Market View

Last Week – Some selling pressure, but not alot.

SPY was lower by 1.3% last week, in line with the 1.5% move options were pricing. The market was a bit heavy, especially in comparison to the recent rally, but despite that only closed slightly lower on the week. The options market correctly anticipated a bit of a breather between the FOMC / large-cap tech earnings and this week’s CPI. IV picks up into this week.

This Week – Options have been looking forward to this week.

As mentioned last week, options traders had bid up premiums for this week’s CPI print (in comparison to the surroundings weeks). Options are pricing about a 2.2% move for the week, and about 21 IV. (Last week was 1.5% and 14 IV).

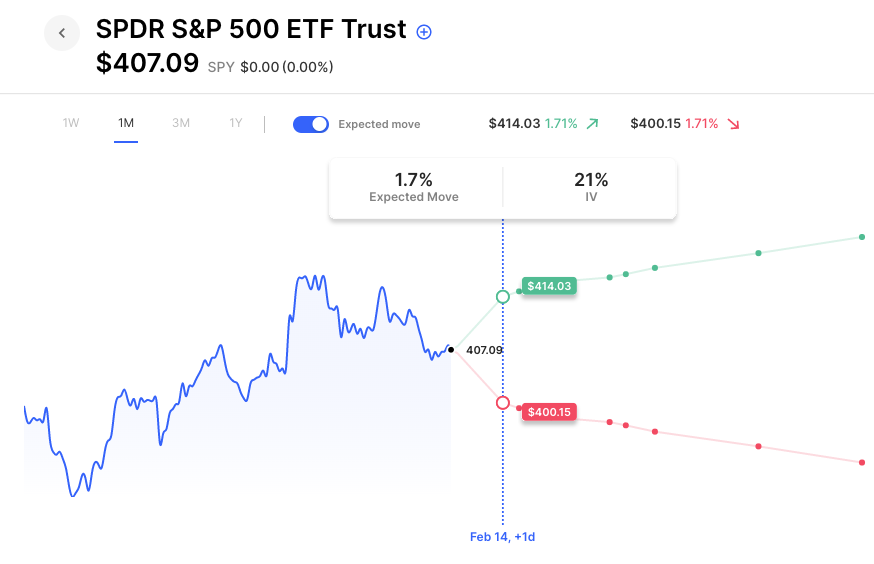

The majority of that expected move is for Tuesday’s CPI, with options pricing a 1.7% move:

Expected Moves for This Week (via Options AI free tools)

- SPY 2.2%

- QQQ 2.9%

- IWM 2.6%

- DIA 1.8%

Economic Calendar

- Tuesday – CPI

- Wednesday – Retail Sales

High Options Volume Friday – KSS, DB, XOM, USO, VLO, JETS, TSLA, HLF, NVDA

Earnings This Week

Via the Options AI Earnings Calendar. Expected move, weekly IV, and prior earnings moves (starting with most recent).

Monday

- Palantir PLTR / Expected Move: 11.4% / Prior moves: -12%, -14%, -23%, -16%

Tuesday

- Airbnb ABNB / Expected Move: 8.4% / Recent moves: -13%, -1%, +7%, +4%

- Coca Cola KO / Expected Move: 2.7% / Recent moves: +2%, +2%, +1%

Wednesday

- Roblox RBLX / Expected Move: 12.8% / Recent moves: +9%, +1%, +1, +3%

- The Trade Desk TTD / Expected Move: 11.9% / Recent moves: -8%, -1%, -3%

- Shopify SHOP / Expected Move: 9.5% / Recent moves: +18%, +12%, -15%, -16%

- Roku ROKU / Expected Move: 13.5% / Recent moves: -5%, -23%, +1%, -23%

- Cisco CSCO / Expected Move: 5.5% / Recent moves: +5%, +6%, -14%, +3%

- Energy Transfer ET / Expected Move: 3.2% / Recent moves: -2%, -1%, -2%, +1%

Thursday

- Applied Materials AMAT / Expected Move: 5.3% / Recent moves: 0%, -3%, -4%, -3%

- DraftKings DKNG / Expected Move: 10.9% / Recent moves: -28%, +10%, -9%, -22%

Friday

- John Deere DE / Expected Move: 4.6% / Recent moves: +5%, 0%, -14%, -3%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.