The Broader Markets

The past week saw selling pressure in the meme/short squeeze stocks, rising major indices and decline in options volatility across the board.

The VIX started the week near 30 and is now near 20. With that compression in options pricing, SPY options are pricing just a 1.2% move for next week. That’s about half the move options were pricing for this week. Here’s the updated expected move to Feb 12th:

Using the Options AI Expected Move Calculator for the full month we can compare SPY, QQQ, and IWM, with the largest expected move in IWM at about 5%:

In the News

Obviously the meme/short squeeze stocks garnered the most attention. Here’s a quick comparison of expected moves for the next month in a handful of the meme stocks, Gamestop, AMC, Nokia, Virgin Galactic and Blackberry via the Options AI calculator. GME is now about a 68% expected move, down from the more than 90% moves options were pricing last week: (link):

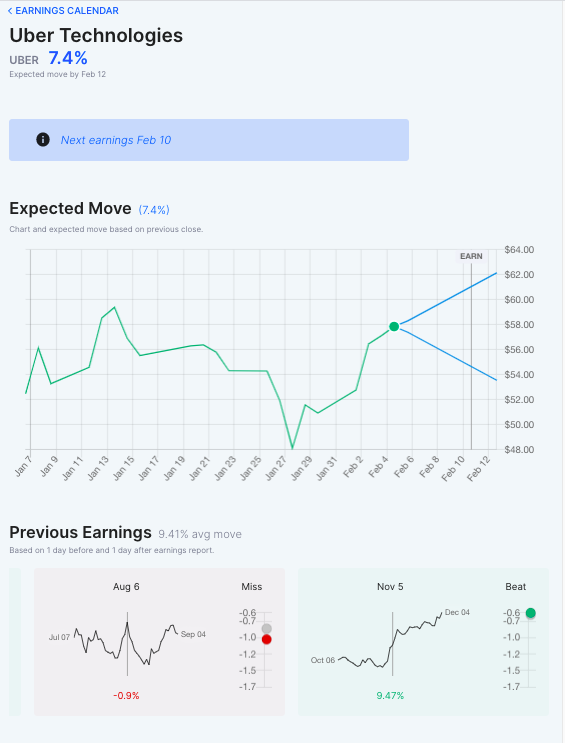

Expected Moves for Companies Reporting Earnings Next Week

Next week sees reports from notable names like Uber, Twitter, Yelp, Coca Cola, GM, Lyft, MGM and Cisco among others. We’ll highlight a few below with expected moves for next week, but a larger searchable list with expected moves and recent history can be found on the Options AI Earnings Calendar. Note these are the moves being priced for the entire week and will change based on where the stocks are into their events.

Options AI puts the expected move at the heart of its chart-based platform and Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading.