Market View

Last Week – Positive reactions to CPI and Bank earnings.

SPY closed 2.7% higher last week. That was slightly more than the 2.2% move options were pricing. Stocks reacted positively to the CPI data and closed the week on another positive note following a slew of large bank earnings. Implied volatility in options contracted following the CPI release. It wasn’t as apparent in the VIX as it fell from and already low 21 the prior week to 19.5 as of Friday, but it was apparent in IV near term, as SPY options pricing he uncertainty of the CPI print were around 27 IV, now near term IV is in the low teens. That is despite the fact that earnings season picks up and headline risk around the debt ceiling negotiations. More on that in a bit.

This Week – (Relatively) Low IV into the heart of earnings season.

SPY options are pricing just a 1.3% move for this 4-day week. Implied vol in SPY options is just 13 for this Friday. In QQQ IV is 17 for this Friday, with a 1.7% expected move. IV is the lowest we’ve seen in some time, despite the slew of earnings on deck. That in turn means IV in individual names may be the lowest they’ve been into an earnings event in some time. That’s something to keep in mind with any new option positions around earnings events.

IV does start to pick back up the first week of February around the next FOMC meetings and CPI/NFP economic data. In other words, macroeconomic news is still the driver of high option vol until it isn’t.

Expected Moves for This Week (via Options AI free tools)

- SPY 1.3%

- QQQ 1.7%

- IWM 1.6%

- DIA 1.1%

Economic Calendar

- Wednesday – Retail Sales, Producer Prices, Beige Book

- Thursday – Building Permits, Housing Starts, Initial Jobless Claims, Philly Manufacturing, Brainard Speech (Fed)

- Friday – Waller Speech (Fed)

High Options Volume This Past Friday (compared to 30-day averages)

- APRN. BBBY, XBI, MARA, CVNA, CVS, UVXY, DAL, RIOT, UPST, DKNG, MS, COIN, GS

Earnings Trading with (Relatively) Low IV

As mentioned above we enter this earnings season with a relatively different set-up than earnings seasons over the past 1-2 years. Implied Vol has come in quite a bit following some re-assuring inflation data and traders are perhaps seeing light at the end of the Fed rate hike tunnel. During the recent bouts of market volatility, options needed to price an earnings event, but also the potential for a broad market swoon that day or that week, Therefore, earnings expected moves weren’t necessarily pure reflections of that company’s earnings, but also carried overall market baggage. A hypothetical example from the past year would be a company with interest rate sensitivity reporting earnings the same week as important inflation data. Are options pricing earnings, or inflation, and how much of each? In a lot of cases, traders were probably more worried about the next year of Fed moves than that company’s prior quarter.

With IV lower into this earnings season, we get a clearer view of options pricing company-specific moves. And perhaps with the VIX near 19 and index IV over the next few weeks lower than we’ve seen in quite some time, it’s possible we may see individual company options actually weighed down by low index vol. Not to mention, we’ve gone from ignoring the importance of the prior quarter because of uncertainty ahead, to now having a little more certainty ahead, but really curious about what all this stuff has done to that company’s earnings recently. So, it’s a different earnings environment this time around.

Let’s take a look at Goldman Sachs, which reports tomorrow morning. Obviously, the large investment banks have been volatile over the past year as traders tried to get a read on interest rates, borrowing costs, banking/M&A activity, and more. In fact, Goldman’s realized vol, or how much the stock has moved over the past year is about 29. That can be compared to IV for this week’s earnings in GS, which is about 25. Quick translation: options are actually cheaper into this earnings than GS stock has traded on average over the past year. And looking at the expected move for GS for this week we see options pricing a 2.6% move, or about $10 in either direction. For comparison, with the market rally off the CPI, and then a sympathetic rally with fellow financial institutions like JPM off their earnings on Friday, GS was up 6%, or $21 last week. And that’s without knowing what they’ll report tomorrow.

With that information at hand, it may make sense to compare credit and debit spreads to express a view. Typically credit spreads into earnings take advantage of high implied vol, and build a buffer of not only the potential move in the stock, but also by being on the correct side of falling IV after the event. But in this case, it’s helpful to look at the risk/reward of credit vs debit spreads when IV isn’t sky-high.

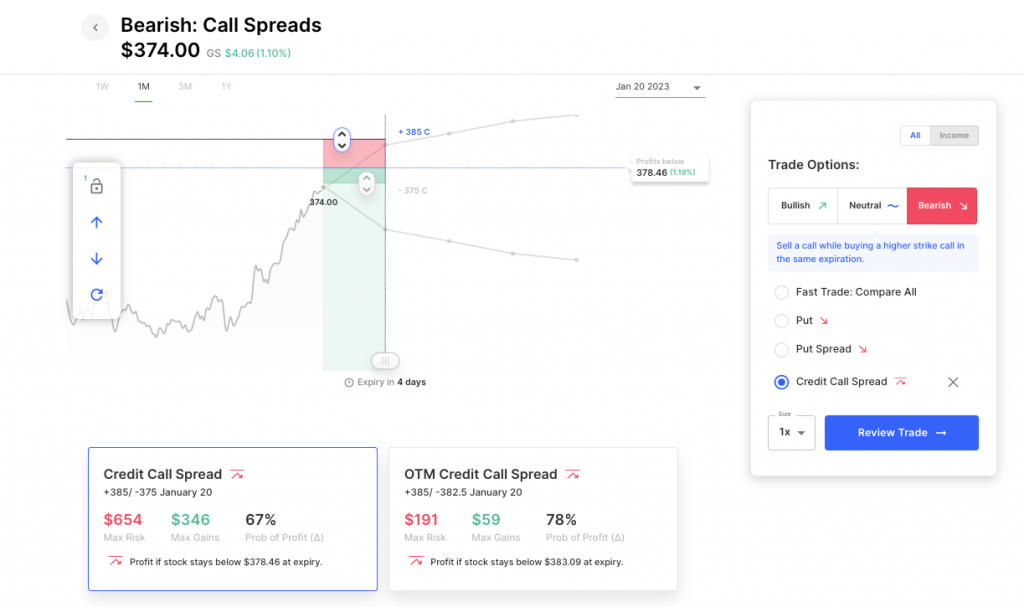

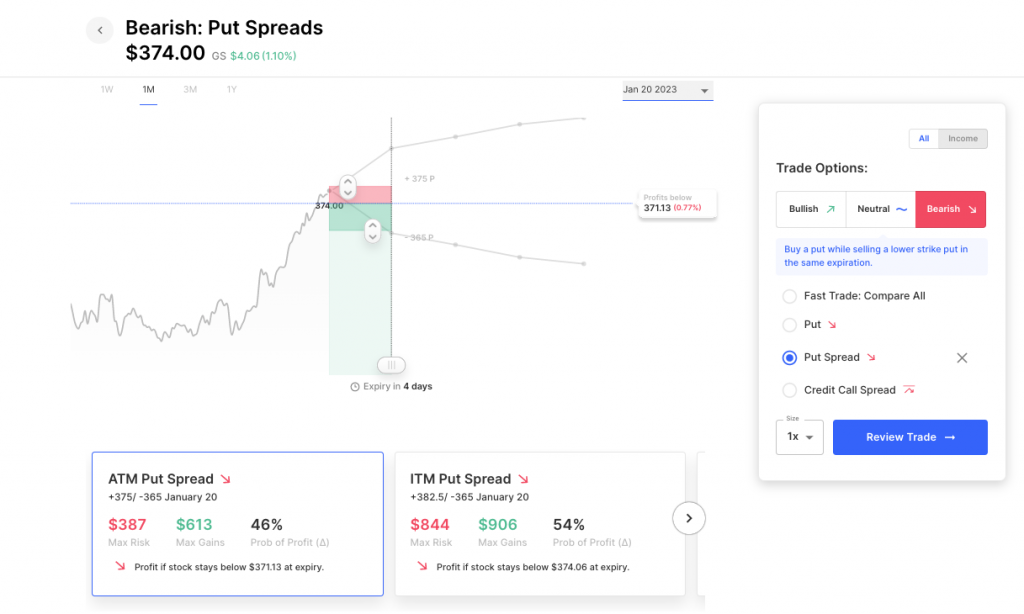

Let’s say you want to take a bearish stance on GS earnings, based on the rally into the event. Based on Goldman’s close of 374 on Friday, an at-the-money credit call spread for this week with the upper strike set at the expected move (selling the 375 call, buying the 385 call) risks about 6.50 to make 3.50. It loses money if GS stock is above 378.50 on Friday, just 4.50 higher than Friday’s close. Compare that to an at-the-money debit put spread (buying the 375 put, selling the 365 put) that risks 4 to make 6, with a breakeven around 371, just $3 lower in the stock: (see the trade here on Options AI’s free tool)

This is a case where the breakevens of credit spreads are really tight, compared to how the stock has been trading, as are the breakevens of debit spreads. The issue with debit spreads is always that you need a move in your direction, while with credit spreads you have a buffer built in to be slightly wrong. But in low IV environments that advantage starts to blur, and the risk/reward of what seem like very likely moves can come into better focus.

Earnings This Week

Via the Options AI Earnings Calendar. Expected move, weekly IV, and prior earnings moves (starting with most recent).

Tuesday

- Goldman Sachs GS / Expected Move: 2.4% / IV 25 / Prior moves: +2%, +3%, 0%

- Morgan Stanley MS / Expected Move: 2.9% / IV 30 / Prior moves: -5%, 0%, +1%, +2%

- United Airlines UAL / Expected Move: 5.2% / IV 52 / Prior moves: +5%, +1%, +1%, -3%

Wednesday

- Charles Schwab SCHW / Expected Move: 3.3% / IV 33 / Recent moves: -2%, -2%, -0%

Thursday

- Proctor &Gamble PG / Expected Move: 2.5% / IV 24 / Recent moves: +1%, -6%, +3%, +3%

- Netflix NFLX / Expected Move: 8.5% / IV 84 / Recent moves: +13%, +7%, -35%, -22%

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC, member FINRA and SIPC.