Hello!

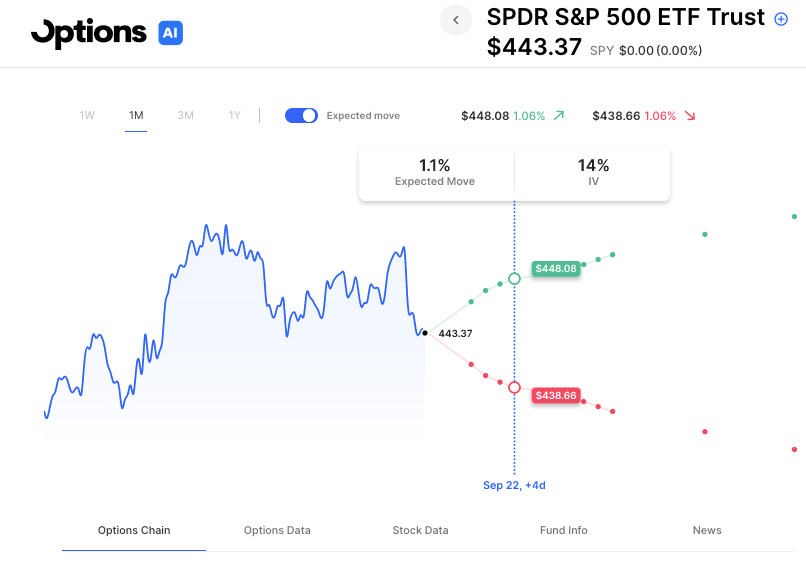

This week is fairly quiet on the earnings front apart from Autozone and FedEx. On the economic news front a slew of interest rate decisions and global CPI and PMI reports. The FOMC announces Wednesday. The market is all but certain (99%) the Fed stays put this month but the focus will be on any hawkish language in the statement. SPY options are pricing about a 1.1% move for the week at about 14 IV. That IV drops the next week to 12, so options markets are trying to price a bit of volatility for this week, however, it’s from a very low level of overall option prices. On that front, the VIX is now about 15, but got under 13 last week (pre-pandemic levels).

IV is historically low across the board but this past Friday’s expiration saw a significant amount of option premium expire. Traders will be keeping an eye on whether there was a shift in the vol regime following that expiry. It is possible that the gamma in the market into this past Friday’s expiry had a dampening effect on moves. Whether traders become option buyers or remain rolling sellers is yet to be seen. Keep an eye on both 0DTE/Weekly IV as well as the VIX to get a sense of which way that bias is trending.

Expected Moves This Week:

- SPY: 1.1%

- QQQ: 1.6%

- IWM: 1.5%

Earnings of Note

Monday

- SFIX Stitch Fix, Inc. 16.4%

Tuesday

- AZO Autozone 5.3%

- APOG Apogee Enterprises, Inc. 8.8%

Wednesday

- FDX FedEx Corporation 4.6%

- GIS General Mills, Inc. 4.8%

- KBH KB Home 6.2%

Thursday

- FDS FactSet Research Systems Inc. 5.1%

- DRI Darden Restaurantsts 5.1%

Economic Calendar

- Tuesday: Canada CPI

- Wednesday: UK CPI, FOMC Rate Decision

- Thursday: Japan Rate Decision

- Friday: S&P PMI

Scanner Highlights:

- Overbought (RSI): GOOGL (63), INTC (62), TSLA (62)

- Oversold (RSI): CHWY (16), DG (18), M (19), AAL (22), LVS (26), JETS (27)

- High IV: MMAT NVAX (+121%), JBLU (+109%), DNA (+101%), UAL (+98%), DAL (+98%), PENN (+97%)

- Unusual Options Volume: BEKE (+1687%), QQQ (+481%), AMAT (+445%), CHPT (+414%), OPEN (+397%), EBAY (+370%), JETS (+365%), FDX (+360%), LUV (+357%), WYNN (+291%), DG (+278%)

Full lists here: Options AI Free Tools.

Options Education

Have Questions about how to best take advantage of Options AI’s position detail page and visual trade management on the mobile app? Check out this video below featuring a 0DTE Iron Condor:

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.