Market View

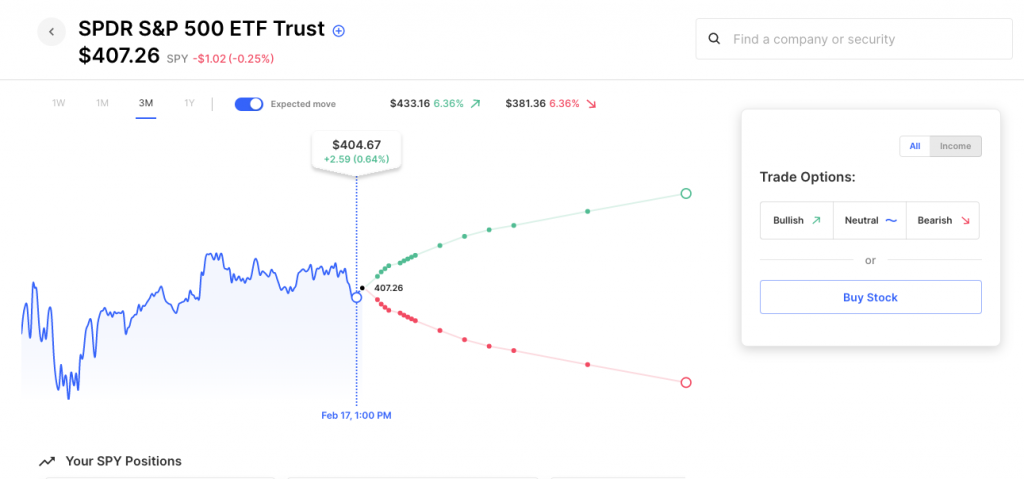

Last Week – SPY holding a tight range for Feb, so far.

SPY traded in about a 2.5% range and finished more or less unchanged on the week. That was versus options that were pricing about a 2.2% move for the week. In fact, the SPX has traded in a fairly tight 3% range for February so far. That’s despite a slew of important economic releases and volatile earnings announcements that could have been market-moving. Implied volatility remains on the lower end of the option premium prices we’ve seen over the past year. The VIX got as low as 18 following the CPI release but closed the week back above 21. The market saw a bounce on Friday that kept it from falling below that February range, a move that would have seen IV spike a bit.

This Week – Downside level of February range one to watch for IV.

SPY options are pricing about a 1.5% move for the holiday-shortened week. The $404.50 level that SPY tested on Friday is one to watch as moves lower than that low end of the recent range could see put protection buying and higher IV. The FOMC minutes on Wednesday and the GDP print on Thursday are ones to watch on the economic calendar. Nvidia, Walmart, Coinbase, Carvana and Block highlight the earnings calendar.

Expected Moves for This Week (via Options AI free tools)

- SPY 1.5%

- QQQ 2.0%

- IWM 1.8%

- DIA 1.3%

Economic Calendar

- Tuesday – S&P Global PMI

- Wednesday – FOMC minutes

- Thursday – GDP, Initial Jobless Claims

- Friday – Consumer Sentiment, Fed Speech (Jefferson)

High Options Volume Friday – OPEN, LOW, BB, MO, BSX, NRG, CSX, KSS, WMT, IEF, EWG

Earnings This Week

Via the Options AI Earnings Calendar. Expected move, weekly IV, and prior earnings moves (starting with most recent).

As mentioned in recent weeks, although the overall market IV is on the low end of what we’ve seen the past year, there are some large idiosyncratic moves happening in single stock names. particularly stocks that saw large declines in 2022, as the potential for large percentage moves from a low stock price can sometimes be difficult for options to price. Carvana is a good example below, it’s seen moves of 40% in its last two earnings, with options trying to price the possibility of a move like that, or the chance of it not moving at all, and seemingly splitting the difference with an expected move of around 24%. The stock is just $11 now and has seen a high of over $18 and a low near $10 this month alone. Massive percentage moves that are difficult for the options market to price as the straddles to account for the potential of a stock doubling would be nearly the entire stock price to zero on the downside.

Tuesday

- Walmart WMT / Expected Move: 4.0% / Recent moves: +7%, +5%, -11%

- Home Depot HD / Expected Move: 3.8% / Recent moves: +2%, +4%, +2%

- Coinbase COIN / Expected Move: 16.5% / Recent moves: +5%, +7%, -26%, -2%

- Palo Alto Networks PANW / Expected Move: 6.6% / Recent moves: +7%, +12%, +10%, +1%

Wednesday

- Baidu BIDU / Expected Move: 6.4% / Recent moves: +1%, -7%, +14, +7%

- Nvidia NVDA / Expected Move: 6.9% / Recent moves: -1%, +4%, +5%

- Lucid LCID / Expected Move: 14.6% / Recent moves: -3%, +4%, -7%, +10%

- Etsy ETSY / Expected Move: 9.6% / Recent moves: +14%, +10%, -17%, +16%

Thursday

- Block SQ / Expected Move: 9.2% / Recent moves: +12%, -2%, +1%, +26%

- Alibaba BABA / Expected Move: 5.7% / Recent moves: +8%, +2%, +15%, -1%

- Carvana CVNA / Expected Move: 23.5% / Recent moves: -39%, +40%, -10%, +21%

- Domino’s Pizza DPZ / Expected Move: 6.5% / Recent moves: +11%, -1%, -5%, 0%

- Mercado Libre MELI / Expected Move: 7.1% / Recent moves: +8%, +16%, +2%, +4%

- Moderna MRNA / Expected Move: 6.6% / Recent moves: -1%, +16%, +6%, +15%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.