Market View

Last Week – SPY exits tight February range to the downside.

SPY fell about 2.7% last week, a larger move than options were pricing (1.5%). Treasury yields spiked as inflation worries renewed. The 2-year yield closed Friday at 4.81, its highest level since 2007. Implied vol continued its rise from the week before. The VIX got over 23 during the week before closing Friday just under 22. A little downside uncertainty returned as the SPX broke below the tight range it had been trading in February.

This Week – Does the rise of IV continue?

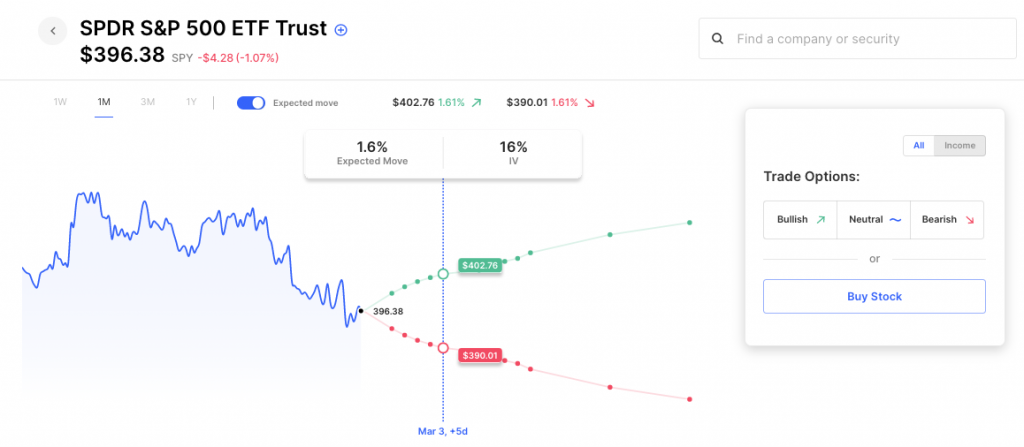

SPY options are pricing about a 1.6% move for the week. We are still in an environment where expected moves across the market are muted compared to the past year. But last week’s selloff was also the first time in about a month where the market moved to the downside significantly more than what options were pricing. And it came during a week of rising treasury yields, which had been rough moments for stocks in 2022. IV has crept up the past 2 weeks but the market was mostly seeing moves cancel each other out. If the market were to continue lower this week one would expect IV to continue to rise (as the VIX is still in the low 20’s.) The VIX has not been above 25 since December and at 22 is not that much higher than its historical mean. In 2022, VIX spikes toward 30 tended to coincide with market bounces and IV is nowhere near that level at the moment, indicating a wait-and-see approach on last week’s selling. Here’s this week’s SPY levels for a 1.6% expected move, about $390 on the downside and $403 on the upside.

Expected Moves for This Week (via Options AI free tools)

- SPY 1.6%

- QQQ 2.1%

- IWM 2.0%

- DIA 1.3%

Economic Calendar

- Monday – Durable Goods

- Tuesday – Home Prices

- Wednesday – ISM Manufacturing

- Thursday – Initial Jobless Claims

- Friday – ISM Services

High Options Volume Friday – BYND, ADBE, KSS, LAZR, XLE, ICLN

Earnings This Week

Via the Options AI Earnings Calendar. Expected move, weekly IV, and prior earnings moves (starting with most recent).

Monday

- Occidental OXY / Expected Move: 5.0% / Recent moves: +4%, -6%, +1%

- Zoom ZM / Expected Move: 11% / Recent moves: -4%, -17%, +6%, -7%

- Workday WDAY / Expected Move: 6.3% / Recent moves: +17%, +3%, -6%, +5%

Tuesday

- Target TGT / Expected Move: 7.3% / Recent moves: -13%, -3%, -25, +10%

- Rivian RIVN / Expected Move: 13.4% / Recent moves: -12%, +4%, -10%, -6%

- AMC AMC / Expected Move: 16.3% / Recent moves: -8%, +19%, -6%, +1%

Wednesday

- Nio NIO / Expected Move: 9.8% / Recent moves: +12%, +1%, -4%, -10%

- Lowe’s LOW / Expected Move: 5.7% / Recent moves: +3%, +1%, -5%

- Salesforce CRM / Expected Move: 6.5% / Recent moves: -8%, -3%, +10%, -1%

- Snowflake SNOW / Expected Move: 9.3% / Recent moves: +8%, +23%, -5%, -15%

- Splunk SPLK / Expected Move: 8.8% / Recent moves: +18%, -12%, +10%, +6%

Thursday

- Best Buy BBY / Expected Move: 6.4% / Recent moves: +13%, +2%, +1%, +9%

- Macy’s M / Expected Move: 8.5% / Recent moves: +14%, +4%, +19%

- Costco COST / Expected Move: 3.3% / Recent moves: 0%, -1%, +6%, +1%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.