Market View

Last Week – QQQ led the way

SPY rallied 1.6% last week, inside the expected move of 2%. Weekly IV was higher for the week to account for the FOMC rate decision on Wednesday, the Jobs number, and earnings reports from the likes of Apple, Alphabet, Amazon and more. The majority of the market volatility occurred into and out of the FOMC event. So despite the final tally being less than what options were pricing the week featured a 4.5% rally from the lows of the week to the highs.

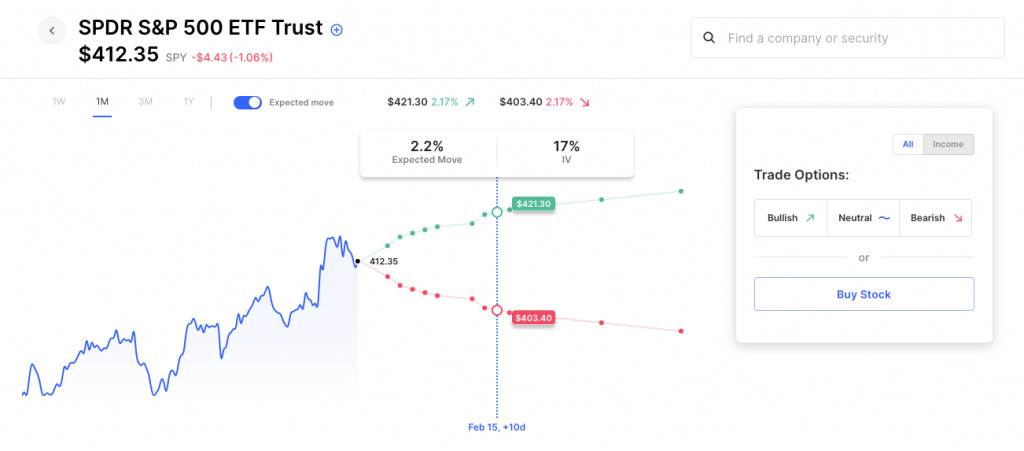

The QQQ was where the majority of the action was, finishing higher by about 3.4% on the week (versus a 2.8% expected move). The VIX was down slightly to 18.30, the lowest it has been in the past year. The next bit of higher IV this month is around the 14th for the next CPI where SPY IV pops from 14 to 17 (as seen on the expected move chart below). However, the CPI is becoming less of a market-moving event (in the eyes of option vol, as 17 IV is not high at all compared to recent months). In other words, even the CPI isn’t enough to get people too geeked up on expensive options:

As mentioned, last week had a ton of news to absorb. Overall the market was pleased, despite the fact that stocks had already rallied into the FOMC and big tech earnings, which could have set the stage for a sell the news week. Amazon and Alphabet gave up some of their recent gains on Friday following disappointing earnings reports, but that wasn’t even enough to cause a major market pullback. And looking specifically at Amazon, its 8% decline on earnings wasn’t even enough to take the stock down on the week. It finished up 1% on the week because its rally into earnings was more than its sell-off after.

Then there’s Meta, which options weren’t even close to getting right, finishing the week higher by 23% and is now up 105% from its November lows. Meta isn’t alone, there are tons of stocks that have rallied massively off their 2022 lows. Netflix is +120% since last Summer. Shopify is up 100% since October. Even left-for-dead stocks like Peloton have found buyers, up 100% in 2023.

These types of bullish moves are something to be aware of if IV continues to decline. The rally in markets the past month has crushed IV, yet a lot of stocks can make large percentage moves higher. The math on how options can get caught sleeping on moves higher from lows is obvious. Shopify is a great example, declining 85% from its highs to its 2022 lows. That was a -$125 or so move lower. But from those lows, a move of just $25 higher is a 100% rally. So option traders need to recalibrate sometimes following the sort of wreckage we saw in 2022. For SHOP to rally +$25 from its lows is a 100% move higher, despite being nowhere near to recovering its massive decline last year.

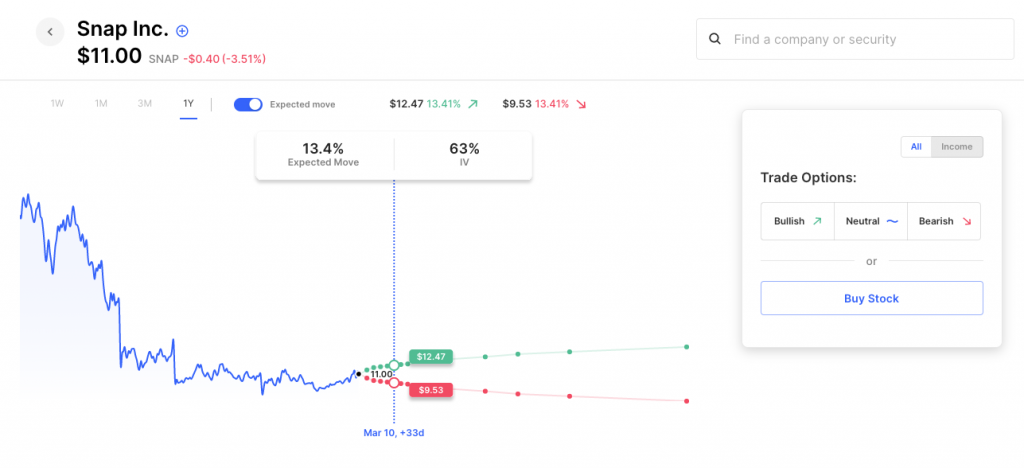

Just as another example, take SNAP. Options are pricing about a 14% move for the next month. But just in the last week, it had both a move higher and lower of 15%, more than options are pricing 30 days out from now. In dollar terms these moves are nothing since the stock is now just $11 (from a high of $40+. For instance, a 100% rally off its lows wouldn’t even get the stock to 50% off its highs. These type of dollar cheap potential moves are something to keep in mind if trading low IV options in a beaten down stock, as a stock rallying 100% off its lows is not uncommon, despite options not even close to pricing the possibility.

This Week –The Hangover

There’s a little bit of a breather on both the earnings and economic calendars this week. Highlights for this week in earnings include Disney, and we do hear again from Fed Chair Powell on Tuesday, but the calendar isn’t as active this week.

Expected Moves for This Week (via Options AI free tools)

- SPY 1.5%

- QQQ 2.4%

- IWM 1.9%

- DIA 1.4%

Economic Calendar

- Tuesday – Powell Speech

- Wednesday – Waller Speech

- Thursday – Initial Jobless Claims

- Friday – UoM Consumer Sentiment

Earnings This Week

Via the Options AI Earnings Calendar. Expected move, weekly IV, and prior earnings moves (starting with most recent).

Monday

- Pinterest PINS / Expected Move: 11.1% / Prior moves: +13%, +11%, +14%

Tuesday

- Chipotle CMG / Expected Move: 5.5% / Recent moves: +2%, -1%, -5%, +1%

- Enphase ENPH / Expected Move: 10.2% / Recent moves: +10%, +18%, +8%, +12%

Wednesday

- Uber UBER / Expected Move: 8.7% / Recent moves: -3%, +3%, -5%, -6%

- Disney DIS / Expected Move: 5.3% / Recent moves: -13%, +5%, -1%, +3%

- Robinhood HOOD / Expected Move: 9.8% / Recent moves: +8%, +6%, -3%

- MGM Resorts MGM / Expected Move: 5.1% / Recent moves: -11%, +4%, -3%, -3%

Thursday

- Pepsi PEP / Expected Move: 2.3% / Recent moves: +4%, -1%, 0%, -2%

- Abbvie ABBV / Expected Move: 3.4% / Recent moves: -4%, -4%, -6%

- Paypal PYPL / Expected Move: 7.9% / Recent moves: -2%, +9%, +11%

- Cloudfare NET / Expected Move: 12.1% / Recent moves: -19%, +27%, -16%, -10%

- Lyft LYFT / Expected Move: 13.7% / Recent moves: -23%, +17%, -30%, +7%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.