Hello!

An Uptick in Vol

Last week saw a pop in volatility and several down days following the FOMC announcement. SPY finished the week down 2.9%, nearly 3x the move options were pricing. The VIX closed on Thursday Sept 14th below 13, into a Sept 15th triple witching expiry that saw the expiration of alot of gamma that may have been keeping a lid on market volatility while some bad news piled up. Once that gamma got unwound/expired implied vol began ticking up into the FOMC meeting and then even higher with stocks going lower out of the meeting.

The VIX is now above 17, still slightly below its historical mean but now matching its highest levels since late May. In other words, the low vol, slow grind higher we saw over the entire summer looks to have come to an end, at least for now, with September expiration. Keep an eye on both weekly IV as well as 30-60 day IV as both got very low into that Sept 15th expiry. Stocks that had seen a slow grind higher all Summer were suddenly making large moves in the span of days or weeks that options weren’t pricing to happen in the span of multiple months in the future.

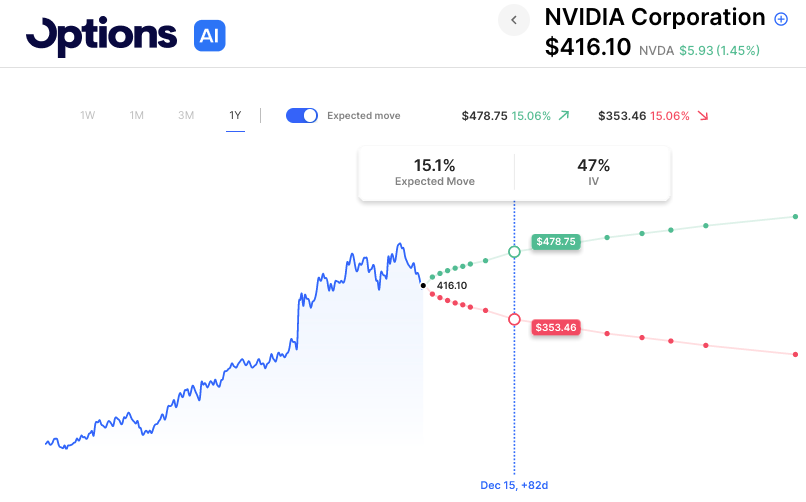

For traders, it’s helpful to look at recent stock moves and compare to the expected move in the future to see instinctually if options are inexpensive out in the future. Just as an example, NVDA has made several 15% moves in the past month, yet options are not pricing that sort of move to happen again until December expiry:

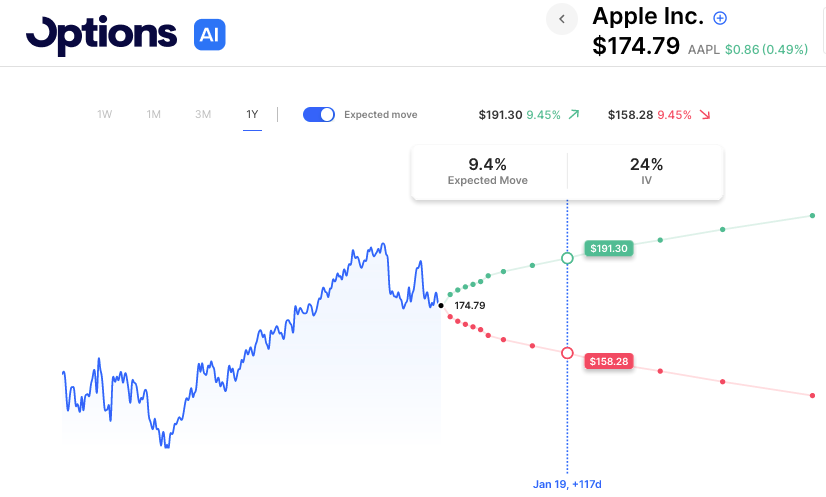

And Apple has made several moves in the 8-10% range recently, yet options aren’t pricing a 10% move until well into the beginning of 2024:

There’s no guarantee the volatility will continue, it could stop on a dime again. But, options clearly are still in a hangover from the low vol days of Summer and are still playing catch-up. The weeklies have made the biggest spike so far, now pricing in expected moves about 50% higher than just a few weeks ago. Here’s this week’s look:

- SPY expected move this week: 1.5%

- QQQ expected move this week: 1.9%

Earnings This Week

Tuesday

- COST Costco 3.0%

- CTAS Cintas Corporation 4.5%

- FERG Ferguson plc 5.4%

- SNX TD SYNNEX Corporation 6.0%

Wednesday

- MU Micron Technology, Inc. 5.3%

- PAYX Paychex, Inc. 4.5%

- CNXC Concentrix Corporation 9.0%

Thursday

- NKE NIKE, Inc. 5.2%

- KMX CarMax, Inc. 8.2%

- BB BlackBerry Limited 8.8%

Friday

- CCL Carnival Cruise Lines 8.3%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.