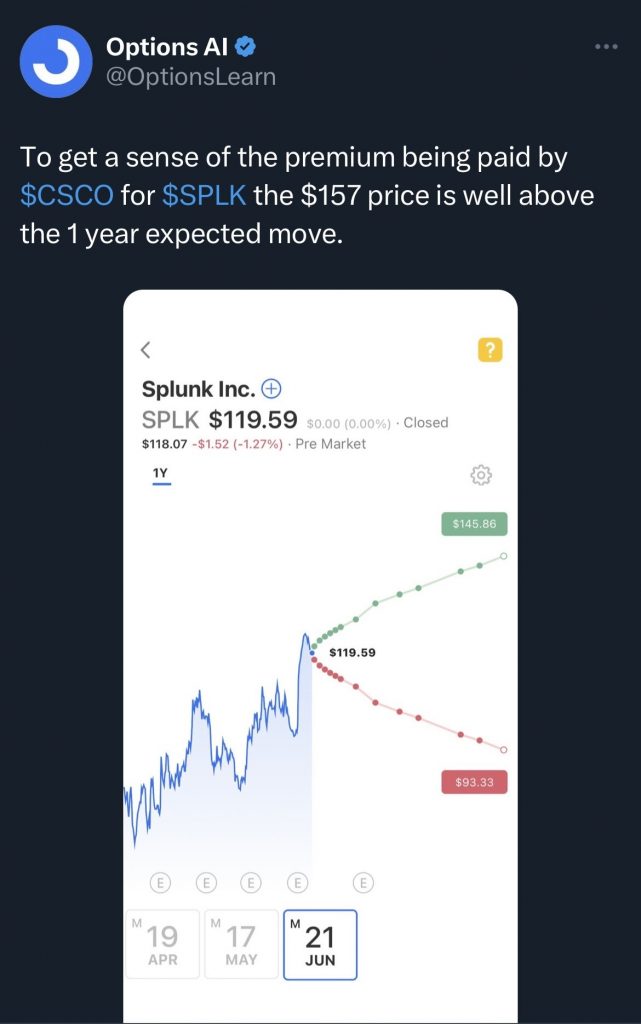

- Splunk SPLK is higher this morning after a buyout from Cisco CSCO. The buyout price of $157 is more than options were pricing as a potential bullish move for the next year.

- Broadcom AVGO is sharply lower on news Google may drop them as an AI chip provider.

- FedEx FDX shares are higher on earnings, up 5.5%, slightly more than options were pricing.

Is Volatility Back?

3 days ago I mentioned how there was a ton of option gamma expiring on Sept 15th expiry and with that now cleared this week could see increased market volatility.

IV is historically low across the board but this past Friday’s expiration saw a significant amount of option premium expire. Traders will be keeping an eye on whether there was a shift in the vol regime following that expiry. It is possible that the gamma in the market into this past Friday’s expiry had a dampening effect on moves. Whether traders become option buyers or remain rolling sellers is yet to be seen. Keep an eye on both 0DTE/Weekly IV as well as the VIX to get a sense of which way that bias is trending.

With the negative reaction to the FOMC statement, multi-year high treasury yields and the rest of the news breaking this week, the VIX is now above 16, up from 13 last week. Continue to keep an eye on that number as well as the weekly IV in SPY (currently 18) to get a sense of whether the long gamma/ low vol regime we’ve been in up until Sept Opex has cleared. (Historically September-October is a fairly volatile period in the markets, end of summer, triple witching options expiring may contribute to that)

Early Movers:

- Tesla Inc (TSLA) -2.17%

- Splunk Inc (SPLK) +20.97%

- Cisco Systems Inc (CSCO) -4.50%

- Broadcom Ltd (AVGO) -6.09%

- Alphabet Cl A (GOOGL) -1.31%

- Tradeup Acquisition Corp (UPTD) +33.55%

- Microsoft Corp (MSFT) -0.65%

Economic Calendar:

- At 10:00 AM (EST) Existing Home Sales (Aug) Estimates: 4.1, Prior: 4.07

- At 10:00 AM (EST) Existing Home Sales MoM (Aug) Estimates: 1.5, Prior: -2.2

Options AI Scanner Highlights:

- Overbought (RSI): T (69), AMGN (69), IBM (66)

- Oversold (RSI): CHWY (15), JBLU (18), DLTR (19)

- High IV: WKHS (+167%), KBH (+126%)

- Unusual Options Volume: FDX (+949%), IBM (+926%), GT (+792%), GLD (+608%)

Full lists here: Options AI Free Tools.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.