Snap and Peloton report results Thursday after the close. With Snap (SNAP) trading about $58.50, the options market is pricing an expected move into Friday’s expiration of about 11.5%, corresponding to about $65.50 for a bullish consensus and $51.50 bearish, via Options AI:

With Peloton (PTON) trading near $146.50 options are pricing about a 7.5% expected move corresponding to about $157.50 for a bullish consensus and $135.50 for bearish:

Here we will look at how option spreads might be used to reduce capital outlay and potentially improve probability of profits (versus buying outright calls or puts) and how the expected move can help guide strike selection through this process.

Please note, all trade strategies are for informational purposes only and pricing is approximate at the time of writing. They represent just a few of the many potential ways that options might be used to express a view.

Debit Spreads to the Expected Move

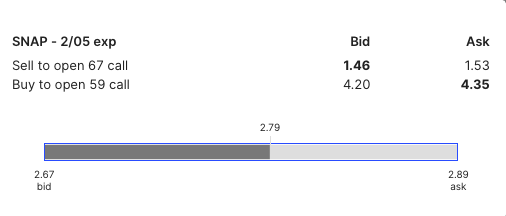

Knowing that the options market is pricing a move of about 11.5% in SNAP this week, let’s assume that a trader is inclined to agree with the crowd – that a move beyond that is indeed, less likely. In this scenario, a trader might look to a Debit Call or Put Spread, targeting this expected move. This reduces cost vs at the money calls /puts, and increases probability of profit versus both at the money calls or puts or out of the money calls/puts. Often, a spread to the expected move is not much different in cost than a call/put at the expected move, which would need much more movement in the stock to be profitable. Using SNAP stock at the time of writing, here’s an example of a bullish Debit Call Spread, buying an at the money call and lowering the cost of the position by selling a call at the bullish consensus. Note the breakeven on this strategy, just a few dollars higher in the stock. Also note the max loss and max gain levels. The strategy does not have unlimited upside because of the call sale, but it lowers the breakeven versus outright calls and establishes a range of profitability in the stock with defined risk in case the stock goes lower:

As you can see with the two strikes, this Debit Spread is a net cost not too far off from the out of the money call (the spread is a 2.80 debit, the out of the money 67 call is 1.50). But the breakevens for the trade are very different (61.80 for the Call Spread, 68.50 for the out of the money call):

In other words, buying the 67 call would require SNAP stock going to 72.20, an area beyond the expected move, to see the same reward as the spread that sells that call and only needs SNAP to go to 67 (or higher).

The same concept applies for bearish positioning with put spreads that involve selling a put at/near the bearish consensus.

Credit Spreads: ‘Selling to the Bulls’ and/or ‘Selling to the Bears’

Again, using Snap as an example, traders can also position bullish or bearish but with a credit received, by selling a Call Spread or a Put Spread. This is essentially being bullish by ‘selling to the bears’, or being bearish, by ‘selling to the bulls.’

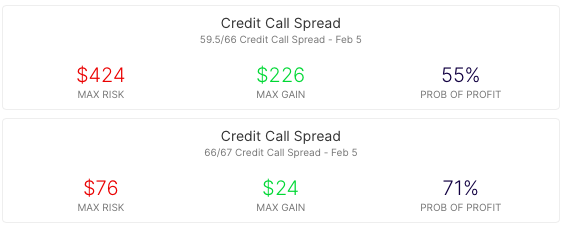

Here are two examples in SNAP with the stock $59.50:

We’re going to look at two Credit Spread strategies that might be used to express a bearish view by ‘not being bullish’

1. At the money Credit Call Spread – taking a view that the stock will be lower by Friday.

2. Out of the money Credit Call Spread – taking a view that even if the stock is higher, it will not be above the bullish expected move

Selling a credit to both the Bulls and the Bears

Finally, let’s consider the scenario where you believe that the options market is overpricing the move and believe that a stock will stay within the expected move on a given timeframe. Rather than “not bearish” or “not bullish” like the Credit Spreads above, this is a trade that ‘sells the move’ to both the bulls and the bears – the Iron Condor. Here’s an example, in Peloton, using the stock’s expected move to initially set strikes:

Note the range created on the chart within the expected move. The Iron condor, which involves simultaneously selling an out-the-money Credit Call Spread, and a Credit Put Spread seeks to collect the premium (income) received if PTON stays within the expected move. It is a higher probability of profit trade, that in this case is about a 3 to 2 risk/reward. It is a max loss if the stock moves beyond the outer range of the trade, but it is defined risk.

Summary

Remember, the above are just examples of the many ways a trader might express a view using options. They are based on where the stock is trading at the time of writing and are intended solely to demonstrate how the expected move can help provide actionable insight to consider before making any trade, particularly into an uncertain event and how it might be used for more informed strike selection. Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading. The concepts shown in Snap or Peloton can apply to any stock and are simply used here for illustrative purposes.